I am failing financially.

No, not bankruptcy. Something worse.

I have failed. I have failed financially. Trust me. It is not easy to come to you with that news. No, we will not have to declare bankruptcy. However, the news I share today is just as bad.

I retired 22 years ago at the age of 52. I am 74 today. I thought when I retired, I would have all the money I needed to live a life of luxury without ever having to work again. That part of my financial plan DID work out. Why? I followed my own financial advice! Actually, it was the advice of William Bernstein but at least I did what he told me to do.

Where did I fail? I have more money today than when I retired more than 22 years ago. Some people might think that is an excellent result. No! Having more money today than when you retired is NOT a good thing. That’s not a good thing. Yes, I optimized for increasing my net worth. But I did not necessarily optimize for my life’s net personal fulfillment.

Don’t misunderstand. Yes, I failed to fully optimize for my net personal fulfillment. How, do I know that? I have more money today than when I retired. I failed but I don’t give myself an “F”. I’ll go with a “C+”.

During my business career, I earned more than 12 million frequent flyer miles. You read that right. 12 million frequent flyer miles. Back in the day, you could get a free frequent flyer ticket for 25,000 miles. That means I earned 480 FREE airline tickets. We had a family of five. Can you imagine the amount of traveling our family did to use that many free airline tickets?

If I was home, I never missed a play, a game, or a soccer match for any of our three kids. I coached their sports teams. We went to Disneyland a million times. Could I have done more? Yes.

Since retirement, I have averaged 175-200 nights of travel every year for more than two decades. I routinely visit 25-30 states and 8-10 foreign countries or more every year. Despite doing all of that “fun” stuff I still couldn’t reduce the principal of our investment account.

You might read all of this and come to one or two or more conclusions. You might say, “Damn, you’ve had a pretty good investment strategy over all of these years”. You might say, “You’ve traveled the world but maybe you should have spent even more money traveling in better hotels and eating at better restaurants”. Maybe you would say, “There must be other things you could have spent your money and time on that would have increased your net personal fulfillment”.

Being defensive I would probably say back to you, “I DID have an excellent financial plan that produced. I did stay in Marriott hotels.” Whatever my rebuttal the numbers don’t lie. I worked hard to earn the money and spend the money but I didn’t do enough. Now I’m older and playing full-court basketball or skiing down black diamond trails is not in my future. I failed. How do I know I failed? I have more money now than I did when I stopped working. I am not bragging. I am confessing. I earned and invested quite a bit of money that I will never use. In my eyes, I have failed.

What I am about to share with you is going to be controversial to some. Some folks are not going to accept my premise and conclusion. Have you ever thought about something one way and the next day or the next year concluded that you were thinking about the issue the wrong way from the beginning? I have.

People are always telling me that financially, they are “doing OK”. They don’t see a need to spend more money because if they did, they would worry about running out of money. What many are really saying is that they would be embarrassed if they ran out of money. What would their family think? What would their friends think?

Are you doing OK? Do you see a need to spend more money to achieve “net personal fulfillment”? Do you even know what net personal fulfillment is in this context?

What I am about to share with you is the most significant and important life and financial strategy that I have ever come across. That’s a strong statement coming from a “money guy”. It’s really rather simple.

Most people feel better about optimizing for money than personal fulfillment. Most people think it’s a good thing to have more money in retirement, after being retired for more than 20 years rather than having less money. I used to think that way. I don’t anymore.

Most people don’t understand the value of trading some of that money for “memory dividends”. Most people don’t understand that life passes them by and they are no longer able to do things that they saved their money for.

Life has passed many people by. They have the money but they can no longer do the things that the money they saved was originally intended for. Lots of older people can’t spend their money on themselves. They can’t do the things that they saved the money to do!

I’m going to share with you what I have learned from listening to a podcast called “All the Hacks”. This is a podcast that focuses on optimizing travel and personal fulfillment and more.

The episode that hit me like a freight train is titled “Die with Zero”. If you listen to podcasts you will find that “Die with Zero” is episode #91 on the All the Hacks podcast.

Don’t be misled. The title “Die with Zero” does not have the goal of dying with no money whatsoever. What does it mean? You don’t want to have so much money that the acts of getting that money prevented you from enjoying the benefits that money could bring to you, your family, your loved ones, and any other entity that might benefit.

At the end of what I share with you today will be a link to a YouTube video. This is the video version of the podcast. It’s nearly two hours long. That will turn off many folks right there. Just as a point of perspective I have watched or listened to this four times. I will probably watch or listen to it four more times.

Most people are too rushed in their daily life to take the time to sit down and understand this concept. I am normally rushed for this kind of thing as well. “Die with Zero” caught my attention. Maybe it will catch yours.

Following are the notes I’ve taken from listening to the podcast. These notes will likely make much more sense after you listen to the podcast.

PLEASE. Do not read my notes and believe you understand “Die with Zero”. I’m not that good of a note-taker.

Disclaimer: There is a small amount of bad language sprinkled throughout the podcast. Not much really. I recommend you simply ignore it so you can benefit from the overall message.

I want to give full credit to the “All the Hacks” podcast host, Chris Hutchins. His podcast on all kinds of financial/travel topics to optimize is excellent. I highly recommend it.

The “Die with Zero” author/speaker is Bill Perkins. This was my first exposure to him. I plan to listen to more of his stuff.

The title “Die with Zero” simply means that one’s objective should be to optimize for net fulfillment, and not for net worth. What does that mean?

More choices!

Would you rather retire with $1 million and die with $2 million or retire with $1 million and die with $100,000 after spending that money on your own personal net fulfillment? I’m going to guess that most people would rather have the former rather than the latter. After understanding the overall concept of “Die with Zero”, I would much rather have the latter option.

Fulfillment is all about choices. It’s not limited to money. Your choices might include having more time to visit your grandmother or donating to a charity or going roller-skating with your kids. It’s about spending less time working and saving and more time creating memory dividends and experiences, whatever they may be, that increase your own net personal fulfillment.

You need less in retirement than you think. Yes, healthcare will cost more as you age, but most other expenses will cost you a lot less. As you age you won’t spend as much on travel. You won’t need to buy a new refrigerator or a new house or a new car as often as you did when you were younger. In point of fact, most people build wealth in retirement rather than consume wealth.

People looking to spend money often realize they can’t spend it on experiences that they originally planned for because of aging. Money has a declining utility as we age.

By the way, this is not a message primarily directed at older people. If you are twenty or thirty or forty you must start planning now so you don’t end up in the same position as people who are sixty or seventy or eighty.

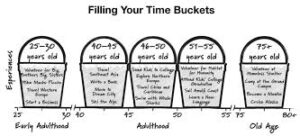

Where and when do experiences belong? This is where “time bucketing” comes into play. It’s critical to get your order of experiences right. It’s better to have a skiing trip when you’re 30 in most cases than when you are 75, isn’t it?

Your body has a utility curve. Timing matters. Obviously, you will not look the same or feel the same or be able to do the same things at age 80 as you did at age 30. Some folks say they are in better shape at 65 than 35. What they are probably saying is that they weren’t in very good shape at age thirty-five!

Memory dividends. Memory dividends are key to the “Die with Zero” strategy. The real value of doing things now is being able to create memories that will last you a lifetime. If you do something at age 30 and live to 80 then you have 50 years of memory dividends from doing whatever you did. If you wait until you’re 70 to do what you could’ve done at 30 and live to be 80 you only have 10 years of memory dividends. That’s banking on the idea that you could do at age 70 what you could do at age 30. Yes, you may need to reread this paragraph to get the entire gist of things!

The purpose of money is the net personal fulfillment of your life.

What are we really saving money for? What do you do with the excess of your savings that never got spent on anything?

Consuming experience creates joy… recalling experiences creates joy. These are memory dividends.

Is it better to take one two-week trip now or a couple of two-week trips 20 years from now?

What creates your highest personal fulfillment?

One experience now plus the memory dividends that experience creates can be better than two experiences of the same type in the future.

Really the entire point of “Die with Zero” is to optimize for net personal fulfillment, and not to optimize for money.

It’s important to invest in experiences as early as you can.

Turn off the desire to maximize for money.

As you age, it’s harder to spend money.

Fear of running out of money creates a need and expectation to optimize for money.

Older people can’t spend their money. Life has passed them by. It’s too late for them. Don’t misunderstand. It’s not that older people can’t SPEND money. It’s that too often they can’t enjoy the experiences they saved for compared to having had those experiences earlier in their life.

The objections someone might have for not optimizing for money include:

You might think optimizing for money is the way to go only to find out that what you saved your money for is no longer what you want or need.

You fear you will run out of money.

You fear living too long.

You fear the high cost of long-term care. Few people ever go to a nursing home and very few who do stay very long in that environment. There are always outliers but you can insure against this.

The real fear of running out of money is a fear of embarrassment. What would your family and friends think of you if you ran out of money and had to declare bankruptcy?

Would you be willing to switch lives with Warren Buffett at his stage in life? Would you like to have a net worth of $117 billion AND be 92 years old? Not likely.

People give up their lives to keep their money.

You should never try to save money to insure against every risk. You can buy insurance against risks that you can’t save for like your home burning down or being in a nursing home.

Should you spend more or less money?

The point is that once your basic survival needs are met, which means food and shelter, and safety, then you have all the money you will ever need. If you have more money than that those funds should be directed toward your net personal fulfillment.

It’s important to understand the pace that both your mind and your body are deteriorating.

Net personal fulfillment is directly tied to your wealth, health, and time remaining.

In some cases, your work, and/or your willingness/desire to optimize for money has atrophied your desire for social interaction. You just don’t WANT to do things.

FIRE! This means financial independence, retire early.

People who support the FIRE concept want to save, save, and save more money, so they can retire and live off their investment income. Living off your investment income without touching the principal is not a good idea. You’ve got to spend the principal! This is key.

A key to understanding the “Die with Zero” concept involves two important items. The first is “time bucketing”. The second is “memory dividends”.

Time bucketing simply means being able to do the things during the time in your life when you can do them. For most people playing flag football is a distant memory. Flag football is best done when you are younger than thirty. Going on a cruise is an activity a 75-year-old can do comfortably whereas a thirty-year-old might find to be too expensive. You’ve got to line up your experiences in your life’s “time buckets”.

Memory dividends simply mean that you can enjoy just remembering the experience of something that you did at 20 for the rest of your life. If you live to be 80 that experience at age 20 can create so many more memory dividends, than something you did when you were 78 years old and lived to be 80.

I personally choose net personal fulfillment over net worth.

I quit early. That’s good. I haven’t spent down the principle of our retirement investments at this point. That’s bad. I intend to change that.

For the people who maintain they are doing OK and that there’s nothing that they really want to do, I would suggest that that person’s “play” mindset has atrophied. They no longer know how to play. What is the purpose of accumulating more money than the amount needed to cover your survival needs?

Of course, health is paramount in reaching your own personal net personal fulfillment. About 85% of good health is low-hanging fruit.

Maintain a good weight

Exercise

Limit sugar

Don’t smoke

Limit alcohol.

A lot of this could be summed up in the simple phrase “Spend the money on the trip, don’t die with that money in the bank”!

Now I invite you to find a quiet place, possibly get a glass of wine (with the idea of limiting alcohol in mind) and listen to this YouTube video. You can also listen to the audio podcast while you’re simply driving around on your next trip.

Despite all that I have mentioned many, maybe most, are still going to think it’s a good idea to have more money 20 years into retirement than they had when they retired. I’m sorry. I no longer feel that way.

I’m going to do everything I possibly can to spend down, not deplete, that retirement principal.

I know folks who are spending let’s say $100,000 per year. They tell me they are doing “OK”. They tell me they don’t see any need to spend any more money. I offer this. If you won the lottery and that included an annual payment for the next 20 years of $500,000, would you find a way to spend that extra money? I’ll bet you would!

Once your survival needs are met, your current investment principle is YOUR lottery. If you don’t spend it on yourself and your loved ones, or in whatever way you find worthwhile, the government will get a big share of it, and your heirs might waste it!

As always, all of this is up to you. That’s always the case, isn’t it? Here’s that YouTube link I promised you. If you watch it tell me what you thought.