Today’s note is really rather simple. I have only two objectives. I’m going to give you an update on our solar panel program. I’m also going to give you an overview of how I make financial decisions.

As always, I recommend that each reader keep an open mind regarding the ideas being shared. The folks who come in with an attitude like, “that works for Randy but it wouldn’t work for me” or “Randy lives in a warm weather climate and I don’t so something like solar wouldn’t work for me” will definitely not be receptive to new ideas.

Actually, some of the above of thinking might very well be true. However, if you go into this with a how can these things help me more so than there is no way these things can help me you might be better off. That’s just how I see it.

As we go along, I definitely don’t want you to think I am ever bragging. I am simply explaining how I have done things. As Dizzy Dean used to say, “It ain’t braggin’ if you can do it”. You really can’t argue with old Diz, right?

On July 3, 2021 I will enter my 20th year of retirement. When I retired, I retired. I didn’t leave my company to go to work for anyone else. I have never earned a single dime of work income for nearly 20 years.

Over the past several decades I have maintained a monthly household budgeting process which includes about 15 expense categories. I stay on top of the maintenance of the budget. I record virtually every penny that comes in or goes out. Each month that takes me about an hour to complete. Every young person, and probably every older person should work with a budget.

Did you know that the federal government’s budget includes four items that account for nearly three-quarters of all money spent? That’s right. Medicare/Medicaid 27%, Social Security 24%, defense 15% and interest on the debt 7% are those groups. That means about 73% of the U.S. government’s annual budget is locked in with a very few major items.

We have seven expense categories that account for 75% of our household budget. Here’s a description of those groups.

Home mortgage – 26%

As you know I am a very strong believer in retirees having as big of a home mortgage as they can afford to pay. We have a huge jumbo mortgage locked in for the next 10 years at an interest rate of 2.75%. This is an interest only loan. I absolutely love interest only loans for one reason. I don’t have to move money from investment accounts into home equity with each monthly payment. With an interest only loan no money goes towards principle.

Think you’re “saving money” by having a completely paid for home? Sorry, you’re not. The money tied up in home equity is earning zero!

Since I retired nearly 20 years ago, I have refinanced our mortgage probably six or seven times. I am beyond amazed that banks will loan a fellow who hasn’t worked for 20 years the amount of money that they have loaned me. Our payment is fixed for the next 10 years so no matter what inflation does our payment will stay the same.

I’m going to tell you how we handled our current homeownership process. I don’t think you will be able to read any financial publications that recommend doing what I did. What does that mean? I’m not sure. You will have to draw your own conclusions.

My realtor always told me that “all money flows to the sea”. I think he might be right. Over time we moved from a house that was on a cul-de-sac to a house that had a view to a house that had a view of the ocean to a house that was essentially oceanfront. Yes, maybe all money does flow to the sea.

By the way, in California right now real estate is white hot! A house doesn’t stay on the market for more than a week. We had some midwestern relatives visit recently. They toured a California home near the beach.

I asked them what they thought that house would sell for. The first person said, “$250,000.” The second person quickly chimed in with, “No way. That house would easily be $350,000 or maybe $400,000”. What did that house sell for recently? $1.7 million. What creates crazy pricing like that? Supply and demand. People want to own a home in California.

In the year 2000, we bought a property just 100 yards from the sand. The house on that lot was 25 years old. The lot was good but did we REALLY need the house? With that purchase, I began doing some things that were NOT at the top of the list of financial planning recommendations in most books that you might read.

First of all, I went down to Lowe’s and bought a pickax. I didn’t have a pickax. The pickax would be the only tool I would need. Why a pickax? Read on.

We decided we didn’t need the current house. We would build a new one. It was going to take us 29 months for architectural approvals in addition to the building process. Does that sound like a long time? I thought, with what we had to do, things actually went by pretty quickly.

Next, we didn’t sell our house to buy the new house. Most people sell their old house when they buy a new one, right? We wanted to sell the house it’s just that it took us 16 months to do it.

For the first six months after we bought the new property, we rented the home back to the sellers. During that time, we fought with our neighbors over easements, plumbing and more. On Christmas Eve, when my renters had 12 family members in the house, my neighbor shut off their water (no showers, no toilet, no water) in an attempt to negotiate with me. Why did he do that? Because he could. My wife would remind me that no one gets a house on the beach in SoCal without a little “tough love”.

For five months after our renters left, and before we had the architectural approvals needed to begin building, every night after work I took my pickax down to the new house and started a one-man demolition. It was just me and the pickax. Destroying stuff was the only thing I was qualified to do. I tried to set a goal of knocking out all the drywall in a single room during each visit. Sometimes I met the goal and sometimes I didn’t.

Somewhere along the line, I got in touch with a guy who ran a drug rehab facility. For a very small donation and letting the drug rehab company keep any of the building materials that were coming out of the old house I got this benefit. The guy I was working with would bring down his “crew” of about five guys who had the shadiest and suspect backgrounds that you might imagine. Nevertheless, they could swing sledgehammers and do all kinds of crazy stuff as well as entertain me with their lifelong biographies. It was quite an educational process for me.

Next up, I did something that most financial planners wouldn’t recommend. My company Procter & Gamble was in the midst of downsizing. They did this for about two decades. Every two or three years they would offer senior employees a year’s pay if they would retire. For the longest time, while I was employed, I factored in a year’s severance pay into my long-term financial plan. Just a year and a half after we bought the new house and before we had sold our old house, I took the severance and I’ve never looked back.

I would ask this question. Who buys a new house, without selling their old house and then goes over to the new house and tears it down and then quits their job in the middle of the project? “Prevailing wisdom” is not always good wisdom.

Some 16 months into the 29-month building process we finally sold our old home. Then we moved into a two-bedroom condo for more than a year. The condo wasn’t that big. Our moving boxes were stacked to the ceiling. There was virtually no room to walk in that place. We simply plopped our king-sized Tempur-Pedic mattress on the floor of the condo. Without a bed frame, we slept on the floor for more than a year.

During the new home construction process, which took 18 months in addition to the nine months of architectural planning, we had construction loans. It just happened that most of those construction loans were at 3%. Rates were at historic lows at the time. When we finally did get permanent financing, the rates were low but I always seemed to find a better deal by refinancing all the way through 2020.

We bought our first home back in 1973 in Phoenix, Arizona. This was a beautiful house on a third of an acre with an inground swimming pool and all kinds of amenities. Today our home in San Clemente is worth a bit more than 100 times (not a typo) of what we paid for that home in Phoenix. Could I have predicted that? Absolutely no way.

Oh yeah, there was the benefit of paying for much of my home building costs with cash. Want to know more about that? Get back to me after the statute of limitations has expired on that concept…if they ever do.

What can we learn from this? I don’t know that I would necessarily recommend that you buy a new home and then tear that house down. I might not recommend that someone quit their job (and not get a new one!) in the midst of building a new home. I wouldn’t recommend for someone else to buy a new home and not sell the home that they are living in at that point in time for more than a year. However, as you may have come to understand as you read what I have published in the past I do things differently than some. Quite often they work out very well.

One more thing! Someone might be thinking, “Randy inherited money”. Sorry. Nope. Both my wife and I came from poor families. Our wedding cost us $500. We paid for it…with a $200 bank loan.

Vacation and Entertainment. – 15%.

We spend a lot of money on airplanes, hotels, rental cars, cruises and all of the fun stuff that someone should be doing in retirement. During retirement, I have averaged 175 nights away from home…every year. I know how to buy travel right. If I pay $50,000 a year on travel it would cost someone else $75,000-$100,000 for the same stuff.

This expense category is NOT immune to inflation. If inflation in future years were to become a big deal our solution might be to travel less or used less expensive accommodations if we wanted to maintain 15% of our total spending of our budget for this important category.

Other – 15%.

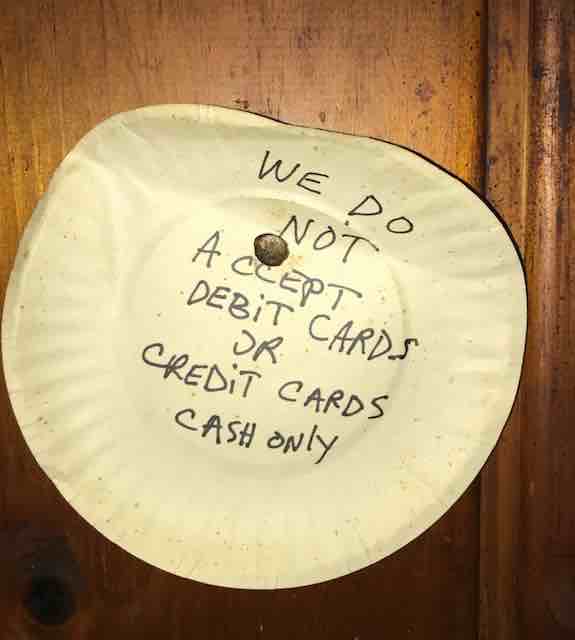

Our “other” category is simply that. If something is paid by credit card, checks or cash and doesn’t fall into one of our other expense categories it gets lumped into the “other” budget category.

What types of expenses might these “others” be? How about gasoline, food, restaurants, clothes and such.

By the way, our current expense categories which have been the same for decades are:

Home mortgage,

Home equity loan

Property tax

Electric

Phone

Water/sewer/trash

Insurance

DIRECTV and Internet

Gas heat

Federal income taxes

California income taxes

Vacations and entertainment

Home improvement

Medical

Randy’s car payment

Carol’s car payment

A couple of these expense categories, from time to time, don’t have any spending. Currently, we don’t have a home equity loan nor does Carol have a car payment.

Property taxes – 8%

Some people think of California as a high tax state. After having lived in California for 40 years I can tell you that that’s not really true.

We pay slightly less than 1/2 of 1% of our home’s value in property taxes. Our property taxes can only increase by a maximum of 2% per year. This is a result of “Proposition 13” which was implemented about 40 years ago. You may have heard of it. I would submit that virtually everyone reading this who owns a home has property taxes that are greater than 1/2 of 1% of the home’s value.

Randy’s car payment – 7%.

I don’t recommend that people who are building wealth spend a lot of money on their cars. However, if you’ve already built your wealth and you’re in the fourth quarter of your own “basketball game” dumping some money into a nice means of transportation is not the end of the world.

Of course, I could have paid cash for my car, a 2020 Tesla Model X. Why would I want to do that? I was able to secure a 1.99% auto loan for six years. I can invest my money at 8% or so. Why would I want to take money out of an investment earning that to retire a loan that is charging me just 1.99%? The theory here is pretty much identical to having an interest only home mortgage.

One more thing. My car is powered by electricity. That means no gasoline expense. Gas currently sells for about 4 bucks a gallon in California. Gas IS expensive in California! The more expensive gasoline gets here, the better value owning an electric car becomes. I can’t wait for gasoline prices to rise to ten dollars a gallon!

The car I used to own would get about 22 MPG. I drive my personal car about 12,000 miles each year. With an electric car that’s a gasoline savings of nearly $2,200 each year. I don’t have any expenses for electricity for my Tesla. When I bought my Tesla, they threw in free supercharging. The nearest supercharger is 8 minutes from our home.

Insurance – 4%

We have various forms of insurance including automobile, homeowners, earthquake, umbrella liability and life insurance. These insurances protect us against all kinds of major perils.

I’m a risk-taker. I don’t believe in insuring things that I could pay for if I had to. I just increased our homeowner’s deductible from $25,000 to $73,000. I saved $1,000 a year on my homeowner’s premium.

Do I want to be on the hook for $73,000 if we have some catastrophe with our home? No, I do not. However, in approximately 50 years of homeownership, we have never had a major claim. Maybe that streak will continue. If it does, I’ll make $1,000 a year. However, if that one in one thousand problem occurs, I’ll be taking $73,000 out of my IRA!

Electric – 0%

I told you when we started that I was going to explain the benefits of our solar panel program. I’ve just completed explaining some of the financial strategies and theories that I have implemented over the past 20 years of retirement.

We have now had solar electricity for our home over the past eight years. We have lived in our home for about 17 years. Why didn’t I get solar sooner? I guess any of the following terms might explain the answer to that question. Uninformed. Dumb. Clueless. Not paying attention. Yes, I wish I’d gotten solar much sooner.

Today our electrical expense would average about $500 per month if we didn’t have solar. Does that seem like a lot? I have a friend in Las Vegas who told me his electric bill averages $1,500 a month. I suspect most people reading this have an electric bill somewhere south of $500 each month.

Is getting solar a good idea for you? I don’t know. It depends on several things. I’ll mention most of those items and you can decide for yourself.

Do you live in a cold-weather climate? Do you believe that people who live in cold-weather climates cannot benefit from Solar? If you answered “yes” to these questions I might ask that you get in contact with the people who have one of the biggest solar arrays in the country. That solar setup is right next door to the Indianapolis International Airport. Indianapolis is in a cold-weather climate. The solar array they have is one of the largest I’ve ever seen in the United States. They think solar is a good idea.

Do you know what your electrical expense is based upon kilowatt-hours of electricity? Do you know how many kWh hours of electrical energy you use each month? For the longest time, I didn’t know any of that stuff.

From a monetary point of view, you simply need to be able to handle a simple equation. You would use these numbers as inputs. How much do you currently pay for electricity each month? How much would adding solar panels cost you? When you figure out the cost of solar panels you need to figure out whatever government, state and county rebates might be available.

Don’t think the government should be subsidizing stuff like solar? My wife didn’t either. Doesn’t matter. We can’t control the rules we can only play by them. When I told my wife how much money we would be saving with solar she toned down her idealistic political rhetoric (my words!).

Let’s say that solar will cost you $8,000 after rebates. Then let’s say that your annual electrical expense is $2,000 as an example. You will simply divide the $8,000 in solar expense by the $2,000 annual solar bill. You will be able to conclude that you could pay off the system in four years. Then every year after those first four years you would benefit by at least $2,000 and with increasing electrical rates more than that for the future.

Another reason you might want to get solar is to be a good environmental citizen. I’m going to be honest with you for two reasons. First, I’m just basically an honest person and see no reason to behave otherwise. Secondly, I will tell you that I had absolutely zero interest in the benefits of being an environmentalist when I bought solar.

I actually got a little bent out of shape when the solar salesman sat across the dining room table and mentioned “going green” about 17 times in the first five minutes of his pitch. I stopped him. I told him that if he mentioned the idea of “going green” one more time I was gonna kick him out of the house. He looked over my shoulder at my framed U.S. Marine Corps discharge papers. I think he believed me. His face did turn a little pale but I was pretty sure he understood what I was telling him. He didn’t mention “going green” anymore.

I’m not against treating the environment in a good way. It’s just that I think one guy getting solar in one house is a little bit like peeing in the ocean. That action isn’t going to have much effect on anything.

I ended up putting 38 solar panels on the roof of our home. The energy produced from those panels would pretty much wipe out our entire electrical experience. By the way, I think we have the best-looking solar array (above) in the area.

Although California is not a high tax state in my opinion California electric rates are high. Eight years ago, when we began our solar program California had a four-tier electrical usage pricing system.

In the very first month of our solar experience, April 2013 we had the following amounts of usage.

Tier 1 – 317 kWh

Tier 2 – 94 kWh

Tier 3 – 221 kWh

Tier 4 – 533 kWh.

Back then, eight years ago, our electrical rates for each tier were:

Tier 1 – $.15/kWh

Tier 2 – $.17/kWh

Tier 3 – $.28/kWh

Tier 4 – $.30/kWh

Let’s fast-forward to March 2021 the completion of our eighth year of solar. Had our rates changed? Had our usage changed?

During the past eight years, our California utility has moved from a four-tier pricing system to a three-tier pricing system.

Our usage had not really changed all that much in eight years. There’s really no reason why it would. These were our usage levels in March 2021.

Tier 1- 347 kWh

Tier 2 – 722 kWh

Tier 3 – none

However, in eight years our electric rates have nearly doubled in the top tier range.

Tier 1 – $.33/kWh

Tier 2 – $.41/kWh

Tier 3 – $.51/kWh

The charges change minorly, almost always increasing, from month to month. A year ago, in March the top-tier for usage greater than about 1,100 kWh per month was $.61 for each kilowatt-hour. How does that compare to your rates? I’ve been told that electricity rates in Florida average about $.10 per kilowatt-hour.

In our first year of solar experience, our average bill without solar would have been about $388 a month. Our average bill for last month was $494 a month. That’s a 27% increase over eight years.

We paid about $33,000 for our entire 38-panel solar array. After federal and state tax rebates our cost was about $21,400. Don’t think the government should pay for my solar array? Doesn’t matter. They do. It took us about 4 1/2 years to recover the $21,400 we paid to get our solar system in the first place. That’s a pretty fast pay out.

For the past 3 1/2 years (since payback) we have saved an additional $20,000 in electrical expenses. We are now saving at a rate of about $6,000 per year and will do so into the future. Actually, if electric rates continue to increase like they are projected to, our savings will increase from the current $6,000 per year level.

Our solar panels are guaranteed for 25 years. We haven’t had a penny of maintenance expense during our eight years of ownership. Each panel operates on its own inverter. That means that if one panel were to fail it wouldn’t affect the others.

I actually have a smartphone app that shows me the daily production of each of the 38 panels. If one of them isn’t performing I’ll know about it immediately. Installation of our solar array took two days.

I’m a huge fan of solar for residential usage. For me, it’s a no-brainer. It really all revolves around the idea that I paid $21,400 for the system and got my money back in 4 1/2 years. I am now saving $6,000 a year.

Much of the money we use to live on comes from a taxable IRA. In order to clear $6,000 to pay for an electrical expense at my house, I would have to withdraw nearly $9,000 from my IRA so that I could clear $6,000 to pay the electric bill. It’s nice not having to take $9,000 out of your IRA for something like an electric bill.

I have a very extensive spreadsheet that summarizes all of the ins and outs of our solar system expense/savings from a numbers point of view. Why did I do that? I like Excel spreadsheets. I’m willing to share that spreadsheet with anyone who has read this far. It’s your reward! Just send me a note.

In summary, I will simply tell you that I like to put a lot of research and brainpower into each financial decision I make. I’ll do that for a week or three. Then I’ll make a commitment and enjoy the benefits for years and years to come without ever having to think about it again.

That’s what I’ve done with interest-only jumbo home mortgages, auto loans, solar and quite a few other things that we spend money on. When you have the right system in place it seems to run itself.

All of this stuff saves money. However, I don’t just want to save money. I want to take the “saved money” and spend it on the good stuff. I don’t want good deals on cheap stuff. I want good deals on quality stuff. I’m not interested in being the retiree with the most money in the bank when I die but the retiree with the most memories when I take the checkered flag.

I will tell you that many of the financial concepts that I explain are not adopted by people in my peer group. Is there only one right way to do things? No, not at all.

I simply share the information that I do to show you that the things that I have been using over literally decades have worked out very well. In many cases, they worked out much better than I could have ever predicted when we were paying $140/month in rent for our first apartment. Will they work for you or will they work for your friends, relatives and children? Maybe. Maybe that’s the reason so many people tell me they pass what I share to them over to their kids.

At this point, I’ll simply thank everyone who read this far. If you have any questions or comments or alternative points of view send them to me. We can talk about it.

Happy solaring!

Randy Lewis

San Clemente, California