Barclays rejects me! We don’t want you, Randy.

100%.

Everything you are about to read is 100% true. This happened to me.

No one likes to be rejected. No one likes to be knocked to the ground. No one likes to be told, “You’re not good enough. You’re a deadbeat. Don’t call us, we’ll call you.”

I hope this never happens to you.

This past week all of the above happened to me. Rejection didn’t feel good. Maybe, if I tell you what happened to me this will never ever happen to you or your loved ones.

Bruce had to reschedule but he’s still coming to an email location near you.

Before we go any further rest assured, I’m still planning to tell you the story about how Bruce Springsteen and I met up in Stockholm. However, the Stockholm story is going to have to wait just a little bit longer.

The naked, unvarnished truth.

Yes, this is the naked, unvarnished truth. I don’t pay my credit card bills. There, I’ve said it. I can’t take it back. In today’s world if you don’t pay your credit card bills you’re going to get more than your share of rejection.

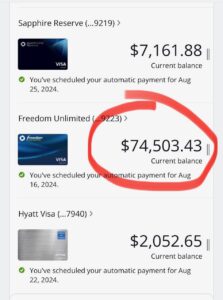

See this graphic? It’s a snapshot of what we owe Chase Bank. That’s right. With just one single card, we owe more than $70,000.

Carol is not really part of this. Could she still to jail?

I don’t want anyone reading this to think Carol is party to my poor performance. Yes, her name is on the credit card bill. I guess that means if I go to jail, she goes to jail. I hope that doesn’t happen. Above she reacts to the last time she was apprehended by the authorities.

It’s important to know where we came from and how we got here.

Let me give you a very quick snapshot of Carol’s and my background. We grew up poor. We met in college. We were both working as RAs (resident assistants) in the dormitory to help pay our college expenses. We started dating in college. When we graduated, we were still poor. We didn’t have much.

How poor? We decided to get married when I finished boot camp in the United States Marine Corps. I had a 10-day leave. Due to various sets of unfortunate circumstances, the two of us were left to pay for our wedding. A long time ago weddings seemed inexpensive.

Getting hitched.

How inexpensive? Our entire wedding which included a sit-down dinner following the ceremony for about 50 people had a total cost of $500. I’ve stayed in hotels that cost more than that. Back in those times, we didn’t have $500.

While I was “away” (that kind of sounds like I was in prison), Carol did all of the planning. This included taking out a $200 bank loan to help us cover the cost of the wedding. That’s right. We didn’t have $500 to our name. Our net worth at that point was a negative $200. Technically, we were bankrupt on our wedding day.

Montgomery Ward rejected us?

During our first year of marriage, we were strolling through our local shopping mall. We happened upon a Montgomery Ward store. Don’t understand that reference? That’s what Wikipedia is for.

One of the employees cornered us and asked if we wanted one of their credit cards. We told him no. We were afraid of credit cards. He insisted. We consented and completed an application. A week or two later we got the news. Montgomery Ward was not going to give us one of their credit cards. Rejected!

Did we take it personally? You be the judge. We never ever spent another penny at Monkey Wards. Truthfully, we weren’t all that disappointed when they went out of business. Payback can be a bitch.

Our first married address.

When I got out of the service, we moved into a duplex in Peoria Illinois. The rent was $140 a month. We got every bit of our fine China, which we still use today, from the bank. Every time we made a $25 deposit we got a plate or a butter dish or whatever.

Once, we invited my boss over for dinner at our duplex. We served him dinner on what was essentially a card table with metal folding chairs. We didn’t have enough money for boxsprings for our mattress. The mattress sat directly on the floor. We didn’t have much.

We wanted a house.

We knew that as newlyweds it would be a good idea to buy a house. However, if we didn’t have $500 to pay for a wedding, we didn’t have any money for a down payment on a house.

I started working for $8,500 a year. For a 2,000-hour work year that’s $4.25 an hour. At least I got a bonus and a car (a ’73 Plymouth Fury with black walls when only police cars had black walls) and a five-dollar-a-week allowance for dry cleaning! I was happy with all of it.

Carol was also employed. However, when our second child Kristy was born, she never worked outside the home again. That was 47 years ago.

The moving van came often for the Lewis family.

I started my working career in Peoria, Illinois. A year later we moved to Cincinnati. A year after that the company was expanding. They offered me a position in Salt Lake City. Even back then auto racing was important to me. I told my boss that Salt Lake City didn’t have a lot of racing. I asked if he might have some other location available for us. I was offered Phoenix, Arizona. We accepted.

This ain’t happening in today’s world.

Back in 1974, things were done just a little bit differently in business. We relocated from Cincinnati to Phoenix in the middle of the summer. Carol was seven months pregnant with our first son, J.J. A move like that would never happen today. Carol drove a 1972 Ford Mustang…that car didn’t have air-conditioning. It was the middle of the summer in Phoenix, Arizona, Carol was seven months pregnant and her car didn’t have air-conditioning. We didn’t have much.

In those days the company would send you out for a weekend of house hunting at the new location. You were expected to decide on buying a house during that three-day trip. That wouldn’t happen in today’s business world.

Our dream home and it didn’t even have an ocean view.

We saw a house that was listed for $40,000. This was toward the end of our house-hunting weekend. We had already seen plenty of houses. This was a for-sale-by-owner situation.

I am not exaggerating when I tell you that when we pulled up to the property, a fellow was lying prone on the front yard grass. He was wearing blue jeans and a cowboy hat. He was literally chewing on a six-inch piece of straw. I asked Carol if we were sure we wanted to stop. This is exactly what happened next.

This fellow had been renting his home but it was now vacant. He had been without a renter for a few months. He was asking $40,000 for his 1,700 square-foot home with a huge inground swimming pool on a third-of-an-acre cul-de-sac lot.

He showed us around. We liked the property. We told him we would get back to him on the deal.

Talk about being “wet behind the ears”.

As we drove down the freeway Carol and I looked at each other. We were both just 25 years old. How many people today buy their first home at that age? This was exactly the home that would be perfect for us. We were excited. We were very excited. We were so excited that we took the fifth exit from the house on the freeway. We found a payphone and called the seller. The conversation was short. I said just three words. “We’ll take it”.

To show you what a financial rookie I was I didn’t ask him to negotiate the price. I offered full price on a vacant home. I’m sure the seller went home to his wife and told her about his absolute good fortune. I can imagine their conversation. It likely went like this. “I showed them the house for 20 minutes. They liked it. A few minutes later they called and said ‘We’ll take it”. I’m sure the champagne was flowing in the seller’s house on that evening.

Talk about a shaky financial beginning.

Here we were a poor young couple just like all of our peers. We had already been rejected on the credit card front. Now we were just a couple of hicks from the sticks who didn’t know how to negotiate a real estate deal. Our financial situation was on shaky ground but we had bought our first house.

Back in those days, companies moved their employees around quite a bit. I was moving up the sales management ladder. We had gone from Peoria to Cincinnati to Phoenix. From Phoenix, we would go to Southern California to Connecticut to Chicago. In Chicago, I threatened to quit if they didn’t move us back to SoCal. They did. We have lived in Southern California (three houses) since 1983. That brings us to today. Has our financial situation improved? Er…you decide.

A sad saga in deed…or more than meets the eye?

We are in debt up to our eyeballs! We owe more than $2.5 million on our home. We owe $75,000 on our car. We have a single credit card amongst many credit cards that we owe more than $70,000 on. If that’s not being in debt up to your eyeballs, I don’t know what is.

Am I to blame for all of this? Quick answer. Yes.

I don’t know that I blame us. No one likes to blame themselves, right? I blame the banks. What bank was dumb enough to loan us $2.5 million on our home when I had been unemployed at that point for more than 20 years? What in the world were they thinking?

We’re gonna talk about credit today.

There’s a term in the credit rating business called, “credit utilization”. Credit rating agencies want you to have a low credit utilization rate. What exactly is credit utilization?

Let’s say that the credit limits on all of your credit cards come out to $100,000. Let’s say that you owe $20,000 at the end of the month on all of your credit cards. Your credit utilization rate is then 20%. That’s $20,000 divided by $100,000. The credit rating agencies would like your credit utilization to be as close to zero as possible. They will go absolutely apeshit if your credit utilization exceeds 30%. Our credit utilization rate is now exceeding 30%.

Hang in there. The dark clouds will pass…hopefully.

Why in the world am I writing a financial-focused newsletter with such a dismal financial past? Maybe you will see a silver lining in this dark cloud as you read on.

A friend in Atlanta says, “Randy is always the man with the plan”.

Months ago, I told you in this newsletter that I had a new credit card strategy. What was the new strategy? I wasn’t going to pay my bills in full. I thought that was an outstanding idea. Credit rating agencies thought just a little bit less of my new idea.

A sinking ship.

In a nutshell, my credit score went from a perfect 850 (as told to me by the Alaska Airlines credit union) to 764. Chase Bank also has a credit rating based on our experience with their credit cards. They tell me that our credit score is 643. They rank that number as “poor” as if to say, “You are a deadbeat. If we had it to do all over again, we wouldn’t loan you any money whatsoever.”

Mind you, seeing my credit score fall when I stopped paying our credit card balances was expected. This was not a surprise. I didn’t care. I already had our home and car loans locked up. Why should I be concerned about my credit rating? Are you concerned about today’s temperature in Hong Kong? No? Why? That’s not part of your useful world. My credit rating would not be part of my useful world for years…until Barclays came along.

Credit rating sinking; borrow more.

Nevertheless, I thought that our solution to the problem was to get MORE credit. I did some research, which led to this decision: I would apply to Barclays to get a MasterCard Black card. Barclays is a British bank headquartered in London. Maybe they wouldn’t know what I was doing credit-wise in the U.S. MasterCard Black is one of Barkley’s “Luxury” cards. The card itself is all metal. Who doesn’t want to lay down a metal card at a swanky restaurant?

The day before I called Barclays, I got in touch with Bank of America. Last year, Carol and I each ordered an Alaska Airlines Bank of America credit card. We did it for the sign-up bonus.

If we spent $3,000 over three months, they would give us each 64,000 Alaska Airlines frequent flyer miles. We spent the money during the intro period and earned the miles. Those miles were worth more than $2,000 in travel benefits. Now we were coming up with having to pay our annual fee for the first time on these cards. The annual fee was only $95/year. Nevertheless, we decided it would be a good idea to close the accounts before we paid that fee.

Should you be concerned about annual credit card fees?

Let me comment on annual credit card fees. I don’t care if there is an annual fee. I don’t care how much that fee is. If the annual fee is $600 and the card returns anything greater than $600 in rewards that I use I’m good with the fee. Some of the people who lead these “points and miles” podcasts have 40-50 different credit cards. The annual fees on those cards combined can be $6,000-$8,000 each year.

I had no idea what my credit limit was on the Alaska Airlines card I was canceling. After the three-month promotional spend, I had never used it again. This is a common practice for people getting a credit card just for the one-time signup bonus.

My credit limit was how much?

It turned out that the credit limit on the card I was about to cancel was $28,000. The Bank of America rep asked me if I might like to roll over the $28,000 credit limit on that card to the one and only Bank of America Alaska Airlines credit card I would be keeping. Why not? The limit on the card I planned to keep was currently at $21,000. Now the new limit on my BofA Alaska Airlines credit card would be $49,000. I thought that was great. This was an unsecured debt. If Carol and I wanted, we could go on a $49,000 spending spree and then stiff Bank of America. It’s always good to be thinking ahead, isn’t it?

I felt pretty good that Bank of America had given me such an easy credit limit increase. If they would give me $49,000 despite our debt situation, then Barclays would surely be cooperative.

It’s true. When I travel I get hungry.

Why did I want a MasterCard Black credit card from Barclays in the first place? I get hungry when I travel. Permit me to explain.

I wanted to get the “restaurant option” offered with the Mastercard Black credit card with Priority Pass. What is the purpose of Priority Pass? This is how Wikipedia answers that question.

“Priority Pass is a membership program that offers travelers access to airport lounges around the world upon enrollment, regardless of their airline or flight class. Its global presence makes Priority Pass access a valuable benefit for anyone who values peace, quiet, and comfort while traveling.”

I’ve had this benefit over the past few years. Just recently, Chase Bank stopped offering the restaurant option. I still have access to well over 1,000 airport lounges.

With the restaurant option, I can go to more than 100 airport restaurants around the world and eat for free. The restaurants offer a $28 food and beverage credit for a guest and me including alcohol. During the first year that I had the restaurant benefit, I earned more than $10,000 in the airport lounge and airport restaurant savings.

Now, Chase Bank was dropping this more than lucrative restaurant benefit. I guess there were too many people like me that ripped off, I mean exploited…er, took advantage of the system….oh you know what I mean.

MasterCard Black from Barclays is the only card that I know about that offers UNLIMITED access to Priority Pass restaurants for their customers. That makes holding the MasterCard Black card a valuable addition to my travel toolbox.

I applied.

With all this as background, I made my application with Barclays. I did this with one of their representatives over the phone. After I gave them all of my information. They had me wait on hold. Then the rep came back and told me they couldn’t make a decision right now. By the end of the day, I would hear back from them.

Rejected! What?

I did hear back from them. What was their decision on my request for a MasterCard Black card? Rejected! Just like Montgomery Ward. Rejected! Frankly, I don’t live in a world of rejection. What was I going to do now? I had been all set to have the pizza in the St. Louis airport and Vietnamese food in the Seattle airport and the Italian food in Boston. I was rejected. Talk about being crestfallen!

I convince and I persuade. I am a sales guy.

I am a sales guy. I made my living, convincing and persuading people to do things that would both benefit me and benefit them. I happen to think I was a pretty good sales guy. I happen to think I am still pretty good at persuading people to take action for my benefit. I don’t mean to sound selfish. It’s just that sometimes there are people out there who can make decisions for my benefit.

I had an idea. I was going to call Barclays and beg for their mercy. Sometimes begging works. I was going to have them try to look at my situation a little bit differently. Bank of America had just given me a $49,000 credit limit. If Barclays was willing to give me a credit limit of only $5,000 at least I would be eating for free in all of those airport restaurants.

People were rolling their eyes at me from all around the world.

When I explained my new plan to family members and friends, who are astute people in the area of finance, they collectively rolled their eyes. I could tell from their reaction they thought I had no shot at reversing the Barclays decision.

Customer service in today’s world.

In today’s world, it’s hard to get in touch with customer service people over the phone. I need a few things when I’m trying to get a customer service rep to help. It would be great if they spoke and understood English. I know, right? The person has to listen, and they have to care. Finally, they have to have enough authority to decide on my behalf.

When the woman at Barclays answered the phone, I knew we were off to a good start. She spoke English! She also seemed to understand what I was asking about and was willing to listen. I went into my pitch.

Why? Why me?

First, I asked why I had been rejected. There was no shortage of reasons. She told me that my debt-to-income ratio was 800%. She said that seemed “a little high“.

I couldn’t admit this to her, but it seemed a little high to me as well. I guess if I went to the doctor and she told me that my blood pressure was 225/180, I would probably nod my head in agreement that my blood pressure “seemed a little high”.

The Barclays rep told me I had too many “hard” credit pulls. According to Chase, I’ve had SEVEN hard credit pulls over the past two years or so. I used three of those pulls to get my new car loan when it looked like Tesla was not going to deliver my car in time to meet the first credit union’s loan terms. Seven credit pulls in this time frame are rated as “poor”.

Credit limits.

The rep told me my credit utilization rate was too high. Remember, that number is computed by dividing how much we owe by the total of all our credit limits. These are the credit limits we have right now.

Chase – $109,600

Bank of America – $49,000

Citibank – $35,000

Lowe’s – $10,037

Total credit limits – $188,037

Payment history.

Our payment history was listed as “great”. No late payments.

Rating – Great

Credit history.

Our credit history showed our oldest account to be 27 years, 3 months. I didn’t think that was accurate, but it would have been difficult to disprove. They gave us a “great” rating in this category.

Rating – Great

Credit usage.

She told me my credit utilization rate was too high. Remember, that number is computed by dividing how much we owe by the total of all our credit limits. These are the credit limits we have right now.

Chase – $109,600

Bank of America – $49,000

Citibank – $35,000

Lowe’s – $10,037

Total credit limits – $188,037

Credit used – $71,054

Credit utilization % – 38%

Rating – fair

How high does your credit utilization number need to be to move from “fair” to “poor”? More than 60%!

Total credit balances.

We owe how much??

Home loan – $2,558,000

Car loan – $74,066

Various credit card balances – $80,364

Total balances – $2,712,430

Rating – no rating

Although we didn’t get a rating on the category of “account balances” they did list $2,712,430 as our loan/credit usage totals. Wow! The day we were married, we only owed $200!

Credit checks.

Inquiries – 7

Rating – poor

C’mon man. Poor? You want me to get your credit card, then you do a credit check and then you hold that credit check against me? C’mon man.

Available credit.

Available credit – 123,273

Rating – no rating

Now it was my turn to defend myself!

This is what is called a “reconsideration” call. I started by saying, “Your Honor,” and quickly checked myself. I wasn’t in bankruptcy court just yet.

I know some of you are thinking, “Randy, this doesn’t look good”. Hold on. Not only am I a sales guy but I’ve always been pretty good with numbers. Most people think they are “good with numbers” even when they are not.

It was my turn to speak. I had carefully laid out my case. Yes, we did owe more than $70,000 on our Chase Freedom Unlimited credit card. But I thought I had a good reason for that.

I told the Barclays rep that Chase was offering a 15-month 0% APR rate for carrying a balance with their card. That despite owing more than $70,000 on the card I wasn’t being charged any interest whatsoever. I had that $70,000 sitting in a Vanguard account earning 5.8% interest.

I posed this question, just to keep her engaged. When you are selling people you need to keep asking them questions. They like that. It makes them feel important.

I asked the woman this question and made this comment. “If this was your money would it be a financially prudent idea to pay off a 0% loan with money that was earning 5.8%?” Unlike some folks, she fully understood and supported my thinking. Point for me. I felt the Barclays lady was starting to warm up to me.

It’s never a bad idea to agree with people.

Yes, my debt-to-income ratio was high. Yes, I owed more than $2.5 million on our home. However, Rocket Mortgage formerly, Quicken Loans were big boys when it came to money lending. They must have known what they were doing, right?

My mother used to ask me how I was going to get something that she didn’t think I could get. “How are you going to get that? With your good looks?”. I always took that as a compliment. Rocket Mortgage did not give us that loan on my good looks. We had plenty of equity to get that $2.558MM interest-only loan.

Barclays needed to understand the “magic” in what I was doing.

I wanted this woman to understand the “magic“ behind my strategy to have such a high home loan. I explained this was an interest-only loan. I told her that the last thing on earth that I would want to do was to move money from my investments account, which earns 8% on an annual basis to pay off a home loan interest rate of just 2.25%

The Barclays woman seemed like an astute student of finance. Despite our monthly home loan payment of $4,800, she saw the value and understood why I wouldn’t want to move money from investment accounts to pay down our home loan principal. The same principle applied to my 3.99% car loan. Why pay off a debt of that amount with money earning 8%?

I wasn’t asking for much.

Whenever the conversation paused, I told her that I wasn’t looking for a large credit limit from Barclays. I would take a credit limit as low as $5,000. I was planting seeds.

We continued to discuss each aspect of the reasons I had been rejected for the new credit card with Barclays. I could tell that the woman was listening. She seemed empathetic. She asked if I would mind holding while she analyzed the situation further. No, I wouldn’t mind one bit. I was winning.

Who were your role models in life?

I’ve learned what I’ve learned from a lot of different sources. One of my role models is a fellow by the name of Eddie Haskell. Eddie appeared on the Leave It to Beaver TV show. Eddie was always sucking up to people. One of his best lines was, “Mrs. Cleaver, you are looking lovely today”.

There’s nothing wrong with sucking up to people. You just have to do it in a way that doesn’t make it seem like that’s what you’re doing. I’m not advocating being insincere. Maybe Eddie Haskell wasn’t sincere or maybe Eddie Haskell didn’t know how to give his compliments. It’s not that difficult to find an honest-to-goodness compliment to give someone. People love receiving a heartfelt compliment. Don’t you? I told the Barclays rep I appreciated her taking the time to listen to my unique circumstances. I wondered how many people each day told her that.

Soon, the Barclays woman came back on the line and said, “We are discussing your credit limit”. “You are discussing my credit limit?” I asked. “Does that mean I am approved?” She told me I was.

Oh, my. I am a sales guy. I guess I still have it.

Then she clarified my, “approval”. She was only in the “credit department”. There still needed to be one more approval above her. I would hear back later in the day to see if I was fully approved and exactly what my credit limit was.

You suck! But maybe you don’t suck that bad.

Mind you, just yesterday, Barclays said “no” to my request for a MasterCard Black card. They were rejecting me and essentially piling on. They pointed out all of the weaknesses in my credit application. Essentially, they were saying I was a deadbeat. They had no interest whatsoever in doing business with me. Most people would have given up at that stage. That’s not my game.

Now after today’s “reconsideration” phone call, I was conditionally approved. They were now discussing my credit limit. Throughout today’s discussion, I had said I was willing to accept a super low credit limit, just to be approved. I had asked for a minuscule $5,000 credit limit. How much were they going to give me? I didn’t know. I could only wait.

A few hours later, I got an email from Barclays. I had been fully approved! There was a link for me to click to determine what my limit with Barclays credit line was going to be.

With some trepidation, I clicked on the link. Was my credit limit going to be $500, $2,500, or maybe, if I was lucky, the full $5,000 that I had asked for? Before you read the next paragraph, what do you think my Barclays bank credit limit turned out to be?

Did the number $65,000 cross your mind? It never really crossed my mind either, but that’s what they were giving me.

Let’s think about this for a moment. First, Barclays rejected me. Our financially astute son and my equally financially astute friend thought I had a near-zero chance of success by calling Barclays.

I was happy Barclays had changed their mind. I was happy that my credit limit was going to be $65,000. I don’t expect to spend virtually any money on this credit card. What was I most happy about? I was going to be following up with my family and friends, and telling them how I had turned the tables. That’s what I was most pleased about.

O.K., if we summarize?

Would it be OK with you if I summarized the situation? Everyone likes a good summary, right?

With the Barclays card, we will now march up to so many different restaurants in airports around the world with a smile on our faces. We will consume many menu items at no charge to us. We will eat more food than we should…because it’s free. We will have the only credit card that offers unlimited Priority Pass membership with restaurants. That’s big.

Was I getting the Barclays card just for the restaurant benefit?

Yes! Was this fair to Barclays? Yes! Why would Barclays make this offer and approval to me and others? Because they know a certain number of people won’t pay their bills on time. They will earn a lot of interest in those situations. They will always earn their transaction fees. Don’t cry for Barclays or Argentina.

We will continue to borrow more money and pay it back slowly.

We will continue to build the outstanding balance on our Chase Freedom Unlimited card until the 0% APR promotion ends in February 2025. The minimum payment on a $75,000 balance is only one percent or $750.

In the meantime, that money is earning 5.8% safely tucked away in a Vanguard money market account. The 5.8% is a tax-effective yield. The Vanguard Treasury Money Market Fund (VUSXX) is tax-exempt from state income taxes. The 5.8% is based on my federal and state tax rates. If your tax rates are higher than mine you will earn more than 5.8%. This rate is not guaranteed but I’m only doing this part of the strategy until February 2025. My rate with VUSXX has been greater than 5.8% since I began this program in November 2023.

This gives us a nearly risk-free return of more than $4,000 for the year. That’s literally like taking candy from a baby.

Borrow baby, borrow.

Borrowing is not a bad thing. You have to have confidence in yourself to pay the money back. You should never borrow more than you can pay back. A good bank will never let you borrow more money than you can pay back!

Borrowing for me is an income source, a big income source.

We will continue to hold a $2.5 million home loan. That loan is interest only. That means I am not moving any money from my investment accounts into the deathly black hole of home equity. Everyone knows that the value of your home is 100% independent of the value of the mortgage you hold.

In the past few years since I took out that loan, my annualized rate of return on my investments has been more than 10%. I’m glad I didn’t move any money from my investment accounts into home equity! Who in their right mind pays off extremely low-interest-rate loans?

The same is true for a lesser degree on my car loan. That loan runs for six years at 3.99%.

Not everyone agrees but that’s on them.

Not everyone will agree with what I am about to tell you. These strategies, led by our home loan strategy, are earning us more than $200,000 each year on average. I could pay off all of these loans if I wanted to. I don’t WANT to.

This message is about money but not for money’s sake.

This $200,000+ in earnings comes from the funds I already have invested. These funds are invested because I choose not to put that money into equity.

Is the $200,000 guaranteed each year? Let’s be real. Who GUARANTEES you $200,000? However, all of this is based upon reasonable rates of return and likely assumptions that I have been achieving for twenty years.

If you don’t want to do what I am doing who are you hurting? You, your family, and others that you love and the charities you like. This is a strategy for getting more money. But this is not a strategy about getting more money for money’s sake. Money is for consumption. Money by itself is worthless. Who will be able to consume the money you get from doing what I do? You, your family, and others that you love and the charities you like.

The bank never would have given me the loans if I didn’t have equity in our house and to a very limited degree the car. What is all of that equity money earning? Nothing. Nothing at all. Of course, all of my “borrowing” earnings are supplemented by income sources like RMDs, social security, and other investment earnings.

If I earn 8% each year on the $2.5MM home loan money, that’s $200,000. The cost of that $2.5MM at 2.25% is $56,250. Nearly half of that $56,250 is a tax deduction.

I just finished a $100,000 car loan at 1.99% over four years. That “delta” of 6% (8% investment earnings less 2% loan cost) gave me an advantage of around $25,000. I’m earning more than $40,000 each year with my “points and miles” earnings! I am doing something everyone reading this can do. I am leveraging my biggest untapped asset, my everyday personal expenses.

How well do you sleep?

People have told me that they “sleep better“ knowing that their home is fully paid for. Despite having such a large balance, I sleep very well. I sleep well because I know those loans are working for me while I sleep. Think what am doing is risky? I am replicating just what a bank does. A bank pays money to people at low rates for their deposits. Then they loan that same money out at higher rates. I’m doing the equivalent. I borrow money at low rates and invest it at a higher rate. I sleep like a rock.

Where else will you see this level of sharing?

You will agree. I have shared quite a bit of personal information. I doubt that you’ve ever gotten that much personal detail from a family member, a friend, or anyone else. Why share? To prove that if I can do it you can do it. I hope that you appreciate and understand my candor.

Did you get knocked down? Get back up. Make the reconsideration call.

I think I proved the point that when I got knocked down and rejected and told that I was no good, I made a pretty strong comeback. I’m very confident that I won’t be going to jail or debtor’s prison…and that Carol won’t be in the cell next to me.

It don’t hurt to ask.

I hope that you agree that a good strategy in virtually every aspect of life is that “it never hurts to ask”. Of course, when you ask, you have to know what you are asking for. You have to ask for things in the right way. You have to ask the people who have enough authority to support your request.

I truly hope that you enjoy reading my newsletter. I know that people pass what I share along to friends relatives, and younger members of their family. I support that 100%.

I don’t think it takes all that much understanding and effort to implement the simple procedures that I have mentioned. On the other hand, if Michael Jordan tried to explain to me how simple it was to dunk a basketball I don’t think I could replicate his abilities.

In reality, this is easy if you know what you’re doing. There’s no overlooking this. You have to take time to educate yourself, have a goal in mind, and be willing to push just a little bit. When you pull all of this together, my achievements can be your achievements.

What is all of this really about?

Is what I am telling you just about “getting more money?” I don’t think so. Then what is it about? I think this is all about not leaving anything on the table. I think it’s about understanding the situation and identifying solutions. It’s about developing reward systems that the skeptics say aren’t possible when, in fact, they are.

That’s my story for today. As so many people do, please feel free to share your comments and questions with me.

Unless some major catastrophe pops up, my next newsletter will be about Sweden, Swedish meatballs, Swedish dollar stores, and, of course, Bruce Springsteen. However, another topic is just about ready to crowd out Bruce!

I dictated this while driving through the night in Minnesota on a lonely two-lane highway. If all goes well, I’ll sleep in a Walmart parking lot tonight for a couple of hours before I catch a flight to Detroit in the morning. Don’t worry. This is what I do.

All the best,

Randy Lewis

He’s a sales guy and likes Eddie Haskell.

RIP – Kindred Powell – One of the smartest people I ever met