This idea is only the “undercard” of today’s newsletter.

I just want to provide a quick update on something I mentioned in the last couple of weeks. For me, the opportunity I’m covering today will give me the equivalent of $6,000-$7,000 in taxable income savings. My cost to get that money? Nothing! This all happens in just one year. This is my version of a “money tree”. If this idea or a variation of this idea sounds interesting, please read on.

Whenever I can, I like to earn miles or cash when charging purchases to my credit card. I just picked up a Chase Freedom Unlimited credit card. This card has no annual fee.

Just a reminder if you don’t act fast, some of these offers will go away. Don’t worry. Many will be replaced by other offers that are as valuable and sometimes even more valuable. To be clear, I am not recommending a waiting procedure for success in this area. I rarely recommend waiting for anything. I always think it’s better to act quickly.

The Chase Freedom Card offers a 0% APR on any balances that I carry for the next 15 months. My plan, already implemented for the first month, is to pay only the minimum payment to Chase. That’s right. Sometimes the road to success with credit cards is to simply make the minimum payment. Oh, yeah. Don’t take that statement out of context.

During our first month, we charged $881 to this card. The time frame for this first amount of charging was only a couple of weeks. The minimum payment we could make on this $881 total spend and not have someone come in the dead of night and repossess our car was $40 U.S. Carol and I have forty bucks. We made the minimum payment. Then we took the difference between the full payment of $881 and the minimum payment of $40, which was $841, and invested that money in the Vanguard Treasury Money Market fund (VUDXX). This fund currently pays a tax-effective yield of 5.9%

If I spend $3,000 per month on average with the Freedom Unlimited card, I will charge $36,000 for the year. I estimate I will earn about $1,000 in cash by making only the minimum payment each month. I will always invest what I don’t pay in minimum payments in the Vanguard money market fund. At the end of the 0% APR promotion, I will send the money from VUSXX over to Chase.

That’s right. In a year I will take the money I have invested at virtually no risk from the money market fund and pay off the credit card balance. Does Dave Ramsay recommend this method? He does not. However, he is dealing with his share of crazies, and not you, the Randy Lewis Racing/Financial planning/Travel newsletter reader. Yes, it is you who has been screened for superior intelligence. Do you see the difference?

Additionally, the Chase Freedom Unlimited card pays a minimum of 3% cashback (points) for the entire year. I will earn $108,000 Chase points by spending $36,000 over 12 months. Remember, in America as well as the rest of the world points are effectively money. Points are tax-free money which makes points a very good thing.

I have discovered I can use 5,000 Chase points to stay in a level 1 Hyatt hotel room where the average cost often reaches $150/night. Those 108,000 Chase points will buy me 21.6 nights at a Hyatt. At $150 per night, that’s $3,240 I won’t be spending for hotel stays.

Why choose Hyatt for this example? Hyatt points “transfer well” in the Chase program. How do I know that? It’s my business to know that stuff. It is not my business to know when the folks come to clean our house. I have people and they have people for stuff like that.

I actually intend to charge a little bit more than $3,000 per month. I plan to pay our federal and state income taxes with my credit card. We will pay our auto insurance and home insurance premiums with the Chase Freedom Unlimited card as well.

Yes, there is a fee for using a credit card to pay state and federal income taxes. However, the 3% cash back from Chase is a bigger number than what California and Washington, D.C. will be charging me. If my federal tax liability for the year was one million dollars and I could charge that amount I could live quite handsomely on the spread!

The net of all this is that I will be earning a minimum of $4,240 ($1,000+ from the money market fund and $3,240+ using Chase points with Hyatt). If I were working and my earnings were taxable or if I was retired and the money was coming from a taxable IRA I would have to earn/withdraw quite a bit to clear $4,240. How much would I have to earn/withdraw? Depending upon my tax bracket I would need to have work income or IRA distributions of $6,000-$7,000 to clear somewhere around $4,240. Where else can you pick up more than $4,000 in after-tax cash in one year by doing something as simple as what I am telling you about today?

I think I can almost read the mind of the skeptic as regards this idea. They are saying, “What if interest rates go down? What if I don’t travel or don’t like Hyatt? Will this minimum payment idea affect my credit rating? I’m already rich. Why would I need another $7,000? Is Dave Ramsay going to sue you?

What do I think of the constant skeptic? People who say things cannot be done should not interrupt people who are doing them.

And now for the main event!

Let’s talk about buying a new car. I have hundreds of people who subscribe to my newsletter. This particular offer is going to appeal to very few folks. Nevertheless, what I am sharing might provide interesting reading for everyone.

You’ve heard me mention several times the book by Bill Perkins titled Die with Zero. The Die with Zero strategy is simple. It pretty much says you should use your money to create enjoyment for yourself, your family, and others.

This is not a one-size-fits-all idea that I am going to present to you. Not everyone thinks of buying a new car as creating personal enjoyment for themselves. Some people prefer to drive a junker or a clunker or a beater. For those folks, my simple newsletter is not going to change their mind.

It’s important to understand that creating personal enjoyment from spending money on a new car is not mutually exclusive with the idea of buying a new car and a new dress and remodeling the kitchen and taking a cruise on and on and on. If you have planned properly, you can do several things with your money that maximize your enjoyment.

The first part of the “Die with Zero” concept is to set aside enough of your financial resources to cover your basic living expenses. This means housing, transportation, medical, education, and whatever else you deem to be important.

The money that is “leftover” is the money you should be using to optimize your personal enjoyment. Far too many people want to use nearly ALL OF THEIR MONEY to protect themselves JUST IN CASE. You don’t have to do that. Worried about something? Long-term health care, the kids, covering your gambling debts? There’s insurance for that. My advice? Never buy blackjack insurance!

Those folks are the people who die with millions in their investment accounts. They worked hard for their money. They thought “saving” and “self-discipline” were the hot ticket. Then they never got to spend their money. That’s sort of sad.

Our kids have told us many times they want us to spend OUR money on US. They absolutely do not want us to forgo the enjoyment of our earnings so they can get a larger inheritance. Good for them. They will do OK with what we were not able to spend. But in the meantime, we are looking for ways to optimize our personal enjoyment. I can take Carol to the beach for sunset walks. That doesn’t cost anything. However, some of this “optimization of personal enjoyment” does require money. That money comes from the pot that exists after all of our basic living expenses have been covered.

This is the main event!

With all of the above being written I am now going to share my famous “Randy Lewis New Car Buying Idea “. This is not a theoretical approach. It has worked for me, my family, and lots of others…many times over. It’s a tried and true idea.

This technique trades on the idea of motivation from the car manufacturer and a decent supply of automobiles. Covid really put a dent in this approach. During COVID there was no supply of cars. When there’s no supply of cars there is no motivation for the car salespeople to offer special deals. I could just as easily have replaced the word “motivation” with the word “greed”.

Each day COVID gets a little bit further in the rearview mirror for most people, including the people who make cars. Salespeople at car dealers are motivated by incentives. In almost every case these folks are paid by commissions. They need to meet goals. They need to meet their monthly goal, their quarterly goal, and their annual goal.

If you’re interested in learning more about this particular part of the strategy, I suggest you Google the podcast “This American Life”. Search for the episode they did about a Chrysler dealership on the East Coast. This will enlighten you on the subject.

I might point out that one car manufacturer, Tesla, does not negotiate new car pricing. The price you see is the price you pay. You can actually go onto your iPhone and order a brand-new Tesla with about six clicks and a credit card. How easy is that!

I prefer negotiating the deal. I also prefer driving a Tesla. I guess driving a Tesla is more important than my desire to negotiate because I have another Tesla on order. All of that will be explained in a future newsletter.

Without further ado, I will share my technique which has been shared for the better part of 20 years.

If you need a new car, there is one day and one day only that is the very BEST time to buy that car. Is it February 22 or August 1 or November 17? It is not. The best time to buy a car is on New Year’s Eve, December 31.

Why is that? December 31 is “triple witching” day in the car business. It’s the last day of the month, the last day of the quarter, and the last day of the year.

The last time I used my method I bought a brand new Lexus automobile. I bought the car for more than $3100 UNDER invoice.

You’re going to need to familiarize yourself with some of the terms of my new car strategy. The car dealer will want to use the term “MSRP“. Stay away from that term. You should not be using “MSRP” in your discussions.

Most people know “MSRP” stands for “manufacturer suggested retail price”. BS! The term you want to use is “invoice”. Invoice is roughly what the dealer paid for the car not counting shipping fees and advertising fees.

What do you need to do to take full advantage of this idea? First, read and understand everything that’s part of my new car buying strategy. Pass this information along to the person in your family or circle of friends who wants to buy a new car. Use my strategy and offer letter and everything else exactly as outlined. When it’s all finished and the car is sitting in the driveway being admired by your neighbors…don’t forget to send me a thank you note.

Can you deviate from my instructions? Yes, you can. Will you be as successful as you could be? Er,…no. Why? Think of it this way. Your diet calls for you to eat 1,500 calories every day. You decide you’ll do just a little bit of “deviating”. You decide to go with “your plan” and eat 3,000 calories every day. You will very likely not get the result you were looking for or the result the diet company promised you. Fair enough?

Let’s go.

So you wanna buy a new car?

So it’s time.

You’ve made the decision. You wanna buy a new car.

You wanna buy it right now….and

you wanna get the best price?

You’ve come to the right place!

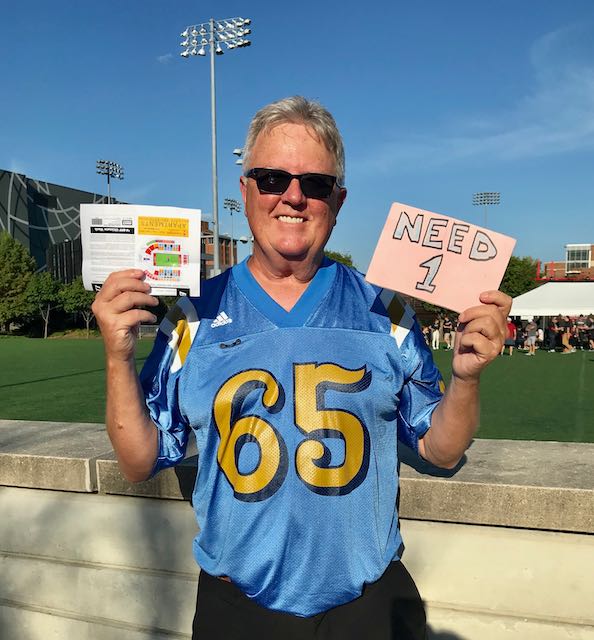

I wanted to take a few minutes to tell you about yesterday’s new car-buying experience. I’ll give you the blow-by-blow. If this method is of interest to you process can be reapplied for your benefit.

One of the best things I ever learned while working at P&G was the concept of “search & reapply”. I have always loved stealing aka benefiting from other people’s ideas and tweaking them a degree or two for my own purposes. I know several people, beyond just my family members, who have already used this car-buying approach. I first began recommending this a few years ago. To my knowledge, everyone has had a 100% success rate. I’ve been employing this process since 1999, for a total of seven personal cars. I’ve also consulted with friends to help them get their cars several times. How can YOU do this? Read on.

You might think of this as a primer for new car buying. For the experienced car buyer, much of what I have to share might be considered basic. For others, there may be an idea or two that they’ve never understood or seen explained. Frequently people share this with friends, relatives, and their children…and now their grandchildren. Everyone enters the classroom with a different set of knowledge and experience with the subject.

First of all, very few people NEED a new car. You don’t go into your pantry and replace a half-filled jar of peanut butter with a brand-new one just because you need another jar of peanut butter. So, unless your car keeled over and refused to go another mile along the side of the road you normally buy a new car because you WANT one not so much because you NEED one. There’s nothing wrong with that. As one of my friends always says, “Travel first class or your children will”. Somebody needs to spend your money and lots of people think it ought to be you.

Some of you will jump on this idea the next time it’s needed with great success. Others might find a reason to avoid this approach for any number of rationalized reasons, (it won’t work with the brand I want, it won’t work in my area, it’s the wrong time of year, it’s too much work, etc.). Nevertheless, this approach can now be part of your “toolbox”. Boy, I haven’t used the word toolbox in that context for a long time.

New cars are essentially commodities. The product is the same and it’s available from several sources. For the most part, the main difference from one dealer to the next for the same brand will be price.

Let me give you a real-life example of the new car buying process. I was in the market for a brand-spanking new Lexus RX 350 SUV. Mind you I have personally used this approach to buy several Lexus automobiles, two Jaguars, a Honda Civic, and a Toyota Camry. I can’t recall all the brands where friends have used this method. One addition to this car story….the car I would be buying today was for my wife, not me.

The first thing one needs to do when beginning this process is to decide what type of car and options you want. Pretty basic huh? This was fairly easy for my wife. I bought a Lexus RX 350 last year at this time. My wife has ridden in and driven this car all year. She’s most familiar with it and loves the car. Remember, I am an unpaid spokesman for Lexus. I love the brand. However, this car buying method is not limited to or specifically to be used for buying Lexus cars. It can be used on any mass-market new car brand.

Despite my wife’s experience with the RX350, I insisted we go to the Los Angeles car show, which occurs in early December each year. She could check out other makes and models at the show. When she confirmed her interest in the RX350 we went to our local Lexus dealer to check out the interior and exterior colors.

There was no need for a test drive. We could have taken one if we wanted. Lexus dealers put zero pressure on you to buy the car. If you want to buy a car from them fine but if you don’t that’s OK too. However, they figure the product sells itself, and if you want to buy one you will. It’s not that much different than shopping at Nordstrom’s. But let me repeat you don’t have to buy a Lexus to use this method! We’re clear on that, right?

A typical car dealer will want to sell you a car using a price relative to MSRP, i.e. “I will sell you the car at $1,000 off sticker”. I don’t consider any pricing relative to MSRP. All of my dealings are relative to the invoice cost of the car and options. I want to use the language of “How much under invoice will you sell this car for?”

To use my plan and get the benefits I describe you gotta do this. What do you gotta do? You’re going to have to know the invoice costs for both the car and the car’s options that you want to buy. If you don’t have this information you will not get the best deal. How do you find these invoice costs? It’s simple. Click on this link and follow the directions.

How to find dealer invoice costs for new cars. Click HERE.

What is “dealer invoice”….or dealer cost?

In addition to the dealer’s cost, there are a couple of other expenses that are not negotiable in my experience. Those expenses would be shipping (destination charges), and in some cases dealer advertising as well as “dealer holdback”. At the bottom of this relatively long, but soothingly relaxing message, is the actual letter I used to tell the dealer what we wanted in our new car. You won’t want to miss that. It’s critical to your success using the method I’m recommending.

Timing. Timing is everything. They say “Don’t be at the airport when your ship comes in”. That makes sense to me. Trying to do this deal on January 1 will get you a lot less than doing it on New Year’s Eve. Don’t try to tell me you are super busy on New Year’s Eve. I know you’re sleeping by midnight most years! So why New Year’s Eve? Read on.

The car business has goals to meet. When those goals are met the dealership gets incentives from their manufacturer. Big incentives. If they miss their goal? No incentives! There’s a great podcast broadcast over on the This American Life podcast. If you get the chance it’s a good listen. The program describes the hoops a Chrysler dealership goes through to meet their monthly goals.

Buying a car on the last day of the month or the last day of the quarter or the last day of the year will probably be a good thing for you. There’s only one day that meets all three of these criteria, December 31. I started my “dealer assault”, sorry dealer interaction, on December 30 just to give myself some breathing room.

I sent the letter shown below to every Lexus dealer in Southern California. Within 130 miles of our house, there are 21 Lexus dealers. That seemed like a lot and it is. If you live in a small town without too many new car dealers you can still use this approach. From the comfort of your small farm, you can do all of this over the internet. When the deal is consummated load up the spouse and the kids and spend New Year’s Eve in the big city. They’ll have fun and you’ll get a great buy on a new car.

January 2016 update

O.K., let’s be honest here. People don’t send “letters” anymore. Yes, this is how I used to complete the new car buying process. But we all have to move on right? Now I type my “letter” into Microsoft Word. Then I copy and paste it into the dealer’s contact form found on their website. You can simply “copy and paste” your message into all of the electronic contact forms of all of the dealers for the brand you want to buy.

When you send an email or text to your kids do they get back to you in just a few minutes? No, our kids don’t either. Well, one does but two don’t. They say all kids are different? Right on baby! However, car dealers are different than most kids. Car dealers get paid to respond. Kids don’t get paid unless you consider their inheritance as being their form of payment and most of the time that is too far off to motivate them today. I digress. I would estimate that if you send a message to twenty dealers you’ll hear back from more than half of them in less than an hour.

Important! You are not trying to make a new friend with a new car salesperson. When this deal is done they are not going to call and invite you over for chicken dinner next Thursday night. Do NOT put your phone number in any of your dealer communications. If the form on their site requires a phone number simply put in a dummy number such as 555-123-4567 to satisfy the computer. Your form letter tells the dealer you will only communicate by email. Unless you want to be inundated with phone calls from car salespeople who will tell you just about anything to get you to buy from them DO NOT INCLUDE YOUR PHONE NUMBER in any communication until you have finalized the dealer you want to work with.

By the way, I have zero allegiance to any new car dealer. Some folks aren’t that comfortable with this lack of loyalty. Those are the folks with a few less twenty-dollar bills available for lighting the fireplace. Money is not everything. However, who wants to give their money away when it doesn’t bring any benefit other than to the car salesman who once smiled at you?

It took me less than an hour to send my offer letter to 21 different new car dealers. Let’s cut to the chase. I heard back from 18 of those dealers within two hours. Within three hours 11 of them had made me a specific price offer. While I waited for the responses I watched the surfers playing in the Pacific Ocean from my office window. Even though I was retired I was “working”. Combine this work with the 1-2 hours it takes to rebalance my retirement portfolio every year and I would be pretty well bushed by the end of the week.

Of course, not all car salespeople get the “drill” the first time around. Some say nicely “call me and I’ll give you a price”. I never do that. One guy would not give me a price without my calling him to show my “sincerity”. I didn’t call. I did send him an email after I closed my deal at a different dealership saying, “I guess I was serious. Have a nice day”.

I frequently have to “redirect” salespeople who must not have gotten good grades in reading. Sometimes they offer me color combinations that were not what I asked for in my contact message. Why would they do that? My letter clearly stated we wanted a silver car with a black interior. Maybe they were colorblind or dyslexic. More likely they didn’t have the car I wanted in stock with the color combos I wanted. Well….you can’t blame a car salesperson for trying.

From my letter below you can see the options we wanted. When using this approach you may have to take a car that has one or two options that you really don’t want. As long as those options don’t cost very much and gets you the deal you want then go for it in my opinion. Just make sure those options are purchased at the same rate (discount) as the rest of the car relative to invoice pricing.

Several dealers came back with price offers. I didn’t feel I could get the deal done without sending a gentle reminder in the form of a response from me. That response? I simply said, “I didn’t think this offer would get the deal done”. I’m nothing if not direct. It was my way of saying, even though I asked you to send me your very best price, “You’ve failed and I’m giving you one last chance”. That worked in several instances.

The best price offer I got was $3,140 under invoice. I thought that was a great deal. However, there is one very important thing to know about getting a great deal. Everyone THINKS they got a great deal on their last car purchase. When was the last time your neighbor said hello from across the driveway and went on to tell you what a terrible deal he just got on his new car purchase? It’s sort of like folks who go to Vegas. Doesn’t nearly everyone say they won “just a little”? It’s amazing how they can keep building those huge made-for-profit casinos when all of their customers are winning “just a little”!

Anyway, another thing I learned during my business career was the use of data. At work, I might casually say to someone “It’s a beautiful day today”. Invariably someone else would say “Where’s your data to support that comment”? I loved it because I like to prove my points with data.

There’s a concept in negotiating called “nibbling”. Was the image above “too much”, “too soon”? Let’s not take ourselves too seriously. Essentially, nibbling means that no matter how good the deal is you always need to ask for a little bit more. For example, you go to Ruth’s Chris Steakhouse, a very expensive yet high-quality eatery. You’ve been given a free steak dinner by the manager just for walking past his front window. My, what good fortune. However, you might be remiss to not ask, “Can you throw in a bottle of wine with my dinner”? If you can get comfortable with this idea you can get comfortable with anything.

The lowest offer I received (and wanted to accept) was more than $500 U.S. lower than the next lowest offer. Nevertheless, I couldn’t resist “nibbling”. The low-offer salesman couldn’t know he was that low. I reminded him that, “Although your offer is very competitive you are 61 miles from my home (which was true). If you are willing to lower your price another $300 we have a deal.” Yes, I have b@#ls. In my case, the low-priced dealer refused to budge from his already low price. By the way, I NEVER lie during the negotiation process. In fact, I don’t lie ever. I consider negotiation a “sport”. In sports, you don’t cheat. In negotiating you don’t lie. What fun would “winning” be if you had to lie?

That’s when another major element of my negotiating training came into play. When the other side is willing to “walk away from the deal” you know you have reached their bottom line. At that point, if the deal is a good one for you and you can’t beat it anyplace else then you had better grab that deal before you lose it. That’s what I did. Remember, you’re getting pearls here. All you have to do is bend over and pick them up to make them yours. Next year you’ll be recommending these ideas to your family and friends and by that time…you’ll think you came up with this process yourself!

I called the salesperson, nibbled some more without success, and agreed to drive up to the dealership immediately. It was December 30. It was 7:30 p.m. The salesperson told me the dealership closed at 9 p.m. but would be staying open late to accommodate the incredible demand they were getting from customers.

I would have to shower and shave. I hadn’t shaved in four days as my wife was away visiting her parents. At 7:45 p.m. I was in the car and headed to the dealership. I arrived at 8:50 p.m. There I met “Leo” a man in his late 30s from Indonesia.

Leo could not have been more pleasant. In the past, these “office transactions” have taken about an hour. Most of that hour is used up getting the car washed and having the intricacies of the car’s operation explained. Tonight’s effort would take three hours. There wasn’t a hint of pressure or anything negative to the deal we had to agree upon. They were just that busy moving cars around, having folks sign papers with the finance department, etc. Remember what I told you about buying at the end of the year?

I took much of this opportunity to quiz Leo on elements of the car-buying dance. He was more than willing to share his knowledge. “Could I have gotten a better deal if I had paid cash?” I asked. Nope. The dealer was getting the same price whether I paid cash or financed with them. By the way, with a Credit Journey credit score of more than 825, I could finance the car for five years at 0.9% with no money down. That’s exactly what I did. It pays to pay your bills on time! I would rather take $744 out of my qualified IRA every month for 60 months than $43,000 or so all at once. I should easily be able to earn far more than 0.9% with my investments over the next five years. I would likely earn thousands on that money during the life of the car loan.

Wow!

This Lexus dealer had 800 cars or so in inventory. Leo took me down to their underground garage where they had 500 cars in inventory indoors! That was impressive.

I asked him if there was anything I could have done better with my car-buying strategy. He told me, “You certainly have your left brain working. I can’t think of a thing you could have done. You explained what you wanted and I knew that to get the deal I had to be aggressive”. Editor’s note: I don’t even know the DIFFERENCE between my left brain and my right brain!

While I had to wait longer than normal from one step to the next everything went exactly as planned. They ran my credit score while I was driving to the dealer. Then Leo texted me with the O.K. When I arrived I filled out a loan app (for bank record purposes), which took less than five minutes. I didn’t have bank account numbers and lots of other stuff with me. No problem.

The salesperson brought the car up from its hiding place. The odometer read 7 miles. Being so late in the evening they didn’t have staff to get the car washed and ready to go. In about a week, the dealership will deliver the car to our home (no charge). They’ll even come to our house to do the 5,000 and 10,000-mile checkups, which are free. Yes, they will send a technician 60 miles one-way to our house to give us free service.

Soon I was meeting with the finance manager. He couldn’t have been nicer and more efficient. He apologized for the wait. During our meeting, the office lights went out. It was midnight! They were on timers. This frightened the cleaning ladies who were already doing their work. The finance manager explained that it had been a madhouse and New Year’s Eve (tomorrow) at the dealership would be even busier.

He offered me, with no pressure, the opportunity to buy four more years of vehicle warranty for $2,900. I declined and he lowered the price to $1,900. I declined again and we moved on to LoJack an anti-theft device being offered for $795. I declined that offer as well. Then I signed the loan docs and we were done.

Bottom line I got a very popular and well-respected automobile for $3,140 below the dealer invoice cost with a financing rate of 0.9%. Was I surprised? Not in the least. This was exactly what I expected to get.

It was now midnight. I had an hour’s drive home. I had to celebrate. How could I do that? I stopped at In N Out Burgers. You may not be interested in buying a car with this method. However, if you come to California you had better not miss out on In N Out Burgers!

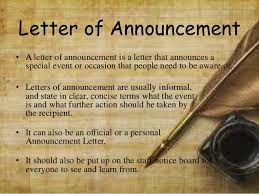

NEW CAR BUYING DEALER ANNOUNCEMENT LETTER

Subject: I want to purchase a 20XX Lexus RX 350 today.

Randy N. Lewis

San Clemente, California 92674

December 31, 20XX

Attention: Internet/Fleet Manager

I am in the market to purchase a new 20XX Lexus RX350 front-wheel-drive automobile immediately. I will not be offering a trade-in. I am a qualified buyer and current Lexus owner. I plan to finance this car with Lexus although I am willing to pay cash if the purchase price with a cash purchase makes sense.

Below you will find specific information about the car I am looking for. I have purchased several Lexus cars in this manner. The last two came from Woodland Hills and Oxnard even though I live in San Clemente. I am a serious buyer. Therefore, we can both save time on this transaction via email or fax.

If you are interested in doing business, please submit your bid as soon as possible and no later than the close of business today, Monday, December 30. I am giving each SoCal Lexus dealer a chance to earn my business. Upon acceptance of your offer, I can purchase the car immediately. I plan to sign docs and pick up the car on or before Tuesday, December 31.

Please no phone calls or gimmicks. I am a serious buyer and will complete the deal if you have the car and price that meets my expectations.

Given the competitiveness of the current market, I understand this model is currently being discounted well below invoice cost. Since all Lexus dealers are great, the LOWEST PRICE WILL GET THIS DEAL!

Here are the specs for the car I will be buying.

Model # Lexus RX350 FWD

1st color choice Silver Lining Metallic

1st interior choice Black

2nd interior choice Light Grey

2nd color choice Starfire Pearl

1st interior choice Black

2nd interior choice Light Grey

I will consider other minor options that may be included on the car you have in stock. However, my strong preference is to go with only the options listed below.

Pricing details Invoice cost

Lexus RX 350 vehicle invoice cost $37,177

Destination charge 910

Base model with destination charge $38,087

Lexus Display Audio Package 792

Heated seats 588

Intuitive Parking Assist 460

Premium package (w/o blind spot) 2,115

Wood/leather-trimmed steering

Wheel and Shift Knob 303

Cargo mat, cargo net,

Wheel locks & key gloves 158

Total option invoice cost $4,416

Total purchase invoice cost with $42,503

all options

I understand that tax and license are extra. I do not want any cars with the Mark Levinson radio system. I will not accept a car with the Navigation System (unless you want to give it away!).

This offer is contingent upon receiving any current Lexus owner loyalty rebates and 0.9% Lexus financing for 60 months. My most recent credit score was 825.

Please give me your best quote (with all customer loyalty rebates included) and a copy of the dealer invoice of the car you are selling via email to ranlay@yahoo.com or by FAX at 555-121-1212, attention Randy Lewis.

Thank you for your time. The lowest price gets this business. Let’s get this deal done!

Randy N. Lewis

P.S. I’ve seen auto racing in 86 countries. By the time most of you read this, I will be headed toward country #87. Talk to you when I get back.