To some, this is a no-brainer! To others, it is no way! Where do you come out on this strategy?

Welcome to Part 2 of my two-part series! Cash vs. Credit…It’s a no-brainer that follows Part 1 of the series…How to get a $100,000 Tesla for just $166/month. Like any good sequel, there will be a small amount of overlap to get readers caught up from the first part of the story to the second.

Disclaimer

I get a lot of feedback from people who tell me “Money isn’t that important to me”. My response to them is likely going to be, “Really? Put down the phone right now or walk away from your computer and take all of the cash you have nearby and flush it down the toilet.” Money is important to people. They just might not think about it that way. Hoarding money or worshipping money is a bad idea in my opinion. Using money for your enjoyment or for the enjoyment or security of others you care for is the real purpose of money.

Lots of people I meet don’t understand how to manage the money they have. They are afraid they might “lose it all” because of their lack of understanding. They might tell me, “Dad, never financed anything. He paid cash”. They might tell me, “I don’t like owing anybody anything”. Folks might also say, “Dave Ramsay says to be debt free”!

Some individuals will come up with all kinds of unlikely scenarios to avoid having to change their behavior. That’s O.K. Changing long-held beliefs isn’t easy. People will want to say, “What if I lost my job? What if my family situation changed dramatically?”. There’s no doubt about it. Stuff changes. It’s important to remember I’m not asking you to take your life savings to Vegas and put it all on red!

What follows is an analysis of choosing between paying cash or financing your purchase. This implies you already have the money to pay cash, right? If you lose your job you simply take the money out of where it is invested and pay off your loan. In my case after three years of doing this and reaping large financial rewards along the way I could simply sell the asset and that would remove the loan liability. After three years my car is worth $87,000 and the loan balance is only $53,000. I’m pretty sure some folks can come up with other “phantom” reasons for not changing their behaviors and managing their money well. If so, this strategy isn’t for them. However, others can take advantage of what I am recommending. When they do they will reap solid financial benefits.

It is at this point some folks could be offended. No one wants to be shamed into changing behavior. To be clear I don’t want to shame anyone into anything. I do want to point out that much of this is “just playing the percentages”. That’s a baseball term but it applies to just about everything we do in life. If you play the percentages, in the end, unless you get hit by a bus, you will do well.

Back to Dave Ramsay! This is for those who don’t know much or anything about Dave Ramsay. Mr. Ramsay is a radio and TV talk show host. He advocates for his listeners to be “debt-free”. Overall, I like Dave Ramsay. However, I feel he is missing the boat when he tells people to be entirely debt-free all the time.

I called the Dave Ramsay show once. I never do stuff like that. I got an answering machine. I left a message espousing what I am presenting to you today. I asked Dave to call me back. I never got a callback. Can you imagine the impact on the Dave Ramsay brand if all of a sudden he told his listeners, “Hey, there’s this guy in California. He’s got a really good idea about managing and profiting from having debt. I think he’s 100% right on”. Subscribers…that is never going to happen!

What do I say when my friends say Dave Ramsay says to have no debt? I would likely come back with “Dave Ramsay didn’t get rich by not having any debt. Dave Ramsay got rich from TV and radio by telling OTHER people to not have any debt”. I had a buddy who told me he drove Fords because “Dad always drove Fords”. Dammit, Dad didn’t have the choice to buy a Tesla!

If you owed me $20,000 and I was charging you 2% interest on that loan…I would be an idiot! If you decided not to invest that twenty grand in a U.S. treasury bill paying 4% and instead pay back the 2% loan to me…you would be an idiot!

As I mentioned I certainly do not want to offend anyone at any time. O.K., that’s not 100% true. There are a handful of people that I don’t mind offending…but that’s on me. In the above paragraph, I am not calling anyone an idiot. I am describing their behavior as idiotic. I know there is a fine line between telling someone they are an idiot and telling someone their behavior is idiotic. But…there is a line!

Reminder

Just a quick reminder. You are NOT going to be using this strategy every other month. There will be special times when you have to decide to part with your cash/investments or finance a large purchase likely a car or house over a longer period of time. As you will come to find out a huge amount of money can be saved/earned with this strategy. In this message, you can see what I have done and what I am doing with a 6-year, 1.99% loan for $100,000. I am in the midst of using the same plan when I added $500,000 to my home loan at an interest rate of 2.25% for ten years. I haven’t even taken the time to calculate those savings/earnings. When I do sit down to figure that out I suspect the number will be nearly TEN TIMES what I shared with you in this post.

Thanks for listening to my disclaimer and reminder! Now let’s get down to business.

What if?

If I sent you a check for $500 and told you it was a reward for reading my newsletter would you cash the check? I would hope you would!

If I sent you an idea that could net you $500 would you act on the idea? I would hope you would!

Today I am sending you an idea that could easily net you much more than $500. Will you act on that idea? I would hope you would!

What if my idea was not the way you were used to doing things? Would you act on my idea? Maybe not? Well…that would be on you.

Try this. C’mon, humor me. Try this.

Before we go any further, and to illustrate my point, I would ask that you fold your arms across your chest. Comfortable? My most comfortable position is having my right arm over my left. Now reverse your arm position. That feels strange, doesn’t it?

We all like to do things that make us feel comfortable. We don’t like to do things that make us feel uncomfortable. Feeling uncomfortable is a very uncomfortable feeling, isn’t it?

Sometimes the comfortable way of doing things isn’t the best way to do things. Overeating is “comfortable”. But overeating is probably not the right thing to do. Folding your arms in your normal fashion is comfortable. But…what if folding your arms in the other direction didn’t cost you anything…and after you got used to folding your arms in the heretofore uncomfortable position you actually began to feel “OK”? What if this “out of the box” thinking process ended up making you some money with what you used to think of as uncomfortable behavior? I know. I’m mixing metaphors.

Here’s the point.

This is what we are here to talk about today. I’m going to share a financial strategy that might initially feel uncomfortable to you. For some folks, this strategy will feel so uncomfortable and “out there” that they wouldn’t consider trying it. By the way, this photo does make me minorly uncomfortable.

The strategy I will now explain is on the way to netting me more than $57,401 over six years. Of course, I never felt uncomfortable doing this. I knew it was the right way to handle this subject from day one.

Maybe you’re thinking $57,000 (rounded) is hardly worth attempting to think out of your box. What would I say to that? I would likely shake my head, roll my eyes and shout internally, “#&#*%$##!” But then that’s just me.

I’m not going to send you a check for $500 today. I know…some of you might just like to get the $500 check and be done with it. That would be too easy. Here’s what I am going to do. I am going to send you an idea that when tweaked to your circumstances should yield you more than $500 even if it doesn’t give you $57,000. Would you like to continue reading and see if what I am suggesting works for you?

Doing just fine, are you?

Some folks would tell the world that they are doing just fine on the money front and don’t need any new ideas. I hope I never get old enough to convince myself I don’t need any more “good ideas”. The people who might suggest they are doing just fine would likely still cash a $500 check if I sent it to them. Why would someone who was doing just fine cash the check? Just about everyone can always do “finer”, right?

Don’t pay cash for stuff!

First, don’t take that headline out of context! There are some circumstances where paying cash is OK. As an example, I went to Costco yesterday to pick up a prescription. My share of the expense was twenty cents. Yep, twenty cents. This would be an excellent example of when it’s OK to pay cash. Did I pay cash? No, I did not. I charged the twenty-cent expense. You see I don’t like carrying change in my pocket. I can’t remember the last time I had a coin on my person. I’m just about to the point of never using any paper currency as well.

I have a very close friend, whom I have known my entire married life. Was that too strong of a hint? This person tells me the government wants me to never pay with cash. I am told they want to track me. Heck, they get my tax return every year. They already know where I live. I tell my “friend” that there are simply not enough criminals in the world to commit all of the crimes that people imagine being committed. Have I digressed? If so, please accept my fullest apologies.

In a nutshell, I am recommending you don’t pay cash for something when your investments can earn more money than the cost of your loan. Why in the world would you want to take money from your investments that are earning more than what someone is charging you to borrow money? In my world, I wouldn’t want to do that.

Indeed, my circumstance is not the same as yours. Your circumstance is not the same as mine. Nevertheless, if you see what I’ve done couldn’t this still be a good idea for you even if the numbers were a little bit different for both of us? Make sense?

How about a car example?

Today I am using a “car example”. Wait! Some might say, “Randy you are always using ‘car examples’. Can this idea you want to share be used with just about everything?” Now that’s a softball question. Yes! This idea can be used in just about any situation when you have the choice to pay cash or finance something. Normally people only finance larger purchases. I guess you could finance a coffee maker from Walmart but it might be difficult to get someone to give you a low loan rate over a long period for a coffee maker.

Lots of people finance things like houses, cars, solar panels, and stuff like that. I’m sure you can think of other products or services that you have financed in the past. Of course, I am not recommending and don’t think I would ever recommend using a credit card to “finance” your purchases. Their loan rates of 20% or more would not make today’s strategy a workable idea.

Let’s get real.

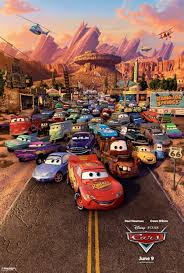

So…let’s get into a real-life example. This is what I did. Three years ago, I bought a brand new 2020 Tesla Model X electric vehicle. Yes, there will be some overlap in today’s message with my last post. Think mini-series and that might help if you feel something is being repeated.

Some people think that buying an electric vehicle is the second coming of Jesus Christ. Others think it is the mark of the devil. None of what I am talking about today has ANYTHING to do with politics as politics relates to buying electric cars. Why would electric cars have anything to do with politics anyway? That’s a story for another time and another newsletter. I am sharing a real-life example with you. I will use real-life numbers. This real-life example involves financing a loan for an electric vehicle. Or, said in even fewer words financing a loan for a vehicle.

Let’s go back about three years.

In November 2019 I walked into a Tesla store (they don’t have dealerships) in a shopping mall. I ordered a 2020 Tesla Model X. The bill came to roughly $104,000. Hold on just a minute. I am going to offer this suggestion. Nobody should “hate on me” for spending that much on a car. I grew up poor. Sometimes when poor people see others “blowing a lot of money” on something they “hate on” those folks. Others see the same situation and admire someone who has done well. Despite starting out poor I have always been one of those that loves the idea of seeing my friends do well. I admire them. They have “figured it out” in whatever area of life I am admiring. Everyone gets the choice to hate or admire.

I have told you more than once that Carol and I paid for our wedding in full for $500. I have NEW information!! Yes, we took out a bank loan for $200 of the five hundred bucks we paid for the wedding. News flash! Carol told me just LAST NIGHT that when she went to give the minister/priest his gratuity he wouldn’t accept the money. He told her we looked like we needed it more than him!

I might also point out that I could have used my iPhone and the Tesla app with about six clicks to order my Tesla using ApplePay. However, I am still “old school” enough to buy a brand new car in a shopping mall just down the hall from where Santa was bouncing little brats on his lap and people were buying coffee makers at Macy’s.

This ain’t 1973 but you already knew that.

So, I bought this Tesla for $104,000. For me that was pricey. Back in 1973, we bought our first house. This was a 1,700-square-foot home on a third of an acre with an inground pool in Phoenix, Arizona. Now I was buying a car for more than 2 ½ times what we paid for that first house. What is to be learned from this? Folks, this is not 1973. I couldn’t buy that home for $40,000 today. I couldn’t buy a Tesla in 1973. Things change. Everyone has to keep up with the times or the times will pass them by. By the way, some of you older folks may need to explain the relevance of this photo to this paragraph to the rookies.

Could I pay for the car with my good lucks? Not likely.

Before the nice lady who was working with me on the Tesla would let me drive it away I needed to “pay” for it. It’s funny how stuff like that works. How indeed was I going to pay for a $104,000 car? With my good looks? My mother loved asking me that question when I told her I wanted to buy something when she was thinking I might not have the money. On several occasions, she would ask me, “How are you going to pay for that…with your good looks?” What did she mean by that question? She’s no longer here for me to ask personally. I’m just going to assume she meant it as a compliment. Why make that assumption? Because I am a positive thinker!

Cash or credit?

I guess I had two choices when it came to paying for the new car. I could pay cash or I could finance it. There are offshoots of cash or finance but to me, those were my two choices.

If I paid cash I would have to take about $150,000 out of my IRA and pay roughly $50,000 in income taxes. Then I would give the remaining balance, $100,000, to Tesla. Lots of people I know pay cash for stuff like this.

This is important! Cash, credit, or don’t buy it are your three choices.

Before we go any further this entire analysis assumes you have enough money on hand to pay cash for something. If you don’t have the money then this is not a cash vs. finance option. It is a finance option vs. a “don’t buy it” option. See the difference?

That’s right. Before I go any further let’s remember what our options are. What are the options? Cash, credit or don’t buy the new car in the first place! I could buy a used car or I could drive a beater or both. I’m not into buying used stuff. I’m not into buying beaters. I’ve been there and done that. I don’t do that anymore. Heck, when I was a teenager I bought used tires for two dollars apiece. I went to junkyards and “pulled parts” because that was a way to get cheap replacement parts.

I have a lot of socks and underwear in my closet. I can honestly tell you I bought all of my socks and underwear brand new. I don’t wear my socks and underwear very far past the warranty period so, for the most part, I don’t have any “beater” socks or underwear. I buy new stuff in virtually every category.

Credit, please.

Here is why I WANTED to finance the car. I found a teacher’s credit union up in Fresno, California that was offering a great loan rate on new car purchases. Fresno is farm country. I am not a farmer. The credit union was for teachers. I am not a teacher in the formal sense. However, for about $10 bucks they would let me join their credit union in farm country that was for teachers. What did this tell me? These people were an auto loan company among other things!

I owed Tesla $104,000. The EECU (Educational Employees Credit Union) credit union instantly approved my loan application (instantly meaning about 60 seconds) for $100,000. I think this meant that we pay our bills on time. This also meant I had to scrounge up about four grand. I could do that. I raided my plastic guitar-shaped Elvis Presley bank and wouldn’t you know it? Out came about $4,000!

Yes, I had a plan.

I didn’t just pick the EECU loan operation blindly. After quite a bit of research, I noticed they were offering the lowest loan rate for an auto loan of $100,000 of anybody in the nation. They would loan me $100,000 for 1.99% with no additional costs. Wow! Before Googling EECU know that they only loan to California residents. Don’t worry. I’m sure you can find the lowest rate available to you if you don’t live in the Golden State.

How long should I take to pay back this loan?

Then I had to decide how long I wanted my loan term to be. Lots of people want their loans to be as short as possible. They wanna pay that sucker off! I am NOT one of those people. Properly structured I want the loan term to be as LONG as possible. Would EECU give me an auto loan term of 40 years? They would not. The best they could do was a six-year auto loan. Then…six years it would be.

How much was the monthly payment? How much?

Do you have any idea what the monthly payment on a $100,000 car loan for six years at 1.99% would be? Let me help you out so you don’t have to find a loan rate calculator. It’s $1,480/month. Does that sound high?

I can tell you this. I have made some great financial deals in the past. There’s a reason I could retire at age 52 and travel the world. I follow my own advice. In the pursuit of full disclosure, I have also made some clunker deals. It’s a little like golf. When you get to the 19th hole you will tell your buddies all about the birdies you made and the doubles you couldn’t avoid.

This was one of my best-ever deals!

One of my very best deals, if not the best, was when I leased a 2004 Lexus LS 430. My monthly payment on that car was $2,008. That made my Tesla monthly payment of only $1,480/month look like child’s play. Of course, the “government” helped me out with that Lexus deal. In the end, the government picked up quite a bit of the payment I was making on that Lexus. Don’t think the government should help foot the bill for somebody’s Lexus? You don’t have to answer that question. This is not that type of newsletter. I always like to tell people “I don’t make the rules. I just play by them”.

I can’t do what you did? Really?

Now, I am three years into a six-year loan with a 1.99% interest rate. I know what you are saying. “Randy, rates have risen a lot now and I can’t get a 1.99% rate now”. No, you probably can’t. However, I was telling people three years ago to do what I am recommending today. I can’t help the person who procrastinates.

The definition of wonderful.

In a nutshell, this is why what I am recommending was and is such a fantastic idea. I was borrowing money for 1.99%. I was EARNING an average rate of return…for the past 20 years…of 8.6% on my retirement funds. If I could earn 8.6% on my money and I owed someone else some money and they were only charging me 1.99% why in the world would I want to pay them off any quicker than I contractually had to? Why in the world? I wouldn’t.

I don’t want to owe anybody a gosh-darned thing…end of story!

I know. Yes, I know. I’ve heard people (lots of people) tell me they just “feel better” knowing they don’t “owe” anybody. Oh my. Remember when we started this entire discussion and you folded your arms the first time? That felt good didn’t it? When you folded them the second time that felt weird, right? Maybe in the right circumstances, the second way of folding your arms was truly the best way to fold your arms. You just needed to get used to a new way of doing things.

People tell me they feel they are “being controlled” by the people they owe money to. I feel exactly the opposite. If I owe people money at a very low interest rate and can use THEIR money to make more money for me, I feel I am CONTROLLING them!

This is how we handle finances at home.

At this point, I might mention that I am married to a beautiful young woman. Why do I say this? Because she might read this message and I would get a benefit? No! We were college sweethearts and have been married for 50 years. Sometimes I tell my friends if I had killed her on our honeymoon I would be out of prison by now. Whoa! I kid because I care!

Did I have to “clear” my Tesla purchase with Carol? No, I did not. Does she think buying an electric car is the mark of the devil? I don’t feel as if I need to answer that question. This isn’t that kind of newsletter. The point is I make the financial decisions in our house because I’m good at it. Carol makes most of the other decisions in our house because she told me that’s the way we were going to do things. I’m good with that too.

Hey honey. I got the loan.

I got the loan. I drove my Tesla away from the showroom. I had a $104,000 car and I had given Tesla just $4,000. Then those farmers and teachers sent Tesla a check for a cool 100 grand. Now, I send a direct deposit of $1,480 to those farmers and teachers every month.

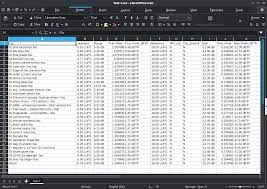

Of course, I created a spreadsheet. Did you expect me not to?

Has this been a good idea? Yes! This plan has been a fantastic idea. I created a spreadsheet. I will try to share the contents of that Excel spreadsheet with you at the bottom of this message. I hope the columns line up correctly for you. You probably won’t be able to read the numbers…but you might find comfort in knowing I DO have that spreadsheet. For anyone who asks I will also send the actual spreadsheet to them.

Now let’s get to the meat in the sandwich!! Here are my results midway into my six-year auto loan.

Wait! This idea is giving Randy $57,000 and he gets to drive the Tesla?

I owed the credit union $100,000, to begin with. Each month I send them $1,480 (this includes five bucks each month for something. I’ve forgotten what that $5 charge is for because I am trained to not remember small stuff like that. I think it is for autopay but maybe it’s for GAP insurance.). After the first month, my balance decreased to $98,520. However, the $98,520 THAT I DIDN’T GIVE TELSA earned $706 using my 20-year 13.4% annualized rate of return after just the first month. 13.4%?? Stay tuned. Each month for 72 months the part of the $100,000 that I didn’t pay Tesla upfront earns money. When I “run the numbers” for the 72-month loan I will have the car paid off and will have a balance of more than $57,000.

That’s right! By borrowing $100,000 at an interest rate of 1.99% for six years the $100,000 that I COULD have used to buy the car will have a balance of more than $57,000 when the loan is paid off! That money that I didn’t give them up front (sorry Dave Ramsay) was chugging along for six years until the loan was paid off.

No, I am not trying to pull a fast one here. Shame on you for even thinking that.

But wait! I think I know what you might be thinking. You might be thinking this. “Randy, are you trying to pull a fast one on us? Yes, you earned 8.6% for 20 years of investing…but that included a lot of good years. What about the bad times we’ve had recently? What would your investment return look like since you bought the car three years ago?”

You’ve been screened.

I would have been shocked if you DIDN’T ask that question. You do know that when you asked to be a part of my newsletter group you were screened don’t you? Screened? Yes, screened. You were screened for superior intelligence…and you’re getting my newsletter…so that means you passed the screening!

Just the facts, ma’am.

Where have you heard that line before? Again, oldsters feel free to help out the youngsters. Here are my investment returns for the past three full years.

2020 – 16.9% – last 9 months

2021 – 21.2%

2022 – (18.6%)

2023 – (43.4) – first 3 months

And now in 2023, which is just a bit more than 30% complete (remember my fiscal year ends on October 11) my annualized rate of return is 43.4%. Yes, my fiscal year ends on October 11 each year. Why? Just know it does and always has. On October 12, 2022, the stock market hit its recent low. That means my 2021-2022 results were negatively overstated. Since October 12, 2022, the market has gone up a good deal, making my current year, 2022-2023 look better than expected.

The bottom line!

Here is the bottom-line folks. If you can earn significantly more over years (six in this example) than your borrowing costs you should invest the money rather than pay off loans that don’t cost much. Dave Ramsay won’t tell you that. Then Dave Ramsay didn’t get rich investing his own money and paying off debt. He got rich being on the radio telling OTHER people to do that!

Are you GUARANTEED over six years to earn more money than the 1.99% being charged for the loan? No, you are not guaranteed. People seeking a guarantee when it comes to investment returns can get a guarantee. What’s the guarantee? The guarantee is that they are going to earn far less than market returns over time.

If the bank guarantees your rate of return that creates a loan for them. You give them your money and they pay you back! That’s a loan where the bank pays you. You can bet your bottom dollar they are very confident they can pay you and then invest the money you gave them for a huge profit. Wait! That’s exactly what I am recommending to you!! Get a low-rate loan and then take that money and invest it for more than your loan cost.

Here’s what happened to my $100,000 earmarked to buy this new car.

First, the $100,000 was invested in a broadly diversified low-cost portfolio of stock and bond index funds. Each month $1,480 was withdrawn to handle the payments of my six-year car loan. The remaining portion of the $100,000 stayed in place earning investment returns.

I like my neighborhood.

I’m going to be somewhere in the neighborhood of $57,000 better off by getting a loan for my new Tesla than having paid cash for that car at the end of six years. Will my financial life be majorly impacted by $57,000? Not really. If I found $57,000 lying on the footpath (forgive I just got back from Australia and footpath means sidewalk there) would I bend over to pick it up? I would.

Maybe, you are doing fine…but you can also do “finer”.

You may not NEED the money in some of the examples I talk about. However, here is the real test. If you would bend over to pick up the amount of money I talk about then the savings I’m talking about are worth a second look no matter how comfortable you feel in not having any debt!

This is also important. Please don’t overlook this point.

I used a car example with my specific numbers to make my point. However, this strategy applies to ALL purchases and loans if you can reasonably expect to earn an investment return that is greater than your loan interest expense. If it makes you feel better substitute the word “heifer cow” or “John Deere tractor” every time I referred to an automobile.

You will use your numbers of course. I would recommend taking a close look at what I am recommending. Is getting a loan and making a monthly payment worth it for $57,000 in this example? To me, the answer to that question is a resounding “Yes!”. As I said in the opening. This really is a no-brainer.

We good?

Randy Lewis

World traveler

Financial practitioner

Dirt track race fan

P.S. I would like to give props to our son J.J. for giving me the heads up on Tesla, Apple stuff, and that farmers and teachers credit union. No, I don’t do this all by myself.

P.P.S. Below are the numbers from my spreadsheet. I know you can’t read them. But, at least you know I didn’t make this stuff up!

| MONTH | FOM | ROI | PAYMENT | EOM | EARNINGS | TOTAL SAVINGS | 57,401 | ||||||

| 1 | 100,000 | 13.4% | 1,480 | 98,520 | 1,097 | ||||||||

| 2 | 99,617 | 1,480 | 98,137 | 1,093 | ACTUAL ROI | CUM ROI | ANNUALIZED ROI | ||||||

| 3 | 99,229 | 1,480 | 97,749 | 1,088 | YEAR 1 | 16.91% | 16.91% | 16.91% | |||||

| 4 | 98,838 | 1,480 | 97,358 | 1,084 | YEAR 2 | 21.26% | 41.77% | 19.08% | |||||

| 5 | 98,442 | 1,480 | 96,962 | 1,080 | YEAR 3 | -18.61% | 15.38% | 4.89% | |||||

| 6 | 98,041 | 1,480 | 96,561 | 1,075 | YEAR 4 | 43.14% | 65.16% | 13.40% | |||||

| 7 | 97,636 | 1,480 | 96,156 | 1,071 | YEAR 5 | ||||||||

| 8 | 97,227 | 1,480 | 95,747 | 1,066 | YEAR 6 | ||||||||

| 9 | 96,813 | 1,480 | 95,333 | 1,061 | |||||||||

| 10 | 96,394 | 1,480 | 94,914 | 1,057 | DEFINITIONS | ||||||||

| 11 | 95,971 | 1,480 | 94,491 | 1,052 | FOM = FIRST OF MONTH INVESTMENT BALANCE | ||||||||

| 12 | 95,543 | 1,480 | 94,063 | 1,047 | ROI = 20 YEAR IRA ROI | ||||||||

| 13 | 95,110 | 1,480 | 93,630 | 1,042 | PAYMENT = 2020 TESLA MODEL X MONTHLY PAYMENT | ||||||||

| 14 | 94,672 | 1,480 | 93,192 | 1,038 | EOM = END OF MONTH BALANCE | ||||||||

| 15 | 94,230 | 1,480 | 92,750 | 1,033 | EARNINGS = MONTHLY EARNINGS ON EOM BALANCE | ||||||||

| 16 | 93,783 | 1,480 | 92,303 | 1,028 | CELLS IN RED FONT ARE INPUTS | ||||||||

| 17 | 93,330 | 1,480 | 91,850 | 1,023 | YEAR 4 IS YTD | ||||||||

| 18 | 92,873 | 1,480 | 91,393 | 1,018 | |||||||||

| 19 | 92,410 | 1,480 | 90,930 | 1,012 | FACTS/ASSUMPTIONS/QUESTIONS | ||||||||

| 20 | 91,943 | 1,480 | 90,463 | 1,007 | IGNORES TAXES | ||||||||

| 21 | 91,470 | 1,480 | 89,990 | 1,002 | COULD STICK WITH A BEATER | ||||||||

| 22 | 90,992 | 1,480 | 89,512 | 997 | MY SITUATION IS NOT YOURS; YOURS IS NOT MINE | ||||||||

| 23 | 90,508 | 1,480 | 89,028 | 991 | BECAUSE MY SITUATION IS NOT YOURS IS NOT A REASON TO IGNORE THIS ANALYSIS | ||||||||

| 24 | 90,019 | 1,480 | 88,539 | 986 | WILL YOUR INVESTMENTS EARN MORE THAN YOUR LOAN RATE? | ||||||||

| 25 | 89,525 | 1,480 | 88,045 | 980 | CAR LOAN 2 1/2 TIMES WHAT WE PAID FOR OUR FIRST HOUSE | ||||||||

| 26 | 89,025 | 1,480 | 87,545 | 975 | CAR WILL DEPRECIATE BUT PROVIDE UTILITY AND ENJOYMENT | ||||||||

| 27 | 88,520 | 1,480 | 87,040 | 969 | AUTO LOAN RATE 1.99% | ||||||||

| 28 | 88,009 | 1,480 | 86,529 | 963 | LOAN TERM 6 YEARS | ||||||||

| 29 | 87,493 | 1,480 | 86,013 | 958 | |||||||||

| 30 | 86,970 | 1,480 | 85,490 | 952 | |||||||||

| 31 | 86,442 | 1,480 | 84,962 | 946 | |||||||||

| 32 | 85,908 | 1,480 | 84,428 | 940 | |||||||||

| 33 | 85,368 | 1,480 | 83,888 | 934 | |||||||||

| 34 | 84,822 | 1,480 | 83,342 | 928 | |||||||||

| 35 | 84,270 | 1,480 | 82,790 | 922 | |||||||||

| 36 | 83,711 | 1,480 | 82,231 | 916 | |||||||||

| 37 | 83,147 | 1,480 | 81,667 | 909 | |||||||||

| 38 | 82,576 | 1,480 | 81,096 | 903 | |||||||||

| 39 | 81,999 | 1,480 | 80,519 | 896 | |||||||||

| 40 | 81,415 | 1,480 | 79,935 | 890 | |||||||||

| 41 | 80,825 | 1,480 | 79,345 | 883 | |||||||||

| 42 | 80,229 | 1,480 | 78,749 | 877 | |||||||||

| 43 | 79,625 | 1,480 | 78,145 | 870 | |||||||||

| 44 | 79,015 | 1,480 | 77,535 | 863 | |||||||||

| 45 | 78,399 | 1,480 | 76,919 | 856 | |||||||||

| 46 | 77,775 | 1,480 | 76,295 | 849 | |||||||||

| 47 | 77,144 | 1,480 | 75,664 | 842 | |||||||||

| 48 | 76,507 | 1,480 | 75,027 | 835 | |||||||||

| 49 | 75,862 | 1,480 | 74,382 | 828 | |||||||||

| 50 | 75,210 | 1,480 | 73,730 | 821 | |||||||||

| 51 | 74,551 | 1,480 | 73,071 | 814 | |||||||||

| 52 | 73,885 | 1,480 | 72,405 | 806 | |||||||||

| 53 | 73,211 | 1,480 | 71,731 | 799 | |||||||||

| 54 | 72,529 | 1,480 | 71,049 | 791 | |||||||||

| 55 | 71,840 | 1,480 | 70,360 | 783 | |||||||||

| 56 | 71,144 | 1,480 | 69,664 | 776 | |||||||||

| 57 | 70,439 | 1,480 | 68,959 | 768 | |||||||||

| 58 | 69,727 | 1,480 | 68,247 | 760 | |||||||||

| 59 | 69,007 | 1,480 | 67,527 | 752 | |||||||||

| 60 | 68,279 | 1,480 | 66,799 | 744 | |||||||||

| 61 | 67,542 | 1,480 | 66,062 | 735 | |||||||||

| 62 | 66,798 | 1,480 | 65,318 | 727 | |||||||||

| 63 | 66,045 | 1,480 | 64,565 | 719 | |||||||||

| 64 | 65,284 | 1,480 | 63,804 | 710 | |||||||||

| 65 | 64,514 | 1,480 | 63,034 | 702 | |||||||||

| 66 | 63,736 | 1,480 | 62,256 | 693 | |||||||||

| 67 | 62,949 | 1,480 | 61,469 | 684 | |||||||||

| 68 | 62,154 | 1,480 | 60,674 | 675 | |||||||||

| 69 | 61,349 | 1,480 | 59,869 | 667 | |||||||||

| 70 | 60,536 | 1,480 | 59,056 | 657 | |||||||||

| 71 | 59,713 | 1,480 | 58,233 | 648 | |||||||||

| 72 | 58,881 | 1,480 | 57,401 | 639 | |||||||||