Managing personal finances……or I caught the fever and Medicare won’t pay for it

.

.

.

.

This message is NOT about a fever or about Medicare. It’s about personal finances, managing money and creating a first-class consumer experience. This is about seeing how someone does things, money-wise, whose demographic is surprisingly similar to yours in age, education and experience. With that in the rearview mirror let’s move on.

OK, I’m going to be honest with you. I caught the fever and couldn’t shake it. The worst part about the fever I caught is that once it was cured I couldn’t even submit a medical claim to Medicare. I knew they wouldn’t pay it.

I’m going to share with you my innermost thoughts on what it took to cure the fever. If you ever catch the same fever I caught maybe you can go back through my notes and find something that will help you cure such a malady.

If you’ve never had the fever, don’t think you’ll ever get the fever or don’t think that any of my solutions could help you cure your fever, don’t be a complainer. Delete this message. That will help you avoid not just the fever but your own personal heartburn. On the other hand, you never know when unexpectedly the fever will hit you or someone that you love. When it does you’ll need to be prepared.

NEW CAR BUYING FEVER

Exactly what fever am I talking about? I’m talking about “new car buying fever”. If you’ve ever had it you know exactly what I mean. All of a sudden you get your heart set on buying a new car and come hell or high-interest rates you’re not going to cure that fever until that new car is sitting in the driveway. Ready? Let’s get started.

I’M RETIRING

Much to the chagrin of the people who email me almost weekly I am retiring from the new car negotiating arena. People who want to use the “Randy Lewis New Car Buying Method” still can. It’s available at my website, www.randylewis.org. Here’s a link:

It’s not that I don’t like to negotiate. I do. I’ll still be out there with the best of them with my, “need one” sign at the biggest sporting and entertainment events around the world. I’ll be negotiating my butt off there.

Why will I stop negotiating new car purchases? Because I just bought a 2020 Tesla Model X. As you may or may not know Tesla doesn’t negotiate at all on new car purchases. They have a fixed price system.

THIS IS NOT THE SAME AS BUYING A JAR OF PEANUT BUTTER

I will tell you that buying a new car is not like buying a jar of peanut butter. OK, I know you already knew that. But did you know why my assertion is true?

When it’s time to buy a new jar of peanut butter you don’t buy one because you want one you buy one because you need one. You go into the cupboard. You’re just looking for a spoonful of Jif crunchy peanut butter to satisfy a short term craving. However, when you scrape and scrape and still can’t get a spoonful it’s time to buy a new jar of peanut butter.

On the other hand, very few people are stranded along the side of the road with a car that has given up its last ghost. The car is steaming, all four tires are flat and the trunk won’t close. A person in that situation NEEDS a new car. Well, at least they need a replacement car. You don’t see very many people standing along the side of the road in a situation like this, do you?

What you do see in the new car buying arena is a person who has a car that they’ve had for a while and for the most part they’ve enjoyed it. But now maybe it’s too big or it’s too small. It doesn’t get the right kind of gas mileage. With the grandkids maybe you need a car that seats more people. Maybe you just don’t like the color of ol’ Betsy/Bill anymore. For whatever reason, you WANT a new car more so than you NEED a new car like that poor soul standing along the side of the road with their disabled piece of junk.

So now you want to get rid of the car that you currently own and get another car that will be new to you. It may or may not be new as in “brand new”.

BRAND NEW OR……NOT

Here’s my thinking about buying brand new cars versus buying used, er……previously owned cars. I always want to buy new. Would I advise my son or daughter who might be 25 years old to buy a brand new car? Probably not. New cars depreciate. That depreciation can be expensive. If you’re still on your way up in the financial world I don’t think investing in an asset that will decrease in value is a good idea.

I know some people think the right thing to do is to buy a one or two-year-old car with low miles. They can get a price reduction that oftentimes is significant compared to what a brand new car would cost. Sorry, I don’t roll that way. I also don’t look down on the people who do roll that way. Here’s my thinking of new vs. old.

I live in Southern California. You will rarely find me wearing anything other than a pair of underwear (too much information?), cargo shorts, a t-shirt and shoes. More than 99% of the days in each and every year I wear those four items. I’ve got to be honest with you. Every piece of clothing that I wear I bought new. Yes, I could have saved a little bit of money buying used clothing but for me, it just wouldn’t feel right. That’s the way I think about car buying as well.

LEXUS ROCKS…..LEXUS JUST ROCKS

I have been a “Lexus Man” since I bought my first new Lexus LS 400 in 1999. That’s 20 years of owning brand new Lexus automobiles. I can tell you this. I have never ever in all of those 20 years had a repair expense…..ever with any of these cars. Yes, I’ve had maintenance expenses such as oil changes and tire rotations. I might have had a brake job done once in all of those 20 years. My current Lexus has 80,000 miles on it and it’s never had a brake job and doesn’t need one right now. I’m easy on cars and Lexus is more than easy on repair expenses.

So, why am I about to throw Lexus under the bus? Is my current Lexus with 80,000 miles on it and in perfect condition about ready to fall apart? First of all, I am NOT throwing Lexus under the bus. Lexus is a great brand. My car will likely go 280,000 miles or more before it is headed to that great shredder in the sky.

My first brand new car was a 1980 Cadillac Sedan Deville, fire engine red (above). I was giving up a company car. The company gave me a car allowance when I moved into the office. That car allowance was enough to buy a brand new Caddy. My boss drove a used up Honda Civic hatchback. I often parked right next to him. I wasn’t always the most politically correct individual. Yes, I’m pretty proud of that.

That General Motors diesel POS turned out to be the WORST new car I ever owned. However, somewhat surprisingly, despite going through three diesel (don’t even get me started) engines, it did last long enough to be turned over to our teenage son. Then when we finally sold it for $1,500 my wife felt compelled (I was out of town) to tell the buyer every blemish that car had experienced since we owned it. There were many. I made sure the buyer signed an “as is” bill of sale!

Since then my wife and I have owned new Lincoln Town Cars, Mercedes, Ford Mustangs, Jaguars and 20 years of Lexis ownership. In my opinion, I’ve never seen a better car than Lexus. However, I am moving away from Lexus with my next purchase. Is that a smart idea? I’m not really sure that it is but if I don’t try a new idea now I’ll never know.

WHERE IN THE GAME OF LIFE (TIME-WISE) ARE YOU?

There are so many elements that helped me make my final decision. I don’t know if one or the other is more important. One of the more significant reasons to buy this new car at this time is something that I’m not sure a lot of people even think about. They certainly don’t talk about it.

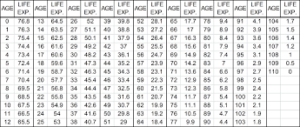

I am 70 years old. By most statistical measurements I am in the last quarter of my life. By almost all statistical measurements I am in the last quarter of my driving life. That being the case it wouldn’t be unusual for me to ask, “what am I waiting for?”

CAN WE BE CLEAR? THERE IS ABSOLUTELY NO NEED TO SPEND THIS MUCH ON A NEW CAR.

Later on, in this message, I’m going to share with you some of the financial numbers around this transaction. I will tell you this right now. From a financial benefit point of view, I don’t think there is any way I can justify paying this much for an automobile. Truth be told what I paid was more than twice as much as I’ve ever paid for a new automobile previously. In point of fact, this car purchase was more than 2 1/2 times what we paid for our first home and that house had a beautiful inground swimming pool on a third of an acre in Phoenix, Arizona.

Why would I spend so much money on an automobile? It’s really rather simple. The explanation is the same as why would I spend so much money on a house, or a suit or a new pair of roller skates. I believe between now and the time this all ends I can afford it. If I can afford it without harming anyone else then why not?

I might make one other point on this subject. Some folks have the attitude that goes like this. If I spent a lot of money on a new car or a new pair of roller skates then I wouldn’t have enough money to leave to the kids, Johnny, Jose and Jenette. I better just hibernate with my spending so the kids get something from me.

First, I don’t think of buying something now versus leaving money to the kids as an “either/or” situation. With proper planning, started decades ago, you should be able to spend money to enjoy life now AND leave a little bit for the kids or your favorite charity or whatever.

LEARNING FROM YOUR KIDS.

Remember when your kids were small? You tried to be a role model and teach them the right way to do things in all matters of life. There comes a time when the two lines cross on the graph of life depending on the subject. When those lines do cross you become the student and your children become the teachers.

Our oldest son bought a Tesla Model 3 about a year ago. He raves about it. He even let me drive it for an entire day to see if I might like to buy one myself. In the end, I felt the Tesla 3 was just a little too small for me. Its ride was just a little too much “sports car” for my taste. After driving a Lexus for so long I’m looking for a smooth ride, not a sports car ride.

WHO WAS THIS GUY ELON MUSK? WHAT WAS A “Y”? WHAT WAS AN “X”?

A few months ago Elon Musk, CEO of Tesla, stood on the stage and introduced the Tesla Y SUV model to the world. The Tesla Y is a smaller SUV. It is also a lower-priced model within the Tesla automobile family.

By the way, if you didn’t already know this, Tesla automobiles are not inexpensive. They first came out with a Tesla sedan, the Model S (above) and a Tesla SUV, the Model X. Both of those sell right at $100,000 plus or minus.

The smaller Tesla Model 3 has a price tag in the range of $50,000 one way or the other. The Model Y, the smaller and more affordable SUV, was also priced in the $50-$60,000 range. The Tesla Model Y uses many of the parts that the Model 3 sedan series does but comes with an SUV body.

THAT’S IT! I’M BUYING A TESLA MODEL Y.

I put in a pre-order for a Model Y. For the most part that’s how you order Tesla automobiles. You place an order and they build it for you. Just in time right. That’s not the way most other new car purchases happen. In today’s world very few people order their new cars, “from the factory”….but they do with Tesla.

For the Model Y, I placed a $2,500 deposit down as a pre-order. My car was going to have a retail price of $59,500 before various rebates and sales tax.

I COULD WAIT……OR COULD I?

Additionally, and this was an important point to me considering my stage in life, I was going to have to wait at least a year to get one. I don’t like to wait… when I have the fever. I did wait about eight months and the fever became so intense I couldn’t wait any longer.

I must tell you that my wife and I have had a few Lexus RX 350 SUVs. What a fantastic car and what a fantastic value. With my new car buying approach, our average purchase price has been about $40,000 per car plus taxes. If you can get a brand new Lexus RX 350 for $40,000 or so I say, just like Lee Iacocca used to say, “Buy it”.

So here I was willing to pay $59,500 for a Tesla Model Y I couldn’t get for a year or more. I started to think. Can I stand having the “fever” for another year? I decided I could not do that.

THAT’S IT! I’M NOT BUYING A TESLA MODEL Y. I’M BUYING A TESLA MODEL X.

I began to entertain the idea of upgrading to a Tesla Model X SUV (above). That car comes with a pretty pricey price tag. I knew the car was going to cost me, if I went in that direction, $100,000 plus or minus.

The first car I ever bought was a 1970 Ford Mustang. The sticker price on that car was $3,000. Of course, that was almost 50 years ago. Did I ever expect when I scraped and clawed to pull a $3,000 cash and loan package together to buy that car in 1970 that someday I would be buying $100,000 car? No, I never expected that. By the way, a lady ran into the back of my ’70 Mustang and totaled it (above). I was only in the hospital for a short time and very lucky to survive.

I will tell you that the list price for the Tesla Model X that I did buy was $96,290. When I write that particular number I try not to think about how much $96,290 really is. However, when I do wild and crazy things I try to compare those actions to, “normal things“ in an attempt to justify my wild and crazy behavior.

WHAT IS THE TRUE COST OF UPGRADING?

I looked at it this way. I had been more than willing to pay $59,500 for the smaller Tesla Model Y SUV. Now I was apparently willing to spend $96,290 on the bigger and more luxurious Tesla Model X SUV. The difference in purchase price between these two vehicles is $36,790.

So this was the challenge. How could I justify the idea that I was now willing to spend $36,790 more than I originally thought I would spend. Secondly, and just as importantly, how was I going to slip this number across the dining room table to my wife without her throwing a dinner plate at me?

I thought long and hard about this. We’ve only got so many dinner plates and we’ve had those since we were married. Below I will share with you the justification(s) I used to rationalize these ideas. You’ll be the judge if my logic works for you.

WHAT IS THE BIGGEST EXPENSE OF OWNING NEW AUTOMOBILES?

Depreciation. Did you know that depreciation is the biggest individual line item car expense when you buy a new car? I wanted to know what was going to be the depreciation difference between the Model X ($96,290) and the Model Y ($59,500).

When you consider an upgrade from one product to another it’s all about understanding the differences. What are the pros of doing it one way and what are the cons? The pros and cons are not always just the cost differences. There is convenience and comfort and a host of non-monetary pros and cons to think about.

I did a lot of online research during this entire new car buying process on Tesla models. Believe it or not, YouTube is a great source of information. I found (not on YouTube) that Tesla models were expected to depreciate over a 50,000-mile driving range by about 28%. I didn’t see any other number to dispute that. By the way, over 50,000 miles the Tesla was expected to depreciate 28% and the Lexus 32%. Both of those numbers are relatively low depreciation rates. I think that’s the case because of the quality and prestige of these brands.

I don’t think you will find a more enthusiastic group of car owners than those folks who own Tesla automobiles. They almost think about their cars as electronic shrines. It is true that the typical Tesla owner is younger, likely less than fifty. That’s pretty amazing that younger people are willing to spend so much money on what is an expensive brand. However, I was encouraged when I drove by a supercharging station the other day and a guy about my age was charging his Model X!

Driving 50,000 miles would take me just a little bit more than four years. My Model X with a purchase price of $96,290 would be expected to depreciate some $26,961 during those four years. The smaller Model Y SUV with a purchase price of 59,500 would depreciate $16,660 over 50,000 miles of driving.

This all amounted to a difference in depreciation between the two cars of $10,301, essentially over four years. That meant the depreciation delta would be $2,575 per year or $215 per month.

I crunched a few numbers. I was 70 years old. I looked at the IRS life expectancy tables. I looked at the $215 a month depreciation difference between the two models I was considering. I finally decided that if I analyzed some of my wife’s discretionary spending and got her to make some concessionary reductions that $215 a month in extra appreciation could be handled. For me, it was worth it to eat a little more depreciation for a bigger and better car.

HOW WOULD I PAY FOR THE CAR?

Then, with my son’s aide, I found a credit union that was offering car loans at 1.99% (California residents only). I could get a car loan for 72 months. I have never had a car loan for six years. However, at 1.99% if I could get a car loan for 50 years I would take it.

I have updated you religiously for the past 18 years with the rate on investment results on my stock and bond IRA portfolio. As a refresher, my annualized annual return on that portfolio over the period of 18 years is 8.1%.

I don’t know if I can earn an 8.1% ROI for the rest of my life on that portfolio or not. If Vanguard sent me a letter guaranteeing me 8.1% if I kept my money invested exactly as it is right now I would sign on the dotted line faster than anyone has ever signed on a dotted line. I don’t expect to get a letter like that.

What will be my rate of return on that stock and bond portfolio over the next six years? I have absolutely no idea. However, I’m going to bet it will be greater than 1.99% which will be my lending cost for the new automobile.

GAP INSURANCE.

During the lending process, I was reminded about, “gap coverage”. What’s that you ask? Let’s say you have an automobile loan amount after one year of car ownership of $30,000. Then let’s say someone runs into your car and totals it. Your insurance company will give you the current depreciated value of your one-year-old car. Let’s say that’s $25,000. Now you can go out and try to find a car, with your $25,000, that is similar to the car you had….that was totaled. All good? Not quite.

Your insurance company gave you a check for the current depreciated value and maybe you can find a replacement car that is just as good as what you had. But….what about the bank loan?

You still owe the bank $30,000 and the insurance company only gave you $25,000. In addition to the trauma of having had your car totaled you now have to SEND the bank a check for $5,000!! Ouch!

The above is true unless you have “gap insurance”. You can buy gap insurance so that no matter what your car is worth during the loan period if the car is totaled the bank is paid off in full. Gap insurance is probably a good idea.

I contacted Farmers Insurance, my auto insurance carrier, about gap insurance. They would sell it to me for $22/month. Over the life of my 72-month loan that would come to $1,584. That seemed like a lot.

Then the credit union, EECU in Fresno, where I was getting my auto loan told me what their gap insurance was going to cost. They would charge me a one-time gap insurance premium of $250. Over the life of the loan that was only $3.47/month. I went with their plan. If my car gets totaled in the first year or so I will be a little “behind” the monthly charge from Farmers. However, if I have my car for six years I will have saved more than $1,300 and had the peace of mind that I won’t owe anything to anyone if something really bad happens to my car.

WHY IN THE WORLD WOULD I WANT TO PAY CASH FOR A NEW CAR WHEN THE FINANCING RATE WAS SO LOW?

Why in the world would I want to pay cash for this car? I know this question is like waving a red flag in front of a bull for some readers. To them, everything is paid for in cash.

Some folks think that in a situation like I was encountering they would not consider buying a new car with anything BUT cash. Would it be impolite of me to say those people are wrong? O.K., I know the politically correct thing to say is that it really depends on a person’s situation.

We live in a world where every little league player gets a trophy at the end of the year. When I played in little league everyone on our team got a soda (cost 10 cents and grape for me please) if we WON the game. If we lost we went to practice the next day and tried to win the next game. In my world, not everyone gets a trophy. If you can borrow money at 1.99% and earn four times that much with your investments you are wrong to pay cash.

Why would I want to take money that is currently earning 8.1% so I could avoid paying someone who is willing to give me $100,000 at 1.99%? I’ll give you a heads up. I wouldn’t want to do that.

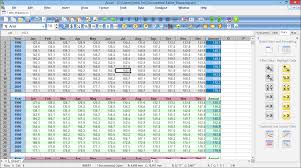

A guy in one of the Tesla forums that I followed created the coolest spreadsheet I’ve ever seen and I’ve created some pretty cool spreadsheets myself. Again, my son turned me onto this valuable piece of information. The spreadsheet listed about 50 credit unions and their auto lending rates over different periods of time. The spreadsheet updates itself every four hours. How cool is that? Want to see that spreadsheet? Just message me and I will forward it to you….or check out this link which I hope can remain current.

Credit union financing spreadsheet

Here’s what I did on the auto loan front. I got the phone number of the Educational Employees Credit Union in Fresno, California. After I got that phone number I just called them up. That’s right I just called ‘em up.

NICE TO MEET YOU NIKKIE. DO YOU HAVE ANY QUESTIONS FOR ME OR ARE YOU GOING TO LEND ME A LOT OF MONEY JUST ON MY GOOD LOOKS? THIS WAS ONE OF MY MOTHER’S FAVORITE LINES!

The credit union phone was answered by a young woman named Nikkie. She asked me a few questions. What kinds of questions? I needed to spell my first and last name. Then she asked me what our taxable income looked like on our last two federal tax returns. I mentioned we received social security checks electronically every month. She asked me my social security number and that was pretty much it.

She didn’t ask me if I had any money in the bank or if I followed my own advice and had a big mortgage (which I do and I do). She didn’t ask me if I had any unpaid gambling debts. It appeared that Nikkie trusted my ability to pay back the credit union in Fresno in full and on time. I found this amazing since I had only been speaking to Nikkie on the phone for five minutes.

During the course of our conversation, Nikkie came back and told me that I had been APPROVED for a $100,000 car loan at 1.99% for 72 months. It appeared that our credit score came back at 850 (max: 900). If I remember right that was my total score on the SAT (max: 1,600)!

Just like my beautiful wife (above) always told me…if we paid our bills on time that would be a good thing. All I had to do was send in the first couple of pages of our 2017 and 2018 tax returns and my social security award letter and that would cover me on the income qualification front.

BUT…..I WASN’T A MEMBER OF THIS CREDIT UNION….YET.

As you might imagine I was not a member of the Educational Employees Credit Union Fresno, California. However, they were willing to admit me to their private club. What was that going to cost me? It was a lot less than the initiation fee for my golf club! I had to make a $10 contribution to the PTA and pay a five-dollar checking and a five-dollar savings fee. 20 bucks! I was in the club. My loan was approved.

SO…WHAT WAS MY MONTHLY “NUT” GOING TO BE?

By the way, I have never ever used the word, “nut” in this context. Why? It just sounded weird to me but today not so much.

So how much is the monthly payment on a $100,000 loan at 1.99% for 72 months. I’ll save you the time of checking. It’s $1,475 per month. Sound like a lot? I guess it really depends.

$1,475 A MONTH? THAT WAS NOTHING COMPARED TO 1999.

I told you earlier in this message that the very first Lexus automobile I bought was a 1999 Lexus LS 400. I’m going to guess I paid about $50,000 for that car. I don’t remember the exact number. However, I do remember the monthly payment on that car. Remember this was back in 1999. My monthly lease payment on that car was $2,008.

I remember signing the final papers and the woman working in the finance department gasping! She told me she had never ever seen a payment as large as mine at $2,008 per month. Then she realized that she was seeming to imply that I was either a very poor negotiator, had terrible credit or had overpaid for my new car or all of the above. She immediately apologized. I simply smiled.

I remember telling a friend from Michigan that my car payment was $2,008 a month. He didn’t believe me. He told me he could never ever buy a Lexus. Why? He said all of his neighbors would think he was stuck up! Class envy is a terrible thing. I learned playing golf that there is always someone you can beat and someone who can beat you.

Let me make a comment about “class envy”. Essentially class envy is being jealous about someone who has something more in whatever category than you have in that category. I hate class envy. Lots of people have more than I do in lots of categories. I think the best approach with this subject is to congratulate people who have done well and not be jealous of them. Remember what Bill says about Bob says more about Bill than it does Bob.

Anyways…..a $2,008 car payment? That $2,008 monthly lease payment was one of the very best financial deals I’ve ever made and without boasting, I will tell you I have made my share of good financial deals. Back in those days, I could write off 90% of the $2,008 as a business expense. What did that mean? It meant that being in a tax bracket somewhere north of 40%, federal and California, the government was paying for $700-800 of that monthly $2,008 payment. Remember, I don’t make the tax rules. Therefore I can’t be criticized for playing by the rules and paying my fair share of taxes. If you want to complain about people and taxes I say take it to Washington D.C. and/or in my case Sacramento, California.

By the way the lease on that ‘99 Lexus was for three years. Because my monthly payment was so large the residual payment was only $12,000. A lease’s residual payment is what you can buy the car for at the end of the lease. If you don’t want to purchase your leased car at the end of the lease you simply hand the dealer the keys and walk away.

After three years that $50,000 Lexus was worth about $35,000-40,000 but I could now buy it at the end of the lease from the leasing company for $12,000. Trust me this was one of the best deals I ever made. When you can get the federal government to pay about $27,000 of your new car purchase of $50,000 you have done well. Please!! I don’t make the rules I only play by them.

But, I know you’ve got other things to do, so let’s get back to the financing situation with the Tesla Model X that I’m buying. My monthly payment is going to be $1,475. However, with a 1.99% interest rate, I wouldn’t be paying very much interest. Over a period of six years, I would pay just $6,200 in interest. That meant the average principal reduction with each monthly payment will be $1,389.

I would be paying less than 100 bucks a month in interest for this six-year loan on a monthly average. It also meant that on a monthly basis I was moving $1,475 out of a taxable account that was earning 8.1% in order to satisfy the loan requirements from some folks who were charging me 1.99%. I didn’t like that but that’s what was required in order for me to pay for the car.

However, and there were no guarantees about this, if I earned 8.1% on 100,000 in an account that I was slowly draining over six years I would earn somewhere in the $25,000 range before taxes. I was only paying $6,200 in interest over the term of the auto loan. Gaining by borrowing can be a good thing.

To put it in even more basic terms I would be paying the credit union in Fresno $1,475 per month. My car equity would increase by $1,389 each month less depreciation. So….MOST of my car payment was actually coming right back to me. That’s a pretty positive way to look at things, isn’t it!

I WOULD BE BUYING MY CAR….BUT IT WAS A LOT LIKE A LEASE BUT WITH NO ANNUAL MILEAGE LIMITS.

You probably know that when you go to lease a car the lease payment is basically what it takes to cover the cost of depreciation during the term of your lease plus whatever profit the dealer might make. In some ways, I was effectively leasing this car even though in this situation I had purchased it. Here’s how that works.

I was buying the car for $96,290. I expected the car, in the first four years or so, to depreciate by 28% or $26,961. On an annual basis that came to $6,740 and on a monthly basis that depreciation amount was $561 a month. That $561 in depreciation expense was essentially the equivalent of my “lease payment”.

TESLA WOULD BUY MY USED CAR!

Another benefit, if I chose to use it was that Tesla would buy my existing car, a 2013 Lexus RX 350, as part of the Tesla purchase process. They would pay the “good” condition Kelly Bluebook value. I could also go to CarMax and get an estimate. Tesla would buy my car for the higher of the two estimates.

Since my car is in excellent condition I think I can get about $1,500 or more than what Tesla offered me. That being the case, I’ll probably just place an ad for free on Craig’s List and/or pay for an ad with Autotrader. I’ve sold several cars, computers and cell phones on Craig’s List. I simply meet the prospective buyer in a nearby grocery store parking lot. Since all the stuff I am selling is in pristine condition it is rare that I don’t close the deal with the first person I meet.

Over the phone, it is common for the buyer to ask if my price is firm. I simply tell them that if the product I am offering is exactly how I have described it then I believe I have set a fair price for what I am selling. I tell them that if what I am selling falls short of the description I have offered they shouldn’t buy it. I sold my last Lexus for more than the Kelly Bluebook “excellent” condition price using this approach.

I THOUGHT OF THIS IDEA ALL BY MYSELF!

Would it be OK if I shared this thought with you? Virtually every idea I’ve ever had I got from someone else. I’m talking about more than 99% of the ideas that make up my core being. Other people have great ideas. Usually, for my purposes, I might tweak these ideas just a bit but to be clear I have come up with very few ideas on my own. However, the idea that I share with you below was my own stroke of brilliance.

There was another interesting strategic move that likely saved me thousands of dollars in the long run. I placed my order on November 29, 2019. I could have purchased a 2019 model from Tesla’s limited on-hand inventory in Southern California at that time. However, if I ordered a 2020 model I could get that car within the next 30 days. By not buying a 2019 model before December 3, 2019, I did forego a $2,500 tax rebate from California. I would not get that rebate when I took delivery in late December of the 2020 Model X I did order.

Why was buying a 2020 model better than buying a 2019 model? Here’s the kicker! The purchase price of the 2019 model and the 2020 model were exactly the same! Think about that.

In two years or four years or six years, a 2020 Tesla Model X is going to be worth more than a 2019 Tesla Model X right? How much more? I don’t know. However, if this car depreciates about 26,000 during the first four years it might be safe to assume that a 2020 Model X might be worth maybe $4,000-6,000 or more than a 2019 Model X. Maybe more! I’m proud to say I came up with this strategic play!

YOU DON’T HAVE TO DRIVE FAST TO ENJOY FAST DRIVING….BUT HAVING A LITTLE PICKUP OFF THE LINE CAN BE FUN!

There was one more pretty neat thing about buying this Tesla Model X. I’m not talking about the fact the car can do 0-60 MPH in 4.4 seconds. It takes my Lexus RX 350, which is pretty sporty for an SUV, 7.7 seconds to get up to 60 MPH. What was the other “neat” item?

FREE! ABSOLUTELY FREE! NO MORE GAS STATION STOPS FOR ME.

My Tesla Model X will come with unlimited FREE supercharging within the Tesla worldwide system. There’s a supercharging station about five minutes from our house. As a matter of fact, as of December 2019, Tesla has more than 15,000 supercharger stalls in 1,800 locations. However, less than 10% of all Tesla charging is done with these superchargers.

I plan on using the supercharging system exclusively. I could just charge the car in my garage. We have solar so the extra electricity wouldn’t cost much. But I wanted my “fuel expense” to be ZERO. Zero is real good in this situation. Real good. I would likely only need to charge the car once a week. My Tesla X long-range model is rated at about 334 miles per “tankful”.

Right now the average price for regular gasoline is $3.90/gallon in California. Remember, we put a “sunshine” tax on everything in the Golden State! My current Lexus gets about 22 MPG on a good day. That means right now I pay about $0.18/mile for gasoline. I drive about 12,000 miles per year. All of this meant I would NOT be paying $2,160 for gas each year. Over the term of the six-year car loan, I would NOT be paying $12,960 for gasoline. That was all good.

The Tesla Model X that I purchased came with lifetime free supercharging as mentioned. However, the Tesla Model Y (the smaller SUV) that I had initially pre-ordered did not offer free supercharging. That meant I was getting a little more savings, to narrow the gap somewhat between the two purchase prices (X vs Y).

I DIDN’T NEED A CARPOOL BUDDY ANYMORE!

My wife and I drive up to see an Angels game or make a trip to the Rose Bowl or the legendary Pauley Pavilion to see UCLA play several times a year. She always reminds me that I am very lucky to have a “carpool buddy” to avoid the traffic that slows down single person cars. Of course, she is right.

A major benefit to Tesla ownership, also available to other EV car owners, is free use of the California carpool (HOV) lanes. Normally, one needs to have at least two people in their car to use these major time-saving lanes. For just $22 I will get carpool stickers good for four years in the carpool lane when I’m the only person in the car. Frankly, the carpool stickers don’t look that cool when placed on the car’s rear bumper but speeding past folks without a buddy in the regular freeway lanes IS cool. Just in the Los Angeles metro area, there are 960 miles of carpool lanes. That’s 68% of the entire total in all of California.

WHAT ABOUT UNCLE SAM?

To complete my financial analysis I also needed to add California sales tax. In Orange County, California the sales tax rate is 7.75%. Then I needed to subtract whatever rebates I would get from anybody willing to give me a rebate. I’m the kind of guy that will take any rebate offered regardless of which political party supports that rebate!

There were going to be some EV rebates I was eligible for. Yep. Both California and the federal government give tax rebates for buying an electric car. Even our electric company, San Diego Gas & Electric, has given rebates to EV owners. Again, I can’t fully explain the reasons behind these rebates and don’t feel as if I am required to.

I will tell you this. My wife said to me at dinner and I quote, “Why should the federal government be giving tax rebates and credits to rich people?” How do you answer a question like that? The best I could come up with was, “Are you talking about us?” She smirked.

I never complain about the government. My friends will vouch for me on that. The guys who do are usually crying into their beer over a plate of linguini at lunch at our private golf club. Of course, that’s before they hop into their luxury car and drive home to their million-dollar homes. However, I have digressed again and am truly sorry.

I am not in a position to explain why the government gives tax credits to rich people or poor people or black people or green people or blue people or white people or short people or tall people. I don’t speak for the federal government.

When I played Little League baseball (too many sports analogies?) I never turned around to the umpire and asked why it was three strikes and you’re out and not four. People have their rules. When I can’t change the rules established by other people I don’t worry about it. I either don’t play in their game or I try to understand the rules and maximize my performance within those rules. Can I make that any clearer to any bleeding hearts who think that one person or another is being given a special advantage that they are not entitled to?

The state of California was giving people who took delivery of a new Tesla automobile by December 3 a $2,500 rebate. However, I couldn’t turn my deal around quick enough to qualify for that advantage. Ya, I know. Bummer.

After December 3 people buying new Tesla automobiles that cost $60,000 or less could still get that rebate from California. Means-tested again! My car was going to cost more than $60,000. Did I complain, stomp my feet up and down and scream to the top of my lungs that I was being discriminated against? No, I didn’t. Rules are rules. I couldn’t close the deal by December 3 because Tesla couldn’t get me the automobile that quickly. I didn’t get the $2,500.

The federal government was going to give me a $1,875 tax credit if I could close the deal by December 31. I expected to be able to get that credit. Editor’s note: I did get my car on December 22, 2019.

For Tesla, the federal government has been reducing the annual tax credits as Tesla sold more cars. I think the original tax credit was something like $7,500. Following December 31, 2019, Tesla will have sold more electric cars than what the government’s tax credit goal was for them. Beginning in 2020 there will be no federal tax credits for Tesla’s new car purchases.

STAND BY. I’LL TELL YOU WHAT MY TESLA OWNERSHIP EXPERIENCE WAS LIKE IN THE NEAR FUTURE.

One of these days after I have driven my new Tesla Model X for a while I’ll probably take some time to tell you about how cool it is. After watching my son drive his and have him tell me about all the benefits I’m pretty sure it’s going to be pretty cool.

IF YOU’VE READ THIS FAR YOU MUST HAVE FOUND SOMETHING OF INTEREST.

I don’t care how small of a font I might use, what I have shared with you is not going to fit on one page. If I could make it that small you would probably have to have better eye care coverage than you currently have.

I will say this because it has been mentioned recently. I never thought much about the Procter & Gamble one page memo idea. If someone came to me and said, “ What you have to tell me is not worth any more than the time it would take me to read one page,” I would be offended. What if you called me and I told you that you had two minutes to complete your conversation. I would essentially be telling you that all I felt my time was worth with you was two minutes. That is absurd. It’s downright arrogant!

CONGRATULATIONS! YOU ARE ONE OF THE SMART PEOPLE.

I’ve only sent this message out to really smart people. O.K. a couple of others may have slipped through the qualification process but you know that wasn’t you, right? I know that it took you a lot longer to get to this point in the message than what it would’ve taken you had everything I have shared been able to fit on one page. However, because you are a smart person as you read along and got all the way to this point in the message you kept making decisions to continue. I can only assume that you made those decisions to continue because you thought the information being provided was worthwhile. I certainly hope by the time you finish reading everything you continue to feel that way.

THIS IS WHAT THIS MESSAGE IS NOT ABOUT.

In summary, this is not a message about a person buying a $100,000 car. Would you mind if I repeated that? This is not a message about a person buying a $100,000 car. It’s not really about that at all. If you get nothing from this message other than this is not a message about a person buying a $100,000 car you will understand my intent.

You, or the people you share this message with, do not have to buy an expensive car to use the ideas shared here. In fact, you would be better off if you didn’t buy an expensive car until you have used these ideas for a long time. However, if you have used the financial concepts I have shared and even more of your own then maybe….just maybe….you’ll sign on the dotted line for that big loan. Of course, it’s your call.

WHAT IS THIS MESSAGE ABOUT?

This is a message about understanding exactly where you are with the time clock of life. It’s a message to remind everyone to think about what you are going to do with your time and your money and anything else you have to give in the remaining days of your existence.

This is a message that I hope stimulates the thinking between making a decision between one item and another item. What is the “delta” on all manner of things when you have a choice between two different products, activities or use of your time. Understanding the “delta” and its impact on you and others is critical.

This is a message about managing money. If you’ve purchased a car in the last couple of years how many of you were able to get an interest rate of 1.99% or less? If you have an interest rate higher than that did you know that you can call those folks up in Fresno and refinance your car loan? However, you will need to live in California to get that advantage. Have you ever refinanced a car loan? You can do that too.

This is a message about how one individual thinks on a few different topics. This is a message from one individual who is demographically very much like you in terms of age, education and work experience and probably a lot more.

If this message helps just about anyone in just about any of the categories that I have made reference to then I will consider the time and effort it took for me to provide this message to you to be a resounding success.

We have a tremendous resource with our P&G retiree conference. We have all kinds of people doing all kinds of things and when they share their ideas it’s a resounding benefit to others.

So, when you get the fever you might pull out this message and read a couple of excerpts here and there. Maybe it will help with the fever. You already know that Medicare isn’t going to pay for it right?

Randy Lewis

San Clemente, California

Ever seen a Telsa Model X go wild with Christmas joy? Click on the video link below.