This is my world. People know me here.

I live in a special world. I’m not sure that the language I hear is the language other people here. That sounds ominous, doesn’t it?

No, maybe, and yes.

When I ask a question, I can expect one of three answers. Those would be “no, maybe, and yes.” With that comes this. Everyone gets to choose their own reaction to the situations they encounter.

When some people hear “no” they shake their heads, look down at their shoes, and slink away. When I hear “no,” I hear “maybe”.

When I hear “maybe,” I think yes; when I hear “yes,” I immediately think I have to ask for something more. Let’s talk about that.

What is this message REALLY about?

Today, I will briefly cover my most recent experiences with credit card arbitrage. Then, I will give you my updated 2024 version of “Randy’s New Car Buying Method.” My annual retirement portfolio financial review is my most popular newsletter, followed by “Randy’s new car buying method.”

But wait!!

Yes. But wait. This is important. This message is NOT about credit cards or buying new cars. It IS about how to handle communications. When you hear no, do you hear maybe? When you hear maybe, do you hear yes? When you hear yes, do you immediately think you should ask for more? Some people are not cut out to think this way. Some can teach themselves. Others are born for this arena. Wherever you are on the spectrum, I recommend you challenge yourself to “move up the ladder”.

Reader feedback. I love it.

Before I get going, let me share some feedback I received from readers of my most recent newsletter on the topic of my retirement portfolio financial results.

One reader, “Jeff”, sent this note along. As soon as I read it, I noticed that my Angel’s baseball cap no longer fit properly. My hat was now too small! When people get messages like Jeff sent, it’s not uncommon for their hat to get too small!

“Randy,

Brilliant. Thanks for taking time to capture and share these “pearls.” I’ve said this before; you could have been a great college professor teaching personal finance.. or how to enjoy life through your financial choices. You communicate in an informative, funny, and often thought-provoking way.

Well done!

Jeff”

On the other side of the ledger, one reader commented about the length of my newsletters. For some odd reason, he thought they were too long.

I always say that everyone gets a chance to choose their own reaction to the situations they encounter. Yes, my newsletter is longer than a text message. On the other hand, my stuff is shorter than a book…most books. This is what I told him.

Why does Randy write his newsletter?

I started writing my newsletter for myself. I did that for two reasons. First, I wanted to create a diary. Anytime I want, I can go back and relive an adventure or revisit a strategy.

The second purpose is to educate myself on the topics I’m talking about. They say if you teach something, you learn the topic even better.

I started sharing my writing with my relatives and close friends along the way. They would end up sharing what I wrote with their relatives and close friends. Now, hundreds of people open the emails I send.

For the people who open those emails, I can only hope the reader is entertained and educated and feels that no matter the length of the message, there will be something in there that is worth reading. I make no promises regarding the length of my messages. I do promise to try to provide you with an interesting, thought-provoking story.

Let’s get started.

What are we going to talk about today? I will “briefly” update you on my latest credit card arbitrage experiences. Then, the primary part of my message will be an update on Randy’s 2024 New Car Buying Strategy. Ready? Let’s do this.

Credit card arbitrage and the rewards.

I started sharing my experiences with credit card arbitrage about a year ago. One of the cards, Chase Freedom Unlimited, offered a promotion where I didn’t have to pay my bill. That sounded enticing. Chase wouldn’t charge me any interest on my unpaid balance. To be clear, I did have to pay the minimum payment, which is one percent of the balance, but 99% of the money I owed did not have to be paid. When I explained my new plan of not paying our credit card bills to Carol, she was, at a minimum, skeptical. However, she has learned to accept her skepticism and move on.

What would Dave Ramsay say?

The balance on my Chase Freedom Unlimited (CFU) card ballooned to more than $90,000 as we went along. I tried to call Dave Ramsay one day. I wanted to tell him that, sometimes, having debt is a GOOD thing. He didn’t return my call. I always like to remind people that Dave Ramsay didn’t achieve a net worth of $200 million by not having debt. He achieved a net worth of $200 million by TELLING people to avoid debt.

Carol and I had never carried any balance on our credit cards. Close friends raised an eyebrow at my new strategy. Had Randy walked up to the cliff and fallen over? Yes, I owed over $90,000 and was only making the minimum payment of $900. Had I totally lost it?

No, I had not. I kept all the money that I would have been paying Chase in a Vanguard Treasury Money Market fund. That fund was paying tax effective yield of 5.8% on average. “Tax effective” means I don’t pay California state income tax on the earnings.

This program was only a tiny part of my overall credit card arbitrage program. However, I was going to earn right around $6,000 doing this.

I can’t do what Randy does.

Some might say, “I don’t travel as much as you do I can’t earn $6,000 with this strategy.” What if you could earn just $1,000? Would that be of interest? I know people who try to travel across town to save a nickel on the cost of a gallon of gasoline.

Just as a reminder, I have not been SPENDING any more money to do any of this. I am just leveraging my biggest untapped asset. What’s that? My expenses. I simply charge every expense that I possibly can. I earn rewards doing this that I use to reduce or eliminate my travel expenses. Then I spend the money that I saved on whatever the heck I want to. Remember, even if you don’t travel much, you can use your credit card rewards to reduce the cash your family and friends are spending on travel as well.

What is your credit utilization rate?

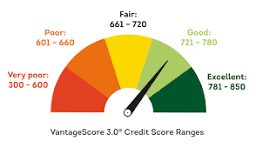

Of course, when you let your balances increase to amounts like this, some folks will not understand. Some of those folks work for credit score companies! What I was doing was going to affect my “credit utilization rate.” You see, the credit score people don’t want you to owe too much money. Why? They think you might not pay that money back!

How is your credit utilization rate calculated? Let’s say the credit limit on all of your credit cards combined is $30,000. If your outstanding credit card balance is $6,000, then your credit utilization rate is 20%. That’s $6,000 divided by $30,000.

There is no need to worry about your credit score*!

Wait. You saw the asterisk, right? I told you a year ago that I wasn’t concerned if my credit score went down as I practiced this version of credit card arbitrage. I was only going to be doing this for 16 months. I already had my home and car loans locked in for years into the future. Who cares about their stinking credit score? I wasn’t planning on getting any new loans.

I know that some readers are very much concerned about their credit scores. What do I say to that? Lighten up, baby. You only need a good credit rating if you need to get a loan. I didn’t need any loans in the near future. When Chase Freedom Unlimited ends its “0% APR” promotion, I will take the money from Vanguard and pay down my balance to zero. That was the plan.

It’s hard to predict the future. Maybe you know where I’m going with this. I listen to “Points and Miles” podcasts, where people provide graduate-level courses on credit card arbitrage. These people convinced me I needed even more credit cards. I was a “salesman” during my business career. Carol always says that a “salesman will buy anything.” So?

I needed more credit cards! I had to feed the beast. I needed to take on more debt. Let’s not just to conclusions. If I borrow $10 from you and then you give me $15 is having more debt a problem? I don’t think so.

MasterCard Black.

The first card I applied for after I stopped paying my total credit card balance on my Chase Freedom card was a MasterCard Black credit card. This exclusive credit card comes with a $495 annual fee. Does that yearly fee sound like a lot? Would you NEVER get a credit card with a fee that high?

Let me say this about credit card annual fees. I couldn’t care less how much they charge me as a yearly fee for a credit card… if the reward is greater than the annual fee. Understood?

I wanted to eat for free. Who doesn’t?

Priority Pass is a special program that lets users into airport lounges and airport restaurants. You can buy a Priority Pass membership but most people get PP as a free benefit when they get certain credit cards.

I had to have this MasterCard Black credit card. Why? Mastercard Black is the only credit card, as far as I know, that offers unlimited use of the Priority Pass restaurant option. Every other credit card I know of that used to provide the Priority Pass restaurant option has discontinued that program or severely limited its use. Many credit cards still offer Priority Pass airport lounges, but not Priority Pass airport restaurants.

What do you get with the Priority Pass restaurant privilege? I can enter any member restaurant and get a $28 food and beverage credit. If I have a guest, then my credit becomes $56. When the program started for me, I earned more than $10,000 in a single year in restaurant and airport lounge credits!

With this card, I expect to get $2,000-$3,000 of free food over and above the $495 annual card fee in the world’s airports in one year. I even added as authorized users three of our children, who will probably benefit to the tune of $500 or so each.

Nope, Randy. No MasterCard Black card for you, sir.

When I first applied for the MasterCard Black card, they rejected me. They said, “No”. When I hear no, what does that mean to me? You got it. It means “maybe”. I figured they needed some more information. If you fear rejection then this world might not be for you.

When I got the rejection, I immediately got on the phone. I called them up. I talked to a young woman and explained my situation. I told her I owed Chase Freedom $90,000. She probably already knew that. I told her I was gonna get around to paying them as soon as I could. I told her Chase wasn’t charging me any interest on the $90,000. I explained that I was earning nearly 6%, by investing that $90,000 in a safe Vanguard money market fund.

I told her about this newsletter. I could tell she was interested. I could hear it in her voice. She was thinking “Why isn’t MY husband thinking like this.” Soon, the “maybe“ that I had initially heard from Barclay’s Bank, which manages the MasterCard Black card, turned into a yes!

No turned into maybe and then turned into yes! Approved.

MasterCard Black had now approved me. During my begging conversation, I told the woman that I was only looking for a $5,000 credit limit. I wanted to make this as easy on her as I could. I didn’t tell her I only wanted her doggone credit card because I wanted to get lots of free food when I traveled in airports.

What do you think MasterCard Black gave me as an annual credit limit? $65,000. I had gone from being totally rejected to a $65,000 credit limit when I only asked for $5,000. What did I think when I hung up on that call? I still got it!

Hawaiian Airlines credit card.

I figured I was now on a roll with credit cards. I would strike again. Hawaiian Airlines had a special credit card promotion. If I got their credit card, with a $95 annual fee, they would give me 70,000 Hawaiian air miles.

When you do the stuff I’m telling you about, it’s essential that you get rewards that you want and can use. For about 40 years, Carol and I owned two timeshares and, for a short time, three timeshares on the island of Maui. We’ve been to Hawaii more than 100 times. We never did fly much on Hawaiian Airlines. I can’t recall ever using frequent flyer miles with Hawaiian.

Why would we need frequent flyer miles with Hawaiian Airlines? Hawaiian was being acquired by Alaska Airlines. I could transfer my miles from Hawaiian to Alaska. If you know anything about points and miles, you know that Alaska Airlines’ frequent flyer miles are some of the most valuable of all frequent flyer miles. I can fly anywhere in the world on Alaska miles with Alaska Airlines or any of their partners.

Do you know what a sign-up bonus is?

New credit card offers like this come with “Sign-up bonuses,” also known as “SUBs.” Ya, it’s kind of like when a major league ball player gets a sign-up bonus…but not really.

To earn the sign-up bonus, usually, a new user has to charge a certain amount on the card, maybe $3,000-$4,000 in a certain amount of time, maybe 3-4 months.

The SUB for this card was going to be 70,000 Hawaiian miles. I could probably fly to Europe in business class for 70,000 miles. That might be a $5,000 ticket. I could likely fly round-trip to Europe in coach for 70,000 miles or less. The annual fee for the Hawaiian card was only $95. They had NO meaningful required spend. Well, they did have one requirement. I had to make ONE purchase of any amount and then those 70,000 miles would come rolling into my account.

Good for one; better for two.

Then I got to thinking. If this was a good idea for me, then it might be just as good of an idea for Carol. I approached Carol and told her she was getting a new credit card. Her first reaction was horror. Then, I explained the rationale. Over 52 years of marriage, she has learned to trust me. Soon, Carol’s application was in the mail!

I think I may have forged Carol’s signature on her application. She’s not really into the details of this stuff, but she enjoys the benefits. Imagine that.

Soon, I heard back from Hawaiian Airlines. Rejected! Both of us were denied. Rejected means no. What does no mean to me? Maybe!

Hello? This is Randy calling.

With my recent success with MasterCard Black, I got on the phone and called the Hawaiian Airlines credit card folks. It just turns out that Barclays Bank of London runs both MasterCard Black and Hawaiian Airlines credit card operations. Just lucky, I guess.

I am a gregarious fellow. I make friends quickly. I don’t know if it’s because I am taller than most or have some gray in my hair, or if I’m just naturally charming. People seem to want to listen to what I have to say.

I got to talking with the young woman in the Hawaiian Airlines credit card department. Soon, I felt as if we were “bonding“. Before I knew it, SHE offered solutions on how we could be approved for these new credit cards. When I get to a point in the conversation like that, I shut up and listen.

She asked if this might be a good idea.

She suggested I take part of my $65,000 MasterCard Black credit limit and move it over to our Hawaiian Airlines cards. I had no problem with that. She asked if I would be OK moving $10,000 from MasterCard Black to the new Hawaiian Airlines card. Since I had only asked for a $5,000 credit limit with MasterCard Black in the first place and they gave me $65,000 I was more than OK with that.

In a matter of moments, Carol and I were approved for our Hawaiian Airlines cards. We could each charge a pack of gum, get 140,000 Hawaiian miles, transfer those miles to Alaska, and be flying in lie-flat business class seats to Europe. Sometimes life is just easy.

My rejection, aka as “no,” had quickly turned into a “maybe” and ended up being a “yes.”

World of Hyatt Chase credit card.

Many of the moderators of the Points and Miles podcasts that I listen to have more than 40 credit cards. They got most of them because of an attractive signup bonus.

How many cards do I have? I think about a dozen. Our total credit limit has now topped $300,000.

Sorry, Carol. You’re not included.

When I get a new credit card for myself, I never include Carol as an authorized user. Why? Do I consider Carol a poor credit risk? No, I do not. It’s just that somewhere down the line, if I get a credit card ABC and collect a signup bonus, then later on Carol can get the same credit card ABC and collect her own sign-up bonus. Double dipping, baby.

Best ever!

The World of Hyatt Chase credit card was offering a great sign-up bonus. One of the best ever. Maybe the best ever. I couldn’t qualify for it because I already had my own Chase World of Hyatt credit card. Carol did not have that card.

I made an application for Carol on the phone. Even though you may never have met me, you can readily imagine that my voice does not sound like a woman.

It is somewhat tricky, definitely inconvenient, and bluntly a hassle to apply for a credit card for someone of the other gender.

Carol would very much enjoy the reward she was about to earn with the approval of her Chase World Oo Hyatt credit card. At the same time, she did not have what I thought was the appropriate amount of patience to make the application herself. No, I don’t do chores, but I do credit card applications.

While making the on-the-phone application, I had to have Carol tell the credit card representative on the phone that it was OK for me to negotiate on her behalf. She provided some basics like the last four of our Social Security number, her birthdate, etc. I could have brought in a homeless lady off the street for the same purpose, but Carol is much more attractive.

Wow! Best ever! Who wouldn’t do this?

The Chase World of Hyatt credit card that Carol was going after had a $95 annual fee. However, the sign-up bonus and the annual bonus on that card would be SIX FREE nights in a Category 4 Hyatt hotel. Category 4 Hyatt properties commonly cost $350-$500 a night and sometimes more. Let’s work on the low end of that range.

For one $95 annual fee, Carol was going to get six free nights at $350 a night, which is $2,100. By doing this, she would reduce our travel expenses by $2,100.

We live off of money that comes from our IRA. In order to clear $2,100, I would have to withdraw $3,000 to buy six nights in a Category 4 Hyatt hotel. Yep. To do that on our own we would have to pay Uncle Sam $900 in taxes to clear $2,100 for Hyatt. What a deal!

You might not think you NEED to stay for six nights in luxurious Hyatt Hotels for ninety-five dollars. No disrespect meant, but that is wrong-headed thinking. Even if you hold that point of view, you can give the reward to your family or friends.

Getting this card for Carol required some patience on my part.

The security questions I was being asked to get the full approval for Carol were insane. The rep would list five makes of cars and ask me if I recognized any of them. I thought this might have been a disguised cognitive test.

Sometimes, she was talking about a car we had owned 20 years ago. She did the same thing with property addresses, where our children lived, and on and on. I wondered if Carol was worth it. Did she deserve this reward when she was only willing to stop by my office for 40 seconds and speak to the credit card rep? Finally, I decided she would be worth it because she would likely take me along on the trip.

Initially, Chase said they would think about Carol’s application. That is credit card speak for “I doubt you will get approved”. Later, we got an email saying they needed to ask us more security questions. It took all of my personal strength not to take my iPhone and chuck it through my 83-inch flatscreen TV. I’m glad I didn’t do that. That would’ve negated our savings with the hotels, right?

At one point, we received a message saying we were rejected. I called them up. The lady told me we were not really rejected. They were just continuing to think about it. I rolled my eyes when I heard that.

After about three weeks, they got back to us. Carol was approved. The initial “no” turned into a maybe, a very long maybe, and then we were approved.

The summary. What was the reward?

I would like to be clear on a few points. This is a financial newsletter. I enjoy optimizing for money which lets me optimize for personal enjoyment. Money doesn’t have any value until it is used. I’m good at what I have just told you about. It’s not work for me. It’s a game. I don’t like crossword puzzles or jigsaw puzzles. They are way too frustrating for me. You might like doing those puzzles and not like the kind of optimizing I do. No problem. Hang in there. Pass this news along to someone in your family who thinks a bit more like I do. Then ask them to give you a free hotel room!

Let’s try to summarize. We owed more than $90,000 on a single credit card. We were just making the minimum payment on that balance. My credit score had dropped by about 100 points. We had been rejected on our last four credit card applications. We never got down on ourselves.

Now, with the four credit card APPROVALS, we stood to earn more than $10,000 in direct reductions to our travel expenses. We would be staying in Hyatt hotels when we traveled, no matter what. However, as I have described, we would be paying $10,000 LESS than if I hadn’t done this.

This is the important part. What is to be learned?

What can we learn from this? The simplest and broadest learning is that “No means maybe, maybe means yes, and yes means I need to ask for something extra.” Being in sales I learned this a long time ago.

I’m still not finished with the Chase Freedom Unlimited “0% APR” promotion. I’ve got until February 2025 to exploit that program. This year’s credit card arbitrage program is on track to earn $48,000 in pre-tax rewards. This means we will reduce our annual travel expenses by about $38,000 after tax.

Even though you might not have ever heard of this…Credit card arbitrage is a thing!

Credit card arbitrage really is a “thing”. We travel a lot. The credit card rewards reduce our cash travel expenses. You may say, “We don’t travel as much as Randy and Carol.” In all likelihood, that is a very true statement. Maybe you don’t spend enough to earn $48,000 in pre-tax rewards. Perhaps you only spend enough to earn $5,000 or $10,000 or $15,000 in travel expense reductions. Would you walk away from that much money or educate yourself in this arena?

I dictated this entire missive while driving along Interstate 80 on my way from Canton, Ohio, to Detroit, Michigan. They’ve got a lot of trucks on this road. I needed to pay attention.

I just got a text from Experian, one of the three credit score rating agencies. They told me my credit score with them had increased from good to “exceptional.” My credit score is now 811. I was pretty well surprised by that.

Your credit score is not important*.

Of course, that 811 credit score doesn’t amount to a hill of beans. I didn’t need to get any loans. Who cares what my credit score is? Don’t believe that?

Then you tell me, if you don’t need any loans, what is the value of a good credit score? I’m waiting.

Even if I need to apply for more new credit cards, I figured I could simply call them up and sweet talk ‘em. Soon, I would be getting exactly what I wanted. This is the world I live in. The language I hear may not be the language you hear, but then maybe it is.

Don’t worry. Carol’s fine.

When I got home from my trip, Carol gave me a kiss and a hug as she always does. Then she told me she had something to show me. She had been involved in a fender bender. Her 2014 Lexus RX 350, with only 61,000 miles on it after 11 years of driving, had an “owie” on the right rear corner. This “owie” was going to require stitches.

It doesn’t take much nowadays to have a minor automobile accident and total a used car. Her car was totaled. Luckily, she wasn’t hurt, and the guy who ran into her only complained of a minor foot injury. I can just imagine what that will amount to as we go through the Insurance process.

Carol gets a new car.

Now Carol needed a new car. We could pay cash, but if I could get a decent loan rate, we might practice automobile loan arbitrage like I always do.

Randy’s New Car Buying Method to the rescue!

It was now time to put “Randy’s New Car Buying Method” into practice once again. Carol wasn’t happy about losing her car. I would make things right for her. No, I wouldn’t vacuum the rug or take out the garbage. I would get her a new car. Fair trade?

I promised you I would talk about credit card arbitrage and then cover the 2024 version of “Randy‘s New Car Buying Method.” However, to respect the people who think these messages are a little bit too long, I’m not going to do that. I’ll be back to you in a few days with how we handled getting Carol a new car. It turned out to be a most exciting process.

Late breaking news!

You know that the Los Angeles Dodgers beat the New York Yankees in five games to become the World Series champions. Our son J.J. and I had tickets to game 6. There would be no game 6! Nevertheless, you all know I am a savvy negotiator.

I made a deal with J.J. He, and I would go to game 6 of the World Series. I would pay the first $2,000 for those tickets. If we had to pay more, then J.J. would cover that cost. We ended up paying $2,005 for those two tickets. I nicked J.J. for five bucks in this deal! But wait. There’s more. Our deal also included him picking up all of the expenses for refreshments and parking. But wait. There’s still more. He would help me with Turbo Tax. That Turbo Tax clause tilted the deal in my favor!

I want everyone reading this message to use their best Saturday Night Live Gilda Radnor voice and say, “I wouldn’t pay 2,000 bucks for no stinkin’ World Series tickets.” Next, imagine Randy saying these words.

“I don’t need $10,000 from the programs mentioned above. However, when I get that $10,000, I am certainly not going to save that money. I’m going to spend it! Money is meant to be spent. To me, paying $2,000 for two baseball tickets was the same as free! I got $10,000 for essentially playing a game, so I could use that money on ANYTHING…frivolous or not. I loved Gilda Radnor.

Randy Lewis

Randy is a freelance writer who commonly flies in coach and is more than willing to stuff an army field jacket full of clothes to avoid paying a baggage charge. In his world, no means maybe, and maybe means yes, and yes means he really needs to ask for more.