Your expenses are your greatest untapped asset…if you know how to leverage them…Devon Gimbel, M.D.

The above is one of the most profound statements I’ve ever read about financial planning and enjoying life. Most people have never considered leveraging their expenses.

I have been wanting to share my credit card arbitrage experiences with you. I’ve been doing this for more than a year. Now is the time.

All in one paragraph.

For those who want the “one paragraph” summary, here it is.

I earned over $90,000 in before-tax income by practicing credit card arbitrage for one year. This income is reducing my family’s travel expenses, which have taken us all around the world and will continue to do so for a long time.

Points and miles, baby.

My hobby is points and miles. I call it “credit card arbitrage.” There are several basics about “points and miles.”

By the way, points and miles are really the same thing. Some airline programs call frequent flyer rewards points; others call them miles. Hotels almost always call their rewards points.

Get ready. These are the basics.

As you consider whether or not to get involved in any of this, you need to understand several important aspects of the hobby.

This would be sort of pointless.

First, don’t collect points or miles for stuff you don’t need or want. Sounds pretty obvious, doesn’t it?

I suspect when you used to work or are working now, you earned money. Money by itself isn’t of much value. People work for money because they can trade the money they earn for stuff. People want stuff! They don’t necessarily want money.

Money wouldn’t be of much value if you were starving on a desert island. You would need food and drink. Collecting money in a situation like this would not be very helpful. Remember, don’t collect points and miles for stuff you don’t need or want. If I go too fast, just ask me to slow down. :)

Where else can you get this much money…tax-free?

When someone gives you $10 to pay for something you want (air travel or hotels, in my example), you can buy $10 worth of those goods and services. That money is tax-free. This is something you need to know. Points and miles rewards are tax-free!

Your credit score doesn’t mean ANYTHING*.

Have you been living your life thinking that your credit score is important? It isn’t… unless you need a loan. We’ll talk about that more soon.

When I started this credit card arbitrage hobby, I didn’t expect to need any loans in the next year. However, and I’ve known this for a long time, it is impossible to predict the future. During the past year, I decided I needed to get more loans. More loans? Yes. I got TWO car loans and SEVEN new credit cards despite a declining credit score. That proved that I didn’t need a pristine credit score to get new loans.

You don’t need to pay your credit card bills in full.

Note! I didn’t say don’t pay your credit card bills on time. I said you don’t need to pay those bills in full. “But what about the credit card interest you will be charged if you don’t pay your bill in full?” the logical and astute reader might ask.

A small amount of the $90,000 I earned came from not paying my credit card bills in full. One of my Chase credit cards offered me a “0% APR” program for 16 months. I only had to make the minimum payment each month. I didn’t need to pay the rest; they wouldn’t charge me any interest with the 0% APR promotion.

The card with this offer was the Chase Freedom Unlimited credit card. I got a credit limit of $92,600 from Chase on that particular card. I know. That’s a lot, right? At different points in time, our card balance on CFU reached more than $90,000. All I had to do was pay the minimum monthly payment, which was one percent of the balance, or in this case, $900.

What the heck is your credit utilization rate?

In the credit card industry, there is something called the “credit utilization rate.” What’s that? Your credit utilization rate can be determined by taking the sum of your credit card limits and dividing that number by the sum of all your credit card balances.

Let’s say you have three credit cards. Those cards have a combined credit limit of $50,000. Let’s say your monthly balance on those three cards is $30,000. That means your credit utilization rate is 60% ($30G/$50G). The credit score bureaus would like to see your credit utilization rate somewhere around 2-3% at most. If your credit utilization rate jumps above 2-3%, it will impact your credit score.

Credit scores.

Different credit score rating organizations will give you a different credit score. The maximum credit score you can get is 850. The minimum is 300. A score of 300 in bowling is fantastic, but not so much when it comes to your credit score.

This is how one credit score agency classifies credit scores.

Credit score ranges

- Poor: 300–579

- Fair: 580–669

- Good: 670–739

- Very good: 740–799

- Excellent: 800–850

When my credit utilization rate increased to 30-35%, my credit score decreased. I still paid everything the credit card company expected (minimum payments), but I owed more than ever. My credit score declined from more than 800 to as low as 629.

To the moon and beyond!

When the 0% APR promotion ended, it was time to pay off the $90,000 balance. What happened to my FICO score after that? It popped right back up to 816, which FICO classifies as “exceptional.”

Wait. I can hear some folks thinking, “I TOLD you your credit score was important!” Hold on, just a second. I am building a case that says $90,000 is much more critical than your stinking credit score in the short run. Please bear with me.

Remember, your credit score doesn’t matter* unless you need a home or car loan or need to apply for a new credit card. For me, this lower credit score was never a problem. I’ll give you some examples of why I say that.

Before I do that, please think about this. Let’s say you have an immaculate credit score. You don’t need any loans. Is that a good thing? I don’t think so. Your outstanding credit score is NOT helping you get any loans. Your exceptional credit score really isn’t helping you at all.

Your sky-high credit score, which you are unwilling to sacrifice, might prevent you from earning more than $90,000, as I did. Did you ever think about that? Your credit score could prevent you from earning sums like that every year into the future.

I told you that I applied for seven new credit cards and two new car loans during the past year. Despite declining credit scores, I was approved for every credit application, and the new car loans were no problem.

I’m a sales guy.

In the spirit of full disclosure, I will tell you that I was declined every time I initially applied for a new credit card. Did that concern me? Absolutely not. Remember, I am the most laidback guy you know.

I’m a sales guy. To me, “no means maybe, and maybe means yes.” I called the “reconsideration” department with each decline and told them my story. I told them I wasn’t paying off my $90,000 credit card balance in full because the credit card company was giving me a 0% APR program. That meant they weren’t charging me any credit card interest whatsoever. In the meantime, I was investing the money that I wasn’t paying the credit card company in a Vanguard money market fund (VUSXX). The fund paid a nearly 6% tax-equivalent yield and was virtually risk-free. Before our phone call ended, I was approved… seven different times.

The credit card reps even told me, “That makes all the sense in the world.” By the end of our phone calls, I’m sure they were prepared to return home that night to tell their family and friends exactly what I am telling you today. Seven credit cards were applied for, and seven credit cards were approved. I got the same result for my two new car loans.

Get as many credit cards as you can.

Does that headline send shivers up your spine? Carol and I now have 16 different credit cards. Yes, that does send shivers up Carol’s spine. In the points and miles world, she is what we call a “muggle.” What is a muggle? A muggle in the Harry Potter story is a person who doesn’t have magical abilities. She has lots of fine attributes, but she doesn’t have magical abilities in the P/M world. I do.

Our number of credit cards is climbing. The experts I listen to on Points and Miles podcasts have 40-50 and more. I hope to have many more new cards when we talk about this next year.

Get the largest credit limit the credit card company will give you.

Currently, the sum of our credit limits for all 16 cards is $375,700. Does that seem like a lot? I plan to surpass half a million dollars in credit card limits by this time next year.

Remember, our home loan exceeds $2.5 million. I’m responsible for three car loans totaling over $150,000. Those loans, with the amount of money we can borrow with our credit cards, top 3 million dollars. I am only sharing absolute facts. Why? These facts fully dispute all of the naysayers who have told me this stuff can’t be done. I’m doing it and haven’t earned a penny of work income in more than 23 years.

Charge EVERYTHING you can on a credit card.

You might ask, “What about this and what about that?” If you were to ask that question after I told you to charge everything on a credit card, I would suggest you go to a dictionary and look up the word “Everything.” I’m talking about federal and state income taxes. Real estate taxes. I’m talking about home and auto insurance. I’m talking about every pack of Chiclets. Everything.

Never ever spend any money on a credit card to get points where you wouldn’t normally spend money.

You are trying to leverage your everyday expenses. Doing that will give you plenty of rewards. It would seldom, if ever, be a good idea to spend $100 for something you didn’t need to get a 5% credit card reward.

What affects your credit score?

Your credit score is affected by five main factors:

- Payment history: How likely you are to pay back your debts

- Credit utilization: How much debt you have compared to your credit limit

- Length of credit history: The age of your oldest and newest accounts

- Credit mix: The types of credit accounts you have, like credit cards and loans

- New credit: How many new credit accounts you open and how recently

Pay your bills on time. We never miss a payment. However, as evidenced by the 0% APR promotion, this does not always mean paying your bills in full.

Don’t worry about your credit utilization rate. A rising CUR will more than likely lower your credit score. As I explained, that’s not a problem under the right circumstances.

Never eliminate your oldest credit card, which you may have had since you were much younger. I don’t know why this is a big deal, but keeping that old card doesn’t take much, even if you don’t use it.

Your credit mix might include home and car loans and credit card balances. I’m not sure what “mix” is correct, though.

They are going to pull your credit.

The more credit cards you get, the more “hard” credit card pulls you will get. This will likely lower your credit score. You would only want to endure getting a hard credit card pull when the new credit offer is good. Each credit card pull drops off your credit report after about two years. With all of our latest credit cards, I think we have 7-8 credit pulls on our credit report. For this category, this puts us in the “poor” group. That doesn’t matter. Every time I had a credit card company pulling our credit, it was for an excellent credit card reward.

Educate yourself.

I listen to several Points and Miles podcasts. I recommend the following as some of the best.

Point Me to First Class

Award Travel 101

Frequent Miler on the Air

How about cash-back credit cards?

Some people reading this might get “cash back” from their credit card. Maybe they have a Costco card. Cardholders can get cash back in different amounts and different categories. Here’s an example.

- Cardholders earn:

- 5% cash back on gas at Costco

- 4% cash back on other eligible gas and EV charging purchases for the first $7,000 spent per year

- 3% cash back on restaurants and eligible travel purchases

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

Is cashback good? Rarely. What is usually better than cashback?

Transferable points.

Transferable points are the opposite of cashback. Transferable points are better.

Using the Costco example, you might get 3% back on every dollar you spend with all categories. For every dollar you spend, you earn three cents. Three cents is three cents. You can spend those three cents anywhere you want.

With transferable miles, you might only earn 2%. Is 2% better than 3%? Most of the time, it is!

With transferable points, you spend a dollar and get two cents back in the above example. Then, you transfer the two cents (points or miles) you earned into a transferable currency with different airlines and hotel chains. I transfer most of my credit card reward earnings into the Hyatt hotel program.

By the way, the four biggest credit card issuers are:

American Express

Chase Bank

Citibank

Capital One

I have been working primarily with Chase Bank. Their points transfer to 14 airlines and three hotel chains, including my favorite, Hyatt Hotels.

This past year, for every one point I earned, I could transfer that point into the Hyatt program for 3.2 cents/point. That meant when I moved 2 points into the Hyatt program, I earned 6.4 cents (3.2 x 2) toward the purchase of a Hyatt hotel room. Yes, 6.4 cents is a heck of a lot better than three cents earned from Costco. You can indeed spend the three cents from Costco on anything you want. The 6.4 cents comes to me when I use a Hyatt hotel room or, with the Chase program, many different airlines. I know what you might be saying.

I don’t travel!

Some might say, “Earning points that I can only spend on travel doesn’t matter to me because I don’t travel.” Forgive me for saying this. I think that’s a wrongheaded way of looking at things.

If you’re young and you don’t travel, your parents and grandparents might like a nice trip. If you’re old and you don’t travel, your kids and grandkids might like a nice trip. All of your relatives in prison? Your friends might enjoy a nice trip.

The credit card annual fee means nothing!

This is another statement that can make people lose their breath. Some people believe that the best credit card is the one with a zero annual fee. Wrongheaded, I say.

I couldn’t care less about the annual fee on a credit card. Why would I say that? If the rewards I get back are worth more than the annual fee, let’s do this! Here’s an example to prove my point.

The Chase Hyatt credit card has an annual fee of $95. However, each year, they give the cardholder a one-night free hotel certificate for hotels costing as much as $400 per room. I will pay $95 as an annual fee all day long when they give me a guaranteed certificate for a room that can cost up to $400 a night.

It doesn’t matter if you don’t travel. For $95, you can give someone else the certificate. Then they can enjoy a hotel room worth $400. Do you feel me?

Know the value of your points.

You’ll always need to know the value of your points. If you have ten dollars in your pocket, you know pretty well what that ten dollars will buy.

Sometimes, the value isn’t good when I want to use frequent stay points with Hyatt. What happens then?

Let’s say, by way of example, the hotel I want retails for $100 a night. The redemption fee to reserve that room with points is 10,000 points.

To get the room’s points value, I divide the room cost, including taxes and fees, by the points needed to get the room for free ($100/10,000 points). That’s a value of just one cent per point. I would never redeem points in a circumstance like this. I would pay cash.

On the other hand, let’s say that the best retail price I can find for a hotel room is $300 a night. Then, let’s say the point redemption value is once again 10,000 points. That gives a redemption value of three cents per point.

During this past year, my average redemption rate with Hyatt when I used points was 3.2 cents per point. That’s a relatively high point value. I admit I cherry-picked the hotels and used points only when it made sense. I earned 3.2 cents for each point I redeemed on 380,000 points. Using points in this situation covered, at no charge, more than $12,000 in hotel expenses. That’s $12,000 is after-tax money. To spend $12,000 on these hotels, without credit card arbitrage, would have meant an IRA withdrawal of close to $18,000…and six grand would have gone to the federal government!

SUBs.

What is a “SUB?” A sub is not a sandwich or a sixth man. SUB stands for “sign-up bonus.” A SUB is usually the best way to get the most points with a new credit card.

Credit cards offer sign-up bonuses to get new customers. A typical sub might give you 70,000 points/miles if you spend $3,000 in three months. When you’re paying your estimated income taxes, real estate taxes, or streaming bills, spending that amount of money is easy.

As you will see below, we earned several sign-up bonuses. How can the credit card company afford to offer these lucrative SUBs? They are counting on a certain number of people getting their cards, charging stuff, and not paying their bills in full or on time. That’s when the credit card company gets its “reward” in the form of exorbitant credit card interest charges.

You passed!

You might not know this, but before you were approved for this newsletter, an in-depth background search was done on your intelligence. A few folks might have slipped through, but not many. You are too smart to pay credit card interest just to get a sign-up bonus!

Important note.

Please note that I never include the extra perks that Hyatt gives me in the value I compute. About half the time, Hyatt upgrades me to a much more expensive suite room. They give me complimentary breakfast, which commonly amounts to $100 each day for two people. They give me free parking and a 4 p.m. late checkout if I need it. I never include any of these “extras” when I tell you how much value I earned.

Die with Zero.

You’ve heard me talk about “Die with Zero.” For the people who have never heard about DwZ, they immediately think that means you want to die with zero assets—not even close. DwZ means you want to enjoy your assets because, in almost every case, you will die with lots of money you worked hard to earn but will never spend. In my judgment, that’s a bad thing.

Don’t hoard your assets.

Earning frequent flyer miles or frequent stay points and not using them is the same as hoarding your money. If you don’t use your miles/points, then why did you go to the trouble of earning them? The phrase in the hobby is “earn and burn.”

You earn your money to spend, right? You spend money to enjoy your and your family’s and your friend’s lives, right? If you don’t spend your money, you will become too old to enjoy it. If you get too old to enjoy it and then don’t give your money to your kids or grandkids in one form or another, soon enough, they will get too old to spend the money. In circumstances like this, money is useless.

The same applies to points and miles. I don’t earn points simply to tell someone else I’ve earned one million points in the past year. I earned those points to spend on travel, and THEN I tell people what a good time I had traveling!

And now for the main event.

In this section, I will tell you exactly how I earned over $90,000 in pre-tax income. Those dollars will wipe out the next $90,000 I spend on airlines and hotels for me, my family, and my friends. I will be conservative at every turn and not exaggerate anything to prove my point.

Earning $90,000 in the past year is not a one-time thing. I will earn nearly that much this year and next year and as long as I practice this hobby.

I can’t tell you how to do this. That’s on you.

I wish I could tell you every step to make you successful in this hobby. However, the laws of finance don’t make it a piece of cake to reduce your expenses by $90,000. I can’t tell you all of the ins and outs. Maybe I could, but what fun would that be for you? I taught myself by listening to podcasts. My effort was rewarded with more than $90,000 in rewards in the form of airline and hotel expense reduction. It’s not difficult to learn, but it requires your attention.

You never thought you would reduce your expenses by more than $90,000 by reading one newsletter once, right? You won’t be able to do that. I can point you in the right direction, but you must walk down the path to glory.

This is how I did it.

You might do better, and you might not. Educate yourself in the process and get going!

These are the individual types of returns I earned. Until the very end, all of these are after-tax returns.

$42,392.

I earned 1,324,356 Chase Ultimate Reward points this year, which I will redeem in the Hyatt Hotels program at 3.2 cents/point. I may redeem my points at a lower valuation in the future. You can redeem the points you earn through many airline and hotel chains. I don’t focus much on airlines because I have staff travel benefits. I need hotels when I travel more often than I need flights, which is where the upscale Hyatt chain comes in.

$5,735.

Hyatt gave me nine free night certificates during the year. Hyatt identifies each property on a category 1-8 basis. Category 8s are the highest and most exclusive properties.

I gave my son a category 8 free-night certificate for a special birthday present. He redeemed it for a property selling for $2,200/night while he stayed there in Northern California. Most of the other free nights retailed at $400/night, for an overall total of $5,735.

$2,277.

This was my after-tax return for investing the money I wasn’t paying the credit card companies; instead, I invested in a Vanguard Money Market fund. My average investment balance was $60,000, returning an average tax-equivalent yield of nearly 6%. My federal and state marginal tax rate is 31%. In reality, earning just $2,277 after tax was hardly worth it because of the impact on my credit utilization rate and, therefore, my credit score. However, I never like to leave anything on the table!

$1,400.

I opened a Hawaiian Airlines credit card with a signup bonus of 70,000 miles. Typically, I will earn the most significant rewards with sign-up bonuses. Airline miles are normally worth about 2 cents/mile, hence the $1,400 value. We don’t use HA miles but could transfer them to the Alaska Airlines frequent flyer program. Alaska miles are some of the most valuable in the industry.

$1,400.

We used the same promotion for Carol to earn 70,000 HA frequent flyer miles.

$960.

Carol opened a new Chase Hyatt card. This came with 30,000 Hyatt points as a signup bonus. Those points were valued at 3.2 cents with Hyatt. Oh yeah, she gets a free hotel night every year on this card with a $95 annual fee.

$1,200.

I opened a new Alaska Airlines card (I already had one). The signup bonus was 60,000 miles, which, at 2 cents each, are worth $1,200, again, all after tax.

$1,200.

Carol did the same by opening a new Alaska Airlines card (she already had one). The signup bonus was 60,000 miles, which, at two cents each, equals $1,200.

$1,400.

Then, believe it or not, I was able to open a THIRD Alaska Airlines card. The signup bonus was 70,000 miles. At two cents each, that’s $1,400, all after tax.

$1,400.

Wouldn’t you know it? Carol opened her THIRD Alaska card. Let’s be real. I opened the card! Remember, she’s a muggle but I still love her. The signup bonus was 70,000 miles. At a value of two cents each, that is $1,400, again after tax.

$1,200.

I opened a Barclay’s American Airlines Aviator card. The signup bonus was 60,000 miles, which, at two cents each, are worth $1,200.

$4,646.

Barclay’s MasterCard Black card is one of my best in creating value. The card comes with a $450 annual fee—no problem. This card gives me access to all Priority Pass restaurants in airports around the world—I am not aware of any card that still does that. At each restaurant, I get $28 in free food and drinks off the menu. If I have a guest, I get $56 in food and drink at no charge.

The $4,646 is calculated using the $28 credit 52 times and the LAX Priority Pass in conjunction with the Gameway Lounge 52 times for $70 worth of food and drink during each visit. I’ve subtracted the $450 annual fee from the total revenue generation amount. These numbers far understate the full amount of this card’s usage.

$2,818.

During the year, I bought 220,000 Hyatt points at 1.92 cents each. My average Hyatt point redemption is 3.2 cents, so I am profiting from the difference (3.2-1.92) over 220,000 Hyatt points.

$880.

The above Hyatt points purchase came with a bonus of 27,500 points. At 3.2 cents each, that’s a $880 reward.

Summary.

All of this totals to $68,909 in after-tax rewards.

Let’s clarify what I mean by “after-tax” and “before-tax.” If you had $100 in your back pocket that you earned from working a taxable income job or from an IRA taxable withdrawal, then that $100 is “after-tax.” You can spend that $100 to buy yourself a hotel room!

However, to “clear” that $100, you would have had to earn more, pay tax, and then have that one hundred dollars.

I earned $68,909 in after-tax money. My marginal tax rate is 31%. To clear $68,909, I would have to earn or withdraw from an IRA $90,270! That’s right.

I could buy $68,909 in airline tickets and hotel rooms, but to buy that amount of travel, I would have had to earn $90,270 before tax.

Got all of that? Did it seem complicated? It isn’t, but as I mentioned throughout, you must pay attention.

My wife, family, and friends benefit from all of this. I give folks free hotel nights and give family and friends my top-tier frequent traveler status all the time. Even though they don’t travel as much as I do, they get all the perks I get when I gift them my status.

Good luck. Remember, Die with Zero, or someone else will sit in first class…and it won’t be you.

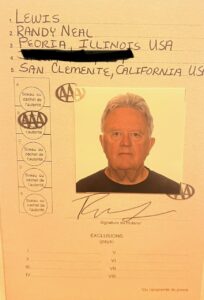

Randy Lewis

Hyatt – Globalist

Marriott – Titanium Elite

National Car Rental – Executive Elite

American Airlines – Executive Platinum

Husband, father and grandfather

Oh yeah, World’s #1 Trackchaser