From the travels and adventures of the “Finance Man”

EVERYBODY NEEDS A MORTGAGE! This is a follow-up note on why I think EVERYONE* in the P&G retiree conference should have a mortgage on his or her home. Of course, just to give myself an out, I have included an asterisk behind the word “Everyone”. I’m going to use the assumption that 99% of the people in our conference are in the 50-90 age range. By the way, I did not think up these strategies. They are an outcome of my years of study with financial planning and household budgeting. Additionally, I am not trying to “gore anyone’s pet ox”. However, it is a good idea to entertain alternative ways of thinking if for nothing else than intellectual exercise. Before I tell you why I think having a mortgage is a good financial idea let me tell you who this would not apply too. Independently wealthy people. Folks who fall into this category don’t necessarily need to do anything that maximizes the value of the money they do have. That’s why they call these people INDEPENDENTLY wealthy! People with little or no home equity. What would there be to mortgage? As long as your total mortgages are less than 50% of your home’s value you should be good to go for a very long time. Renters. By definition, renters would not have a mortgage of any kind. Who DOES this apply too? Homeowners who are not independently wealthy, in the 50-90 age range and who are retired. Most P&G folks who are in this group have their money in three different buckets. That would be 1) personal savings, 2) IRA rollovers from their P&G profit-sharing funds and 3) equity in their homes. Most of these people would use these three buckets plus social security income to live on for the rest of their lives. Most people try to spend within their means so they don’t run out of money before they die. That’s a great idea. However, what if people don’t spend their money because they FALSELY feel they might run out of money? That’s what can happen if you have too much of your net worth tied up in a fully paid for home. Most people (when I say ‘most people’ I’m talking about the vast majority of P&G retirees) cannot live on social security alone. That means they draw funds from the three buckets listed above. Some people don’t have a lot in the savings bucket because the P&G bucket was so generous over the years. Nothing wrong with that. The P&G bucket really was a form of personal savings. Let’s take some real-life examples. If a person has $100,000 in personal savings, $1,000,000 in their rollover IRA (from P&G mainly) and $400,000 EQUITY in their homes then they have $1,500,000 in assets to fund their retirement years plus social security. However, if they don’t have any plans to ever get the equity out of their home to live on (read that ENJOY) then they don’t have $1,500,000 in retirement savings but $1,100,000. You can do the numbers for your own situation. In California, homes are much more expensive than just about anyplace else. However, with the recent recession, they are not as expensive as they used to be! Nevertheless, I have a retired friend who lives in a $2 million dollar home (it might cost $600,000 in Cincy!). He’s married without kids and was very much against having any mortgage at all. That meant his biggest “bucket” was the equity in his home. He might have had a net worth of three million dollars but without being able to use any of his home equity he didn’t have THREE million in retirement assets he had only ONE million. I know there are some people who have read this far and are thinking, “We don’t spend much. We could certainly live on one million dollars”. That’s fine but what if you HAVE three million? Do you still want to live a retirement lifestyle that limits you to just one million for the rest of your retirement life? If so, who will get that “hidden” two million when you pass on? Remember you can add or subtract zeros to replicate your own situation. I know lots of retirement couples that eat sandwiches rather than steaks so their kids can get their money after the parents die. That’s great if you prefer a peanut butter sandwich to a sirloin steak. If the IRS life expectancy tables are correct my wife and I will live until we are 85 or so. By that time our kids will be in their 50s. I figure if our kids need our money by the time they’re 55 years old then we probably didn’t teach them how to earn and save their own money that well. I also get that “I don’t want to owe anybody” feedback to this overall financial strategy. Sorry, can’t agree with that one either. Would you rather have $1,000,000 in the bank and owe somebody $50,000 or have $25,000 in the bank and be debt-free. There’s nothing wrong with debt as long it is fully in control. In this example, the person with $1 million in the bank is managing their debt very well. Others say I don’t have anything that I really want to buy with my money. That line of thinking would be hard to argue against. However, I suspect that if these people won $50 million in the lottery that used car sitting in the driveway might be replaced, the older TV in the den might become a plasma flat screen, etc. etc. Am I suggesting you take out a $550,000 mortgage on a $600,000 home? No way! However, someone in this situation who might be 65 years old could take out a $20,000 home equity loan to spice up their lives a bit. They could do that for each of the next ten years and still have only a $200,000 loan on a property that in all likelihood would have increased some in value. How would they make a payment on a $20,000 home equity loan each year? The payment on that amount at current rates (4%) would be ninety-five bucks a month. Take out $21,200 and you’re covered for the year. Remember in this example you would STILL have $580,000 in home equity. I had a P&G boss who always told me he wanted the last dollars in his estate spent to pay the guy who covered up his coffin in the graveyard. My boss lived to be just 59 years old. I doubt he was ever able to spend 10% of the funds in his “three buckets”. In summary, I am not talking about “mortgaging yourself” to the hilt. I am suggesting that if you don’t spend the money in your “house bucket” someone else will. Maybe even the government will get there hands on some of it. I’m going to guess you can enjoy your house bucket money should you decide to tap into it a lot more today than ten years from now. If you don’t have a mortgage on your house now, you can tap into it in very small amounts to increase your lifestyle. A $10,000 drawdown annually can give you lots of extras so that YOU get to spend the money that YOU earned. Living “debt-free” might be the mantra of radio talk show host Dave Ramsay. I agree with just about everything he talks about except the debt-free talk for retirees. People who are thirty years old have another 50-60 years to live. Unfortunately, the average retiree has much less time than that. You need to spend your money (not wildly) while you are alive. If you don’t someone else will. Think about it this way. If you won the lottery what would you do? Would you spend a little extra? Probably. Your house can provide some of that lottery today. Don’t be afraid to spend just a small portion of what is tied up in your home. I realize that some people have their strategy and they’re rolling straight ahead regardless of more compelling rationale to change course….at least a little. For those who are looking for other ways to increase their retiree income and enjoyment, this might be for you. Randy Lewis San Clemente, California How many of you know what a “trotline” is? Wikipedia describes it thusly, “A trotline is a heavy fishing line with baited hooks attached at intervals by means of branch lines called snoods. A snood is a short length of line which is attached to the mainline using a clip or a swivel, with the hook on the other end. As a boy, my grandfather and I would “set” our trotline and every day or so “run” our trotline. As a boy growing up on the Illinois River I never dreamed the efficiencies of the trotline would directly transfer to buying a new car. Although you may not be interested in fishing this way (or any way) many of you will buy a new car from time to time. If that interests you what I have to say will help you get the very best price on that new set of wheels that deserves to be in your driveway. Note: I have talked about this in the conference before. However, today was the first time I attempted to upload a file to the conference on this subject. My three attempts might tell you I am a much better buyer of cars than loader of files. Below is a summary of the methodical approach I take to buying a new car. Do not mistake “methodical” with time-consuming. The program really doesn’t take as much time as you might think. Here goes. 1. GET AN IDEA OF WHAT TYPE OF CAR YOU WANT It was time to buy a new car. With that in mind, I went on Edmunds.com and checked out specs. I was getting rid of my 2004 Lexus LS 430, which I also bought via the method I am about to explain. My family and I have purchased about ten cars using this approach all the way from the full-sized Lexus to a $20K Honda Civic. I was in the market for a crossover SUV. I had been renting SUVs all year so I could benefit from the test drive. Being 6’3″ tall and a pound or two (or more) above my high school basketball playing weight I wanted a car that I could fit into. When I had identified cars that were large enough and provided some decent fuel mileage, etc. etc. I moved onto step two. 2. IT WAS TIME TO VISIT THE CAR SHOW I live in the greater Southern California area. The Los Angeles Car Show is a big event held each year in early December. This was perfect timing. I’ll tell you about that later. My wife and I tied about three hours of “browsing” at the car show in with an evening at the “Donnie and Marie” (Osmond) Christmas show. That didn’t make the day so “car-centric“. Not everyone lives near where major car shows are produced. However, it’s a great way to “see and touch” just about every make and model you might be interested in. I’d recommend going on a weekday afternoon to avoid the crowds. From the Edmunds.com spec research and the car show, I came out thinking I wanted an InfinitiJX 35 SUV. I was ready for step #3. 3. GO TEST DRIVE THE CAR YOU THINK YOU WANT In a few days, I showed up at our local Infiniti dealer. I had no intention of buying a car. I just wanted to “kick the tires” and drive one. I tried the InfinitiJX 35. It was too “mini-vannish” for my tastes. I’ll give the salesman credit. He tried another model, the FX 35 out on me. This crossover SUV was a sporty little thing. It came with a 335 horsepower V-8 engine that would go from 0-60 faster than you needed to cover the distance. It might have been the car for me if I was willing to overlook a future kidney transplant. Yeah, it had a rough ride. Note: No offense to Infiniti owners intended. My second brand choice was to return to Lexus. I’ve driven new Lexus LS models since 1999. I dropped by a Lexus dealer for a test drive. The Lexus RX 350 was just what I was looking for. It was like all Lexus cars are, had a luxurious interior, a smooth ride (for an SUV) and got acceptable fuel mileage. Mentally, I had decided this was the car for me. I had told the salesperson I didn’t expect to buy a car then. I’m sure he’s heard that a million times. When I was departing he did tell me they were willing to get “aggressive” before the end of the calendar year. They would go as low as “$500 back of invoice”. Of course, that meant they would sell me the car for $500 below their invoice cost. By the way, when you shop for the car you need to think of pricing in relationship to invoice and not Manufacturers Suggested Retail Price (MSRP). The dealer does get some additional monies (advertising, volume rebates, etc.) that aren’t included in the invoice cost of the car. However, those funds rarely come into play when negotiating a deal. Soon it was time for step #4. 4. GET YOUR PRICING DETAILS STRAIGHT AND GO MAKE AN OFFER Now it was time to go back to Edmunds.com. Did you know you can “build the car you want” on their site? Yep, you can. Edmund’s lets you add every option you want to the base price of the car. They provide both the invoice and MSRP of every option for nearly every car. I added in the things I wanted. One thing I did not want was the “navigation package”. I have a Garmin and an iPhone. Plus I probably never used the “nav” system five times in my last Lexus. It was too complicated and couldn’t be reprogrammed while the car was moving which is when I WANT to reprogram it. When test driving the car the salesperson told me that 80-90% of the cars came with navigation. That would be both a plus and a minus. That meant that the inventory I was looking for would be small just 10-20% of what the dealer would have in stock. On the other hand, it sounded as if most people wanted a car with navigation so the demand for what I wanted would be less. That might help me get a better deal. Soon I had the exact invoice cost of my base car, my options (about five) and the shipping cost of the car. Now it was time to plug these numbers into my form letter (which you can find as a PDF file in the files section of the PNGeezers Yahoo conference). I was now going to send that form letter to every Lexus dealer in the greater Southern California area. That area would be a rough triangle of San Diego, Riverside and Oxnard. How many Lexus dealers are in that area? Twenty-one (21)!!! That’s a lot of Lexus dealers ain’t it? That’s why this program works so much better than if you live in Rawlins, Wyoming. However, that doesn’t mean you can’t do the same thing from Rawlins. They have the internet in Wyoming. Do all of your work from there. Send your letter to all of the dealers in Denver and drive down for the day and pick up your car. Some of you are probably saying I don’t mind doing some online research and going for a test drive. But I draw the line at contacting 21 different dealers. Not so fast. It’s not as time-consuming as you might think. I’ve used the same form letter for the past nine years. When it’s time to buy a family or friend’s car I just update a few items and it’s ready to go. I used to fax and email my letter to the dealers. Faxing has nearly gone the way of the VCR. I didn’t really email the letter either. I discovered that every SoCal Lexus dealer has the same website template. They have a section for customers to send them a message. I simply “cut and pasted” my letter into this message section. I send that letter to 21 dealers in 29 minutes. I figured I had done enough work for one morning. I walked upstairs and had my breakfast. Soon it was time to come back and “run the trotline”. Would I have any bites? I figured I would. Out of 21 Lexus dealers how many to you think send me a “firm price” bid. Ten! I thought that was pretty good. Another 3-4 told me they didn’t have the car and color I was looking for. Still another few asked me to call them to discuss. I presumed those were the ones who did poorly in school especially with reading. I had specifically omitted phone numbers in all of my communications. I told them that during “preliminary” discussions that email or fax would be the only way to contact me. I did send a follow-up message to those who awaited my call to read my letter again and submit their bid within one hour. Recall the dealer what I had taken the test drive offered, without much prodding from me, to sell a car $500 back of invoice. I figured if that was the case I ought to at least get $1,000 below invoice as my closing deal. I reviewed the ten offers I did receive. Some dealers had both colors I had requested and some had one or the other. Some cars came with small options I didn’t really request (cargo nets, roof racks, etc). Even for the options, I didn’t want I knew what the invoice costs were. The ten offers ranged from $1,248 below invoice to (drum roll) $2,701 below invoice. Folks this was not an end of the year closeout model. 2014 versions don’t come out for another 5-6 months. I studied the offers. Some dealers were closer than others to where I lived. However, I couldn’t take my eye off the dealer who had BOTH colors I was considering at $2,701 back of invoice. Granted this dealer WAS ninety miles from my house. However, in SoCal, we drive twenty miles just to go to the movies. I have never bought a car at the dealer closest to where I live. At the same time, I have NEVER taken a car back for routine service to a dealer where I purchased the car. I buy from the dealer who has the lowest price and then take the car to the dealer nearest my house for service. That has worked perfectly every time. Before we go any further let me discuss the time of the year that it’s best to do this. New Year’s Eve!! Yep. New Year’s Eve is the last day of the month, the last day of the quarter and the last day of the year. Think of this as the “triple witching hour” for car dealers. When did I buy my last brand new Lexus? On New Year’s Eve. However, on December 31, 2012, I would be on an airplane flying to Miami, Florida to see my mighty Huskies of Northern Illinois University play in the Orange Bowl. Yes, they got stomped but they were IN the Orange Bowl. I decided to buy my car this year on December 29, 2012. That was a little “early” but I was getting antsy to implement my systemic approach. Before I headed 90 miles north to finalize the deal I called the internet salesman who had given me his best offer. I just wanted to confirm there would be no “funny business” once I arrived. He assured me there would not be. There wasn’t. I guess in the back of my mind I play “old tapes” about what could happen. Every Lexus, Jaguar and Honda deal where I have personally used this program has gone 100% as planned. We drove up to the dealer and had the salesperson park the two different colored Lexus RX 350s side by side. I looked ’em over and picked one. While the car went away to get washed and gussied up we went in to sign the paperwork. Of course, I got to meet the finance manager. He has two responsibilities. First, he puts a preprinted form into an industrial-sized printer to produce the sales contract. However, his other job responsibility is to sell you stuff. He wasn’t much of a salesperson. Maybe he didn’t believe in his product. After I had turned down his paint protection and interior protection and extended warranties we signed the deal. By the way, in ADDITION to getting a brand new Lexus at $2,701 below invoice with this program, Lexus gave us an additional $1,000 off as a “loyalty” bonus because we already owned a Lexus. Then they offered us 1.9% financing for as long as 60 months. I didn’t have to put down a dime. I figured my long-term investment results would almost certainly far surpass the 1.9% cost of money. When the car was finished with prep the various features of the car were explained to us. Then to celebrate my wife and I walked over to a nearby Indian restaurant and had a relaxing dinner before our 90-mile ride home. Oops. One other thing. I had decided I wanted to get some upgraded chrome wheels for the car. Of course, the ones I liked were the most expensive. I pointed that out and the salesman told me he would sell them to me at $300 below cost. That would still make the wheels $2,200 plus tax. I wondered why in the world they would be willing to sell the wheels below cost. I could see them needing to move cars but wheels? I told him I would think it over. I had no idea what those wheels had cost the Lexus dealer. I did some more research and found the very same wheels (Lumarai brand specifically made for Lexus) at a custom wheels shop. Lexus wanted about $2,400 including sales tax and my old wheels. The custom shop sold me the wheels for $1,530 and let me keep the old wheels. Now I’m trying to sell those wheels back to Lexus for $100 each! It pays to do your research. 5. LET’S SUMMARIZE This entire process covered about two months. However, I wasn’t really working on this for that long. The first step is doing some online “spec” research took me the better part of one evening with my computer. The second step, going to the car show, took about three hours. With my wife tagging along it was almost more of a social event than anything else. Then the test drive (everyone should test drive the car they think they want) took another 2-3 hours at the two dealers I visited. Finally, submitting 21 offers took 29 minutes. I took another two hours to review and tweak the offers I did receive. By the time this process was complete I felt I had a very good pulse on the Lexus new car market in Southern California. There are lots of ways to buy new cars. My parents used to have the Ford dealer call them “whenever they had a white Taurus”. I have a buddy who buys new Mercedes from his high school buddy who always “gives him a good deal”. Some folks might just go to Costco to get their car. My approach is a hands-on program. When done efficiently it doesn’t take all that much time and I believe it gets the very losest price. Automobiles, in most cases, are commodity products. Each model from dealer to dealer is the same. The only difference is the price. Once you buy the car at one dealer you can service anywhere you want. Dealers make much more servicing a car than selling a car. Even if they didn’t sell the car they would LOVE to have the service business over the next several years. If you follow this model I can pretty much guarantee you success. Good luck. Take a look at the “form letter” in the files section. Any questions or comments ask away. Don’t forget to celebrate your purchase. Your spouse will love you for it. Randy Lewis Dealer communications form letter. Randy N. Lewis P.O. Box XXXX San Clemente, California 92674 December 29, 2012 Attention: Internet/Fleet Manager I am in the market to purchase a new 2013 Lexus RX350 front wheel drive automobile immediately. I will not be offering a trade-in. I am a qualified buyer and current Lexus owner. I plan to finance this car with Lexus. Below you will find specific information about the car I am looking for. I have purchased several Lexus cars in this manner. I am a serious buyer. Therefore, we can both save time on this transaction via fax or email. If you are interested in doing business, please submit your bid as soon as possible and no later than close of business today, Saturday, December 29. I am giving each SoCal Lexus dealer a chance to earn my business. On acceptance of your offer, I can purchase the car immediately. I plan to sign docs and pickup the car on or before Sunday, December 30. Please no phone calls or gimmicks. I am a serious buyer and will complete the deal if you have the car and price that meets my expectations. Given the competitiveness of the current market, I understand this model is currently being discounted to below invoice cost. Since all Lexus dealers are great, the LOWEST PRICE WILL GET THIS DEAL! Here are the specs for the car I will be buying. Model # Lexus RX350 FWD 1st color choice Starfire Pearl 1st interior choice Parchment 2nd interior choice Light Grey 2nd color choice Nebula Grey Pearl 1st interior choice Black 2nd interior choice Light Grey I will consider other minor options that may be included on the car you have in stock. However, my strong preference is to go with only the options listed below. Pricing details Invoice cost Base vehicle invoice cost $36,754 Destination charge 895 Base model with destination charge $37,649 Options Premium package 2,115 Comfort package 1,232 Lexus Display Audio Package 792 Wood/leather trimmed steering Wheel and Shift Knob 303 Total option invoice cost $4,442 Total purchase invoice cost with $42,091 all options I understand that tax and license are extra. I do not want any cars with the Mark Levinson radio system. I will not accept a car with the Navigation System (unless you want to give it away!). This offer is contingent upon receiving the Lexus current owner loyalty rebate of $1,000 and 1.9% Lexus financing for 60 months. My most recent credit score was 801. Please give me your best quote (with the $1,000 customer loyalty included) and a copy of the dealer invoice of the car you are selling by FAX at 949-366-1767, attention Randy Lewis or via email to ranlay@yahoo.com. Thank you for your time. Let’s get this deal done! Randy N. Lewis Folks from the U.S. get to decide when they want to begin collecting social security payments. This can be done as early as age 62 and late as age 70. Actuarially, the breakeven age is 78. We are told if you live to be 78 years of age or more you will “make out” if you wait to collect social security. If you don’t make it to 78, then it would have been better to have collected your social security checks at age 62. Below is an essay I submitted to the Procter & Gamble retiree email conference (conference name: Pngeezers; more than 2,000 members). Here are just a couple of the several positive responses I received regarding my “Time Value of Life” point of view. “I like your approach and it somewhat matches what my wealth manager is telling me as well – If you don’t need it take it if you need it hold off as long as you can before taking it! I’m just 60 so some time to work thru but if you have any other words of advice please share.” “I retired from P&G last year and I’m 58. I’ve been reading the debate over when to take SS with great interest even though I still have a few years to make that decision. I really like and share your sensible and practical point of view. Thank you for helping me make up my mind!” The “time value of life”. Most of us have heard of the “time value of money”. That means that it’s better to have a dollar now than in the future of course. I’ve been reading with interest all of the comments about when might be the best time to begin collecting social security checks. There are good points on both sides. I’m going to share a point of view that I haven’t seen mentioned yet. All of what I will say is based upon a few basic facts that apply to most people reading this. First, most retired P&Gers have dramatically more money than 99% of the retired people living in the U.S.A. Most people try to be responsible with their money. Ultimately, the money you made will be used in four ways. #1 You’ll spend it. #2 Your heirs will spend it. #3 The government will get it. #4 You can give it to charity. Sometime during your life, you will either run out of money or you won’t. I know…some of this is earthshattering stuff! I’m going to guess that most P&G people will not run out of money during their lifetimes. However, people watch their expenses AS IF they will run out of money if they spend too much. Have you ever bought a Bentley automobile or flown around the world in first-class and stayed at the most expensive hotels in the most expensive cities? Probably not. However, if you had ALL THE MONEY IN THE WORLD you might give it a shot. I know there will always be people who say that no matter how much money they have they would still wear their old coat and keep that old car they drive. However, most of those people have never had ALL THE MONEY IN THE WORLD! My wife and I decided to take our social security funds at age 62 (about two years ago). We don’t expect to ever run out of money during our lifetimes. We figure there’s a reasonable likelihood that social security will be “means-tested” in the future. That might cut down our payout if we waited longer. We don’t know if we will live past 78 years of age the breakeven point for taking social security, who does? We went with the “time value of life” analysis. What is that? We figured having two grand a month to spend at age 62 might be better than having three grand a month to spend at age 72 or 82. We travel all over the world now. Will we want to or be able to travel like that in ten or twenty years? The odds might say “no” to that question. I say that if you don’t think you’re ever going to run out of money in your lifetime taking social security now and spending it on stuff that you might not enjoy as much in ten or twenty years is a good idea. Some folks think leaving a sizeable estate to their kids is a good idea. I figure if I make it to 80 our kids will be about 55 years old then. If they need my money at 55 then they weren’t very successful on their own. Some people might like to leave their money to charity. If you support a good cause that sounds like a great idea. I just hope the “administrative expenses” don’t eat up a lot of your gift. Of course, a few goofy folks might like to leave lots of their money to the government. I won’t comment on that strategy. In summary, if you have enough money to last you through your life I say spend it. That doesn’t mean overspend it or waste it. However, you’re smart enough to know the difference. We’re enjoying our social security payments now when we CAN enjoy it. If we make it to 82, we’ll try to enjoy our savings in whatever way the Man above allows then too. Yep! This is the “time value of life” method of social security benefits management. Randy Lewis San Clemente, California P.S. As I was writing this a filling fell out of my tooth. I think it was God’s way of telling me I really WILL be in better shape now than in twenty years. In April 2013 we installed a solar electric (solar panels) system at our house. I am NOT a solar electric expert just a recently educated solar electric consumer. I’ll give you a few of the highlights of my experience in the hopes it might help someone else who is interested in this subject. After seeing a friend have a positive experience with solar I decided to find out more for myself. We live in Southern California in San Clemente at the beach. That being the case I did some internet searching and ended up interviewing four different companies. The total cost of our system was $31,492. However, after the federal government’s tax CREDIT (dollar for dollar) of $9,447 and a 3% “rebate” from American Express of about $630 on the part of the purchase we were allowed to charge, my net cost came out to be about $21,415. Our system has a 5-degree tilt. The optimum tilt is actually 18%. However, I don’t think our neighbors would think much of our blocking their ocean view. At a 5-degree title we still get 96% of the panel benefits. We’ve had our system for more than a year now. There have been zero problems and it is actually delivering 9% more kWh than what was projected. If the system produces more electricity than we use then the meter “spins backward”. We are paid for the electricity we produce but do not use. However, the rates are very low (4-8 cents per kWh). Unused electricity will accrue and be available to go against the months where we use more than we produce. I can view our daily, monthly and annual production on my laptop and iPhone. I can even see how much power each individual panel is producing. I find myself spending a good deal of time indoors now just watching the graph go up and up. Fast forward now some four years. You saw how we started out. Did all of the “good things” continue? Check out my summary after having the system for four years (April 17). We installed solar panels four years and 151 days ago at our home in Southern California. But then who’s counting! I’ve updated the group at the end of years #1, #2, #3 and #4 on how this project has gone. It has now been 4.42 years since our installation. I wanted to give you another update…..the final update. For folks short on time our experience with solar has been fantastic. I expected the entire project to pay for itself in 4.5 years from the time of installation. We actually beat that by a few days. When we sell our home, someday in the future, I would expect as sellers we will benefit from having a large home that has a zero electric bill in an area where electricity is very expensive. We recently refinanced our mortgage. They gave our home an increased value with the loan appraisal because we had solar. Now, for folks with a little more time, I’ll provide some detail around how solar has worked for us. This message is for people who might have an interest in reducing their going forward electrical expense. As you will see I go into great detail explaining how solar electric has worked for us over the past 4.42 years. There’s so much detail few people will likely make it to the bottom of the message. Everything we were promised is being delivered and more. We couldn’t be happier with the experience. A big motivation for getting a solar system is the federal tax credit. Remember, I don’t make the tax laws. However, I do like to use them to my advantage when possible. Here’s the current situation on that credit as provided by the Solar Energy Industries Association. “What is the Solar Investment Tax Credit? The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (Section 25D) and commercial and utility (Section 48) investors in solar energy property. Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems outright and have them installed on their homes. How does the Solar Investment Tax Credit Work? A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Both the residential and commercial ITC are equal to 30 percent of the basis that is invested in eligible property, which have commenced construction through 2019. The ITC then steps down to 26 percent in 2020 and 22 percent in 2021. After 2021, the residential credit will drop to zero while the commercial and utility credit will drop to a permanent 10 percent.” When we installed our own personal “electrical power plant” the tax credit was 30% of the system’s purchase price. Not only was the tax credit great but also it’s kind of cool to tell folks you own your own personal electrical power plant. Electric rates are very expensive in California. The more expensive the rates the better value installing a solar system will become. Things are expensive in California. Why? It’s the tax for beautiful weather, no rain, no humidity, no bugs, no tornados and no water. That’s why Colorado exists (for the water!). I realize this message will play to a limited audience. However, if it helps just one person that makes me happy. Let me refresh your memory if you’ve read this far. Just over four years (O.K., 4.42 years) ago we purchased a solar power system that was designed to replace most of the power we were purchasing from the San Diego Gas & Electric Company (SDGE). Electrical rates are expensive in California and going up at a pace faster than normal inflation. I decided to do something about that. We purchased (not leased) a 38-panel solar system. We have a flat roof that was perfect for a solar application. The pre-tax credit cost of our system was about $33,000 U.S. However with federal tax CREDITS (not deductions) and local credits the cost came to about $21,415 for the entire system. Let me give you a few facts to mull over. Our electrical usage for the year prior to our solar installation was 15,284 kWh (kilowatt-hours). Our house has about 6,000 square feet. Living in a warm climate requires that we use our air-conditioning nearly all year at least for a little bit. We’ve tried not to change our electricity consumption habits since we’ve added solar. Our cumulative usage during the first four years of our solar install was 62,199 kWh. That’s 1,295 kWh being used, on average, every month. Our usage should have no relationship whatsoever to the fact that we now have solar. We don’t consciously use more or less electricity just because we have solar. When we purchased our solar program the sales rep told us the system, based upon independent government sources, was supposed to produce 13,744 kWh annually. That would be 60,748 kWh for four years. He also told us the projection was always a little bit less than what we should expect to get. It has been. The system actually produced about 68,438 kWh in the 4.42 years we’ve had the system or 12.6% more than what was promised. By the way everything the solar company that provided this system ever told us was true. During several months of the year, the solar system produced more electricity than we used. During those months we received a credit from SDGE to be used in future months. We were selling electricity back to the grid (albeit at lower rates than we would purchase from SDGE) during those months. SDGE has changed their electrical rates from a four-tier system (that we started with) to a three “tier” pricing system and now to a two-tier system. Tier 1 pricing is the lowest and applies to the first kWh used. The hours allotted per tier and price per tier seem to change slightly from month to month. Below are the most current rates from year one until now. Rates through the FIRST year of operation, March 2014. kWh used Rate Tier 1 0-313 $0.15 Tier 2 313-407 $0.18 Tier 3 407-626 $0.33 Tier 4 626+ $0.35 Rates through the SECOND year of operation, March 2015. kWh used Rate Tier 1 0-293 $0.17 Tier 2 293-381 $0.20 Tier 3 381-586 $0.37 Tier 4 586+ $0.39 Rates through the THIRD year of operation, March 2016. kWh used Rate Tier 1 0-293 $0.17 Tier 2 293-381 $0.19 Tier 3 381+ $0.38 Rates through the FOUTH year of operation, March 2017. kWh used Rate Tier 1 0-347 $0.19 Tier 2 347+ $0.40 Rates through the first 42% of the FIFTH year of operation, September 2017. kWh used Rate Tier 1 0-351 $0.22 Tier 2 351+ $0.40 As you can see the more you use the higher the rate paid per kWh. As you can also see the rates have increased a good deal. Most of the hours we use (greater than 300-400 kWh/month or so) are in the highest pricing range. When we started the system the top rate for most of our hours was $0.35 kWh. Now, 4.42 years later, it’s $0.40 kWh. That’s a 14% increase!! Additionally, I wanted to find out what we would be paying if we had not added solar. I figured what our bill would have been each month based upon kWh used and the rates in effect at the time. Without solar FOR 4.42 YEARS, our annual electrical bill would have been $21,415 or about $404/month. With solar, we paid just $125 (when our usage exceeded our production) over 4.42 years or about $2.57/month. Currently, as of 2017, solar is saving us around $439/month. That savings on an annual basis equates to $5,268 for the current year. “Earning” or saving $5,268/year with a $21,415 investment computes to a 24.6% annual return on investment. That’s pretty much what we figured when we purchased a 38-panel system. With California’s current two-tier pricing system it is less “profitable” to try to replace tier 1 ($0.19/kWh) electricity charges than tier 2 ($0.40/kWh). SDGE is projecting their rates will increase by about 7% per year for the next five years. I think they might meet that goal!! In five years based upon expected inflation rates from SDGE, our annual electric bill would be about $6,100. Considering we pay about 25% in total federal and state income taxes, that will save an annual pre-tax IRA withdrawal of $8,100 per year (increasing each year with SDGE inflation and greater tax rates) for the life of our solar system which is expected to be 25 years. Heck, that’s longer than my IRS generated life expectancy! Let’s think about this for one more moment. We “invested” $21,415 in solar. That investment is returning nearly 25% per year in pre-tax savings. However, investing in solar is not like investing in the stock market. We won’t be able to withdraw out initial investment in solar-like we could from the stock market. How will we ever get back our initial investment? Here’s how I’m thinking about that. I feel people will pay more for a house that currently WOULD have a $439/month electric bill without solar but has a bill of only $2.57/month WITH solar. In five years our home’s electric bill (if we didn’t have solar) will be in the neighborhood of $600-700 per month. With solar, the bill might be about $20 per month. Our home is currently worth an appraised value of $4.5 million. I told you stuff was expensive in California! By the way, our very first home cost us less than 1% of the value of our current residence. Who could have imagined? Would you pay an additional $20,000 for a home in this price range if you could save $600-700 per month in electric bills? I suspect when the time comes to sell our home we will never know if someone paid our solar investment back or not. It will all likely be lost in the rounding. However, it might very well be the “nudge” that helps make the sale. By the way, if our house ever needs a new roof the solar company will take the panels off for $500 and put them back up for $500. In the meantime, our roof is actually being protected from sun damage by the panels themselves. One more thing. The manufacturer guarantees all of the parts and pieces of our solar system for 25 years. During the first 4.42 years of operation, we have had zero repair or maintenance expenses. Knock on wood everything has worked perfectly. You may or may not have an interest or need in getting an “electrical power plant”. However, think about it this way. What if you had an expense of some sort (not just electric bills) that, during roughly a 5-year period, would cost you more than $21,000? What if you could pay $21,000 NOW to effectively pay for that $21,000 5-year expense not just for the next five years, but also for the rest of the time you would be expected to have that expense? That would be a good idea, right? I’m just sorry I can’t do this with any of my other expenses! I’m a big one for systems. You probably figured that out already! If I can develop a simple repeatable system that saves money for lots of major expenses such as automobiles, home electric, travel expenses (hotels, cars, airplanes) then at the end of the day LOTS of my major expenses are being bought “right”. Like I said at the beginning. If this helps just one person that puts a smile on my face. Randy Lewis San Clemente, California P.S. Carol and I are going out to celebrate tonight….it’s Taco Tuesday!

When you get advice should you follow it or not? I have a simple theory on that. I first learned this theory while taking a golf lesson. My golf pro was giving me advice which would require a good deal of change compared to what I was used too. Should I follow his advice even though it made me uncomfortable? Here’s how I looked at it. My pro could shoot a lower score with a shovel than I could with a golf club. What did I learn from that? It’s a good idea to take advice from folks who are doing better than you are in whatever area they are offering the advice. Get it? I’ll take golf advice from someone who can break par but not so much from someone who will shoot 95.

I’ve spent a good deal of time in my life studying financial planning. When I came across a good idea I ran with it. This allowed me to retire at the relatively young age of 52, buy a modest seaside cottage and travel the world. How did I pay for it all? I used several of the ideas I explain in this section of www.randylewis.org. My theory has never been to “buy cheap things cheap”. Just about anybody can do that. I want to buy “good things cheap”. Wouldn’t you rather get a good deal on a Lexus than a Ford? Check out the ideas that I have to share with you. Many of them were first shared by me with the Procter & Gamble Yahoo Group (name: pngeezers, membership more than 2,000). From that group of very smart people, I received valuable feedback that made my theories even stronger. Good luck. If you have any questions, let me know.

San Clemente, California

My very own solar electric power company!

The two most popular programs seemed to be leasing the panels for 20 years or purchasing the system. We decided to purchase our system of 38 Suntech STP255-20WDE panels. Our average electric bill is $300 per month (April 2013). I thought that was high until a buddy in the next town told me his bill runs about $100 per month, albeit for a house half our size. Then I thought our bill was low until another buddy, who lives in Las Vegas, told me his bill was “$1,400 or 1,500 per month”. Electric bills are like golf. There’s always somebody you can beat and somebody who can beat you!

The installation went flawlessly and took two days. We have a flat roof. You don’t have to have a flat roof to install solar panels. The 38 panels form an “array” (solar talk) and are tilted at a 5% angle. The optimum tilt for max solar production is about 18%. However, if I did that my neighbors wouldn’t talk to me which is not all bad if you knew my neighbors. You do NOT need sun to produce electricity (but it helps). Even on a cloudy day, some production will be made. Each panel has its own inverter which converts (inverts?) DC into AC. The panels don’t have any moving parts. There are no batteries with our system. If the electricity goes “out” then we are in the same boat as our non-solar aforementioned neighbors. The company I went with will come out twice a year to clean (hose them off) the panels. We can take a garden hose to them whenever I can convince my wife to go up on the roof. Having an inverter for each panel is probably a good idea. Some systems use just ONE inverter and when that goes down the entire system stops. With our program if one inverter stops working then only one panel (out of 38) does not work. The panels and inverters are guaranteed for 25 years.

The solar experiment….Paid off…..Only wish I had done it sooner..

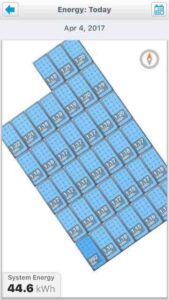

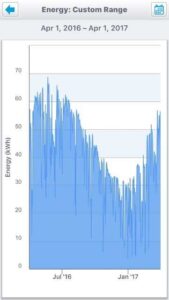

I can monitor the system’s solar production from my iPhone. The above graph shows the seasonality of our solar production. When the days are longer and there is more sun there is more production.

By the way, Advanced Improvements of Anaheim, California did our system from start to finish. I cannot recommend this group strongly enough. The entire system was installed in two days. Whenever I had a question they were there to answer it and act if necessary. If you need solar work done in SoCal you will not do better than the work from Advanced Improvements.

3 comments

We put in a 30 panel system in Ohio 2 years ago. Smaller house, OH sun angles, more clouds, more trees, and occasional snow on the roof but we still generate 1 Megawatt more per year than we use and get paid to be a producer. Love those panels.

Hi Jon, Thanks for your note. Welcome to the “solar” club. Yep. Love those panels!

Randy, you and I in bit different places on this SSA thing. I did not take my money at age 62. I am carefully managing my income and expenses. I travel away from Cincinnati a little over 50% of the year to Hilton Head, Dominican Republic and Hawaii. Because I still have a good deal of P&G stock in an after tax account. By keeping myself essentially in the 15% tax bracket, I was able diversify ~10% of my P&G stock at 0% federal tax rate. My total Federal taxes were 2.96% of my AGI and my Ohio taxes were 3.17% of my Ohio AGI.

If I took my SSA benefits, I would be double taxed on those funds, sort of. First, I would be taxed on that income at either 50% or 85% of the benefit. Second, my diversification efforts (selling of my zero basis PG stock) would also be taxed. My only income last year was from stock options which I took at an opportune time.

We are spending. We are traveling. Not sure what we would do different if we had an additional $40-$60K other than give a significant portion to the state and Fed.

While each person’s finances are different, your analysis above does not mention much about tax efficiency…which can have a significant ROI.

Dave